PwC’s Major Emerging Real Estate Trends for 2023

We prioritize our clients learning and fostering of knowledge within our community of real estate enthusiasts. Therefore, we’ve shortened and summarized PwC’s 100+ page emerging trends report in a much more readable version, catered to local investors and learners rather than institutions.

Without further ado:

Chpt. 1

The 10 emerging trends that we expect for 2023 and beyond follow:

1. Market Normalization

The fundamental statistics of the real estate market are moving back toward the mean and normalizing to pre-bubble condition. On a national level, market performance will continue to “cool” in certain real estate categories, such as the residential and industrial real estate markets.

Market performance in other niche real estate categories may continue to increase, with some even reaching historical peaks. Examples include hospitality and retail.

As demand homogenizes and interest rates continue to rise, returns and prices for many properties are falling. The rental income of some real estate projects will slow down.

2. The aftermath of the Pandemic

The way people work post-pandemic is largely dissimilar to the pre-pandemic situation. Business travel is unlikely to shift back to normal levels for a few years, which means investment in business hotels, fine dining restaurants and conference facilities will face challenges moving forward.

The popularity of telecommuting still affects office use and leasing.

3. Trading volumes are down but the market won’t crash

Buyers and sellers are unable to agree on home pricing amid heightened uncertainty about the future of the market. Real estate transaction volumes are likely to continue to decline. Rising interest rates and restrictions on housing construction by local governments also limit the volume of real estate transactions to a certain extent.

Corporate real estate holdings will shift from institutional investors to non-traded REITs, high net worth investors, and ordinary investors. Borrowing costs are higher, so investors who hold cash will have a better chance.

Balance sheets are generally strong, leverage is low, and property value declines have been modest, so a major market crash is unlikely.

