More details have emerged about a global semiconductor company’s proposed plans to bring at least 500 jobs and a $2 billion investment to an emerging semiconductor hub northwest of Austin.

Applied Materials Inc. – the Silicon Valley-based company that is already a major employer in Austin – wants to build roughly 849,000 square feet of “state-of-the-art development labs and manufacturing facilities, which will be home to Applied’s next-generation [research and development], manufacturing and innovation engine,” in the Hutto Megasite near FM 3349 and Highway 79, according to documents posted on the Texas Comptroller of Public Account’s website June 14.

The proposed site is just up the road from Samsung Electronics Co. Ltd.’s forthcoming $17 billion next-generation chipmaking facility, which already could be growing, and is attracting suppliers nearby.

The latest disclosures are part of the process as Applied Materials seeks Chapter 313 state-funded property tax incentives agreement, which can be used for new manufacturing and energy projects, although the program is currently slated to expire at the end of the year. Applied Materials was approved in March by the Hutto Independent School District to apply for the incentives.

The 313 incentives would cap the taxable value of the property earmarked for maintenance and operations at $80 million from 2027 to 2037, documents show. While the company will still pay all of its school taxes that go to fund school district debt, the incentives would save the company approximately $38 million during the 10-year period, according to Austin Business Journal calculations.

In the full application, Applied Materials noted that it is nearing its service capacity, including at its Maydan Technology Center lab in Silicon Valley, which opened in 2002 and employs 500 people. It’s in need of a new project to encompass expanded research and development, manufacturing and prototyping facilities that will “advance the state of chip making,” the application states.

“Applied supplies the largest and most advanced producers of semiconductor chips today, and its tools and materials engineering capabilities are used to produce virtually every microchip on the planet,” the application states. “Applied’s products remain at the leading-edge for only 18 to 24 months and the company is continuously developing its product pipeline to stay ahead of global competition. Applied’s leadership is fueled by advanced R&D that is concentrated in the U.S. – even though 90% of the company’s revenue comes from overseas. In that context, Applied has made continued investments in R&D facilities that are purpose-built for the development and demonstration of new manufacturing processes and devices.”

If the company moves forward with the Hutto project, the capital investment is expected to top $2 billion, while the project would create at least 525 jobs over a 12-year span in the areas of management, engineering, finance and operations. The company has committed to making 25 of those positions “qualifying jobs,” with an average annual wage of $69,000, plus benefits. A qualifying job under the Texas tax code is a permanent, full-time job that pays 110% of the county average weekly wage for manufacturing jobs.

Construction would begin at the earliest in the first quarter of 2023 and be completed by the second quarter of 2026. It would be operational by the end of 2026.

The company is also on tap for a $150,000 application fee that was paid to the school district.

Applied Materials noted executives are actively engaged with other states for the project, including Arizona, California and New York. It also said the project is dependent on the CHIPS Act, currently pending before Congress, which could provide $52 billion in funding to boost domestic semiconductor production.

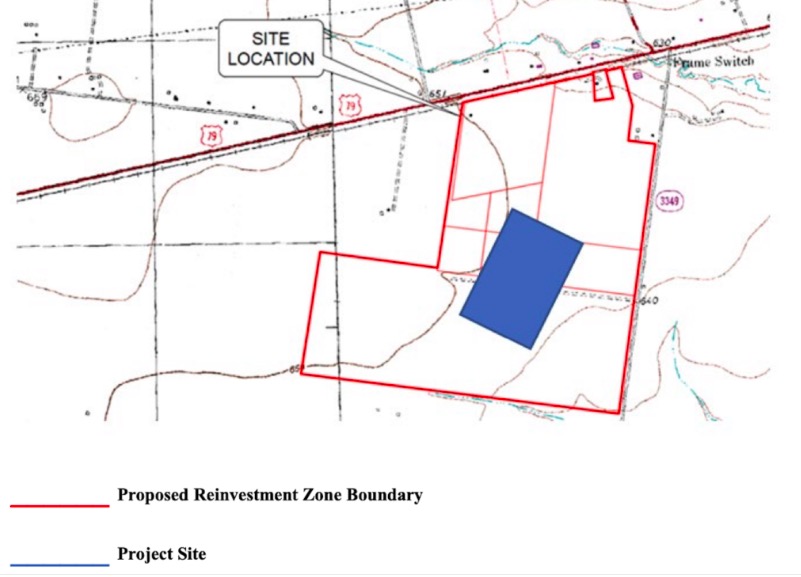

The company acknowledged it has a non-binding letter of intent to purchase the land in Hutto that the project would be built on, which totals about 430 acres in the part of the Megasite that is owned by the Hutto Economic Development Corp. Applied Materials is seeking incentives from the city of Hutto and a nomination for the Texas Enterprise Fund, and is planning to establish the site as a tax increment reinvestment zone.