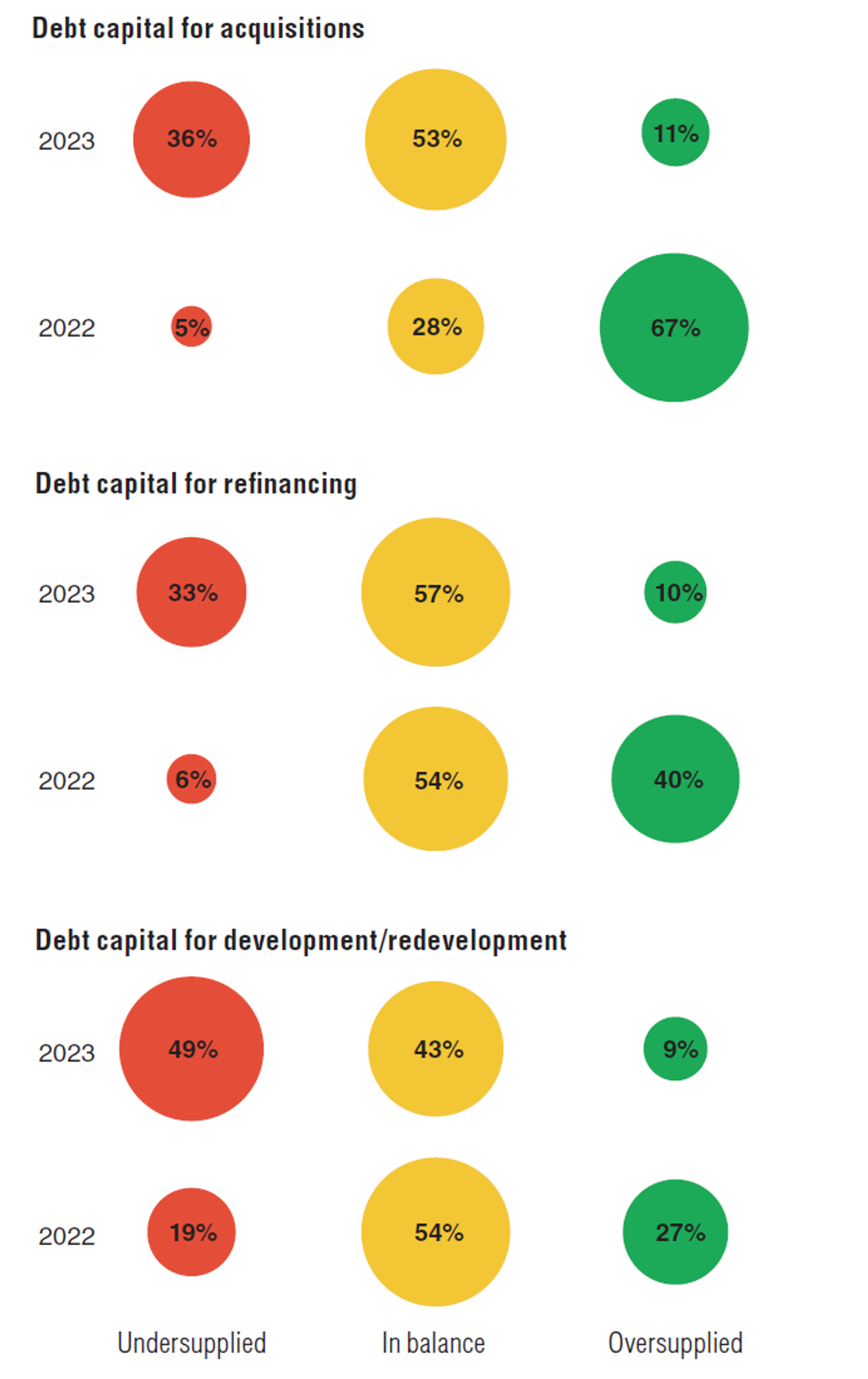

Real Estate Capital Market Balance Forecast, 2023 versus 2022:

4. Housing affordability remains poor

Housing affordability has fallen to its lowest level in more than 30 years. Prices and rents are soaring relative to incomes. Rising mortgage rates are making home ownership impossible for more and more families.

Investors are buying a third more homes than before the pandemic.

The main reasons for this phenomenon are: the overall long-term undersupply of housing; the current tax law is unfavorable to individual home buyers; Remains high; the local government supervises many housing construction clauses.

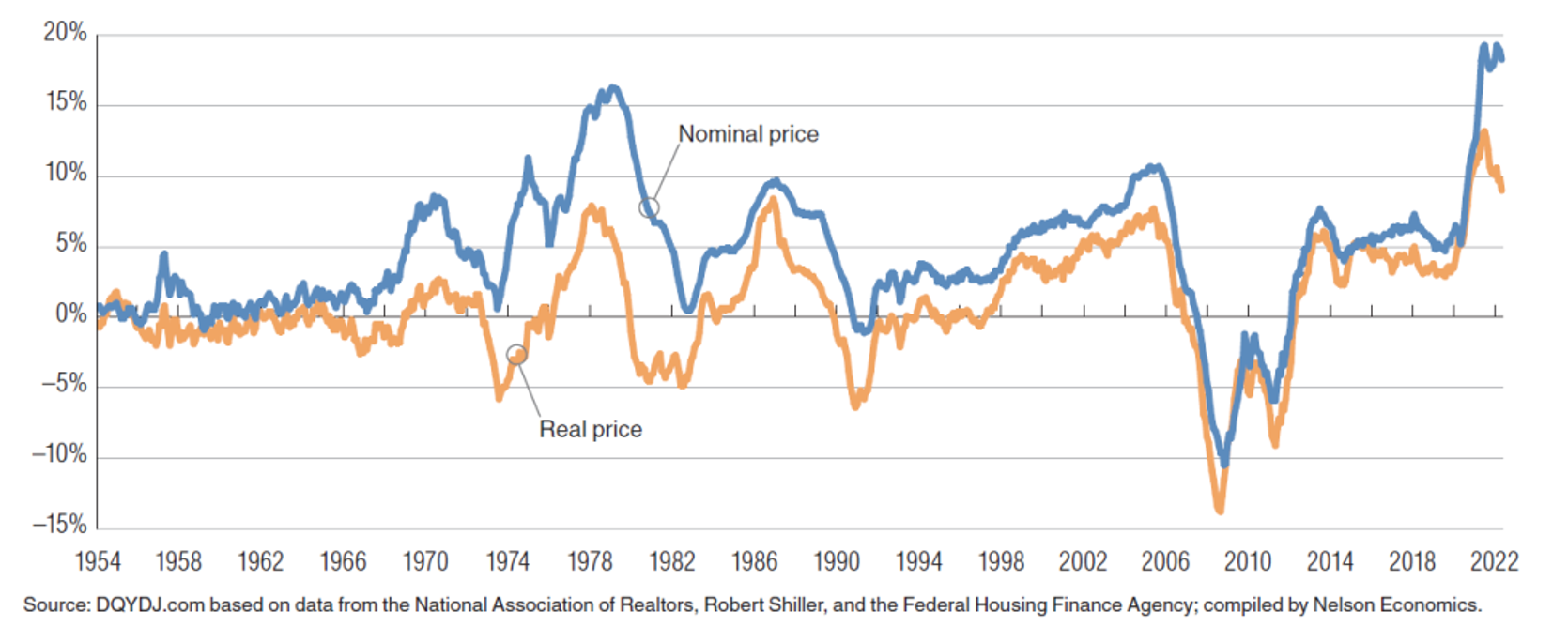

Median Price of Existing Single-Family Homes, Nominal versus Real Prices, 1954–2022

5. Demand for commercial real estate is healthy but diverse

Investment demand for commercial real estate remains healthy, with three categories of commercial real estate opportunities expected to remain in demand: industrial/multifamily, prime retail/office properties in markets with severe lack of supply, and niche markets such as student housing and build-to-rent real estate.

The premise is that these commercial real estate assets must be located in a more competitive market (the second part of the report will analyze the competitive market in the United States).

At the same time, the popularity of different types of commercial real estate in a certain field has intensified. For example, investors will prefer resorts over business hotels, and prefer Class A office buildings and abandon Class B office buildings.

6. Old/outdated commercial real estate faces challenges

In the status quo, the nation lacks modern commercial real estate. Long-term demographic trends and structural demand shifts will phase out many outdated commercial properties over the next year.

Unless investors are willing to renovate old and outdated properties, the gap between same-use properties in different conditions will become wider and wider.

7. Sunbelt cities remain the investment focus

Lower tax rates and lighter regulatory burdens keep the Sun Belt City market attractive to investors. But the rate investment is expected to decrease.

Any slowdown in the rate of investment will exacerbate investor concerns about an “oversupply”. However, population and job growth are key to keeping the market competitive, and as such, Sunbelt cities will remain the nation’s investment focus next year.

The key question that creates doubt in the Sunbelt market is, “Can it sustain such a high rate of growth?” An surplus in the influx of people may cause the cost of living to increase, and cause a deficit in the quality of urban infrastructure. The ways these doubts are realized will affect the decision-making of investors and the inflow of funding to these markets.