Applied Materials did not respond to a request for comment before publication.

The application in Hutto marks the most-detailed acknowledgement from Santa Clara-based Applied Materials (Nasdaq: AMAT) about plans to expand in the Austin area. The company creates equipment and software that the world’s largest chipmakers use to produce semiconductors, and manufacturing experts have suggested that every chip in the world comes into contact with an Applied Materials product at some point in manufacturing.

Applied Materials already has more manufacturing space in the Austin area than all but two companies, according to Austin Business Journal research. Only NXP Semiconductors and Samsung rank higher, in terms of square footage.

At last count Applied Materials had roughly 2,800 local employees. The company, founded in 1967, established its presence in Austin in 1992. Its campus is at 9700 E. U.S. Hwy. 290. Construction began last year on a new 729,000-square-foot warehouse at the campus. In 2021, Austin City Council nominated the company for state incentives under the Texas Enterprise Fund program for the roughly $150 million expansion.

Austin Business Journal reported in February that the company was eyeing the city for the project, with officials later noting that the project would create an influx of jobs, including 7,000 construction jobs. The school board vote started the process for the incentives application sent the proposal for a formal review from the state comptroller. It’ll now return to the school board for another vote.

Chapter 313 allows a school district to cap the taxable value of a property between $10 million and $100 million for up to 10 years, for the portion of property taxes it would receive for maintenance and operations. The tool has been used by several companies making massive investments in Central Texas, including the Samsung plant and Tesla Inc.’s $1.1 billion facility rising in Travis County. However, the Chapter 313 program is slated to end Dec. 31, 2022, because it was not reauthorized by the last state legislature, and companies are rushing to get applications approved before the deadline.

Should Applied Materials choose Hutto — which saw its population grow from 14,698 in 2010 to 30,855 in 2021, according to U.S. Census Bureau figures — it would add yet another high-tech manufacturing project to the city and region.

Back in February, Hutto leaders divulged details of an economic development prospect called “Project Acropolis.” The project was said to represent a manufacturer in the semiconductor industry looking to build on 450 acres at the Hutto “megasite,” a roughly 1,400-acre greenfield site along U.S. Route 79 that is primed for development.

Hutto officials did not name the company during the February meeting, and have declined to provide additional details, cautioning that talks regarding incentives are ongoing and terms of any deal might change. But sources have told the the Austin Business Journal the company is Applied Materials.

City officials had said that the capital investment for Project Acropolis would start at $340 million and ramp up to $2 billion over a decade, including the costs of land, machinery and more. It could create more than 800 jobs in fields such as operations, robotics, engineering, computer science and administration, with an average salary exceeding $100,000, plus benefits.

Project Acropolis is seeking a Chapter 380 agreement with the city of Hutto that would provide roughly $80 million in incentives over 10 years, city officials said during a Jan. 31 meeting of the Hutto Economic Development Corp. That would include reimbursement for infrastructure — including water, wastewater and road construction — plus a potential tax abatement, the creation of a tax increment reinvestment zone and a sales tax sharing agreement.

Project Acropolis has also been listed on the agenda of the Williamson County Commissioners Court in executive session under economic development negotiations since Jan. 18. Williamson County officials have declined to comment, citing policy to not discuss ongoing economic development projects.

A portion of the Hutto megasite was tabbed in June for a massive speculative logistics development from Titan Development Ltd. that could create 2 million square feet of industrial space.

Applied Materials expanding in the area would mark the continued wave of semiconductor manufacturers and suppliers eyeing Central Texas. In addition to Samsung, many semiconductor companies and suppliers already operate in Austin, and some are considering major expansions. That includes Infineon Technologies AG and NXP Semiconductors NV (Nasdaq: NXPI), the former in Hutto and the latter two in Austin. Valex Corp., a Samsung supplier, recently announced it was expanding to Round Rock, and Linde PLC, an industrial gas supplier to Samsung, is looking to build on their Taylor site. Micron Technologies Inc. (Nasdaq: MU) is still rumored to be eyeing a massive project in Lockhart.

There have been setbacks for the sector, as well. Intel considered the Austin area for a factory before ultimately opting to build a $20 billion campus in Ohio. Toppan Photomasks Inc. recently had an application for school district incentives denied in Round Rock, but is still eyeing expansion in the city, which is just down the road from Taylor.

On the morning of June 15, Applied Materials had a market capitalization of around $85 billion and shares were trading for $97.58 apiece, according to Google Finance. In fiscal 2021, Applied Materials employed around 27,000 people worldwide and recorded $23 billion in revenue, up 34% year over year, according to an earnings report.

The Article is from Austin Business Journal, copyright belongs to owner