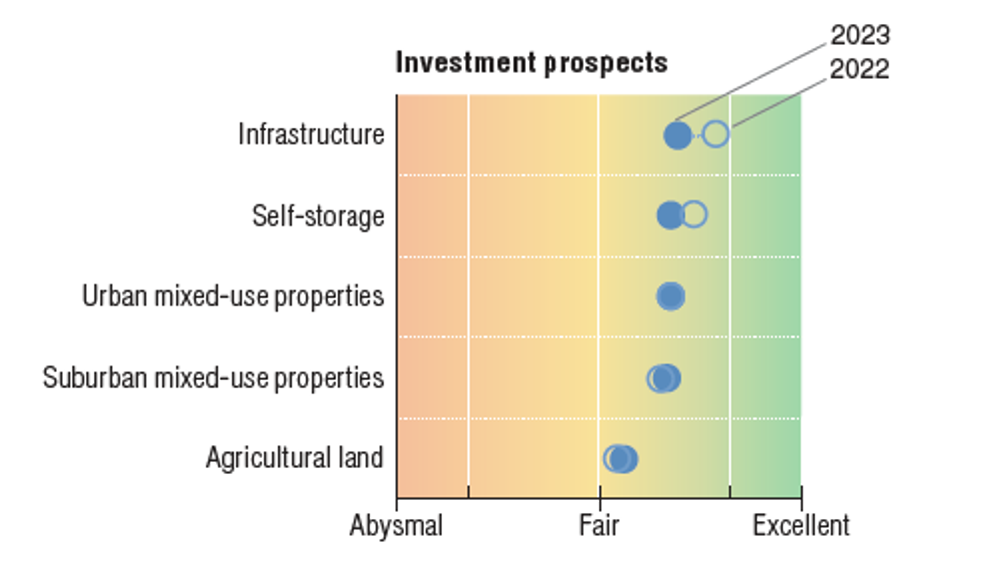

8. The continued development of infrastructure

Infrastructure development has reemerged as a main focus in developers across the United States. Thanks to federal government funding, infrastructure development can help breathe new life into cities and stimulate new development opportunities.

9. The Concept of Sustainable Development Influences Investment Decisions

The real estate industry will be more active in addressing the impact of climate change on assets. Climate change may alter residents’ housing choices, while increasing energy costs cause detriment to many investors.

Investors need to change their investment strategies to accommodate these changes, with methods such as investing in sustainable development properties or technologies.

10. Changes in local regulations

Limited by the pressure of institutional investment, local regulations and supervision changes will be on the upswing in the coming year to cater the concept of the sustainable development of buildings.

At the same time, in order to ease housing affordability issues, more and more local governments will discuss the implementation of rent control regulations.

The implementation of vacancy taxes in some areas will also drive housing occupancy.

Chpt. 2

Chapter 2 gives prospects on the national real estate investment environment in terms of the current market performance, relevant policies, and demographic data.

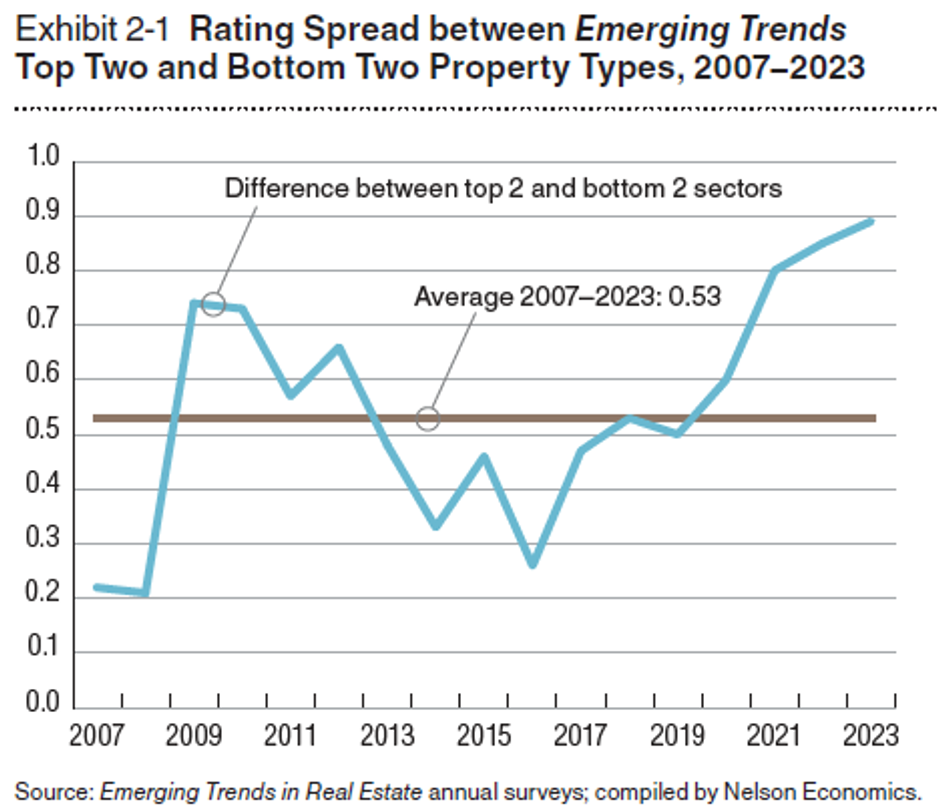

The line chart “Emerging Trends”

A significant expanding spread pattern shows that “investment prospect” ratings for the top two major property sectors have separated from those for the bottom two sectors. Investors perceive a narrowing range of compelling market opportunities, meaning they are more likely to ignore the increasingly smaller property sectors as investment alternatives.

Prospective rating of each type of real estate investment

This year, the industrial/distribution sector is on top of the best prospective property types

Multifamily investment prospects are rated as No.2 because there are still not enough new apartment units coming online

The office is the lowest ranking of any property, followed by retail.

Single-family housing sectors are in the middle. It’s important to note that prospect ratings fell very sharply for housing this year as rising mortgage rates have stunted buyer interest in new homes.

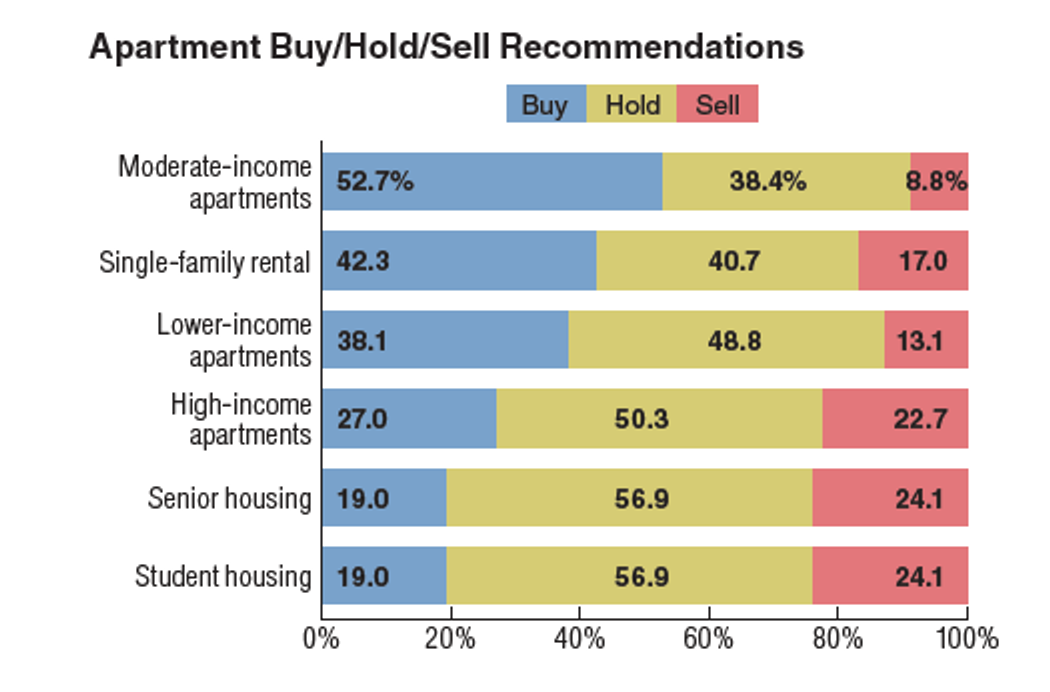

Apartment buy/hold/sell recommendations

Some states have applied rent regulation that brings uncertainty into the market in the future – these laws will disallow landlords to increase rents by margins deemed too large. Fortunately, these laws are not implemented in Texas that makes apartment investment and development, which create a healthy and growing market for apartment investment and development.

U.S. demographic patterns, which are pushing greater numbers of individuals into the 75-plus cohort, creating a captive pool of potential new residents for senior housing.

Single-family housing prospects

People prefer to choose more function, and space added in the same-sized home. Balance between public and private space is also important; rent growths in 2022 are on track to break the previous year’s all-time high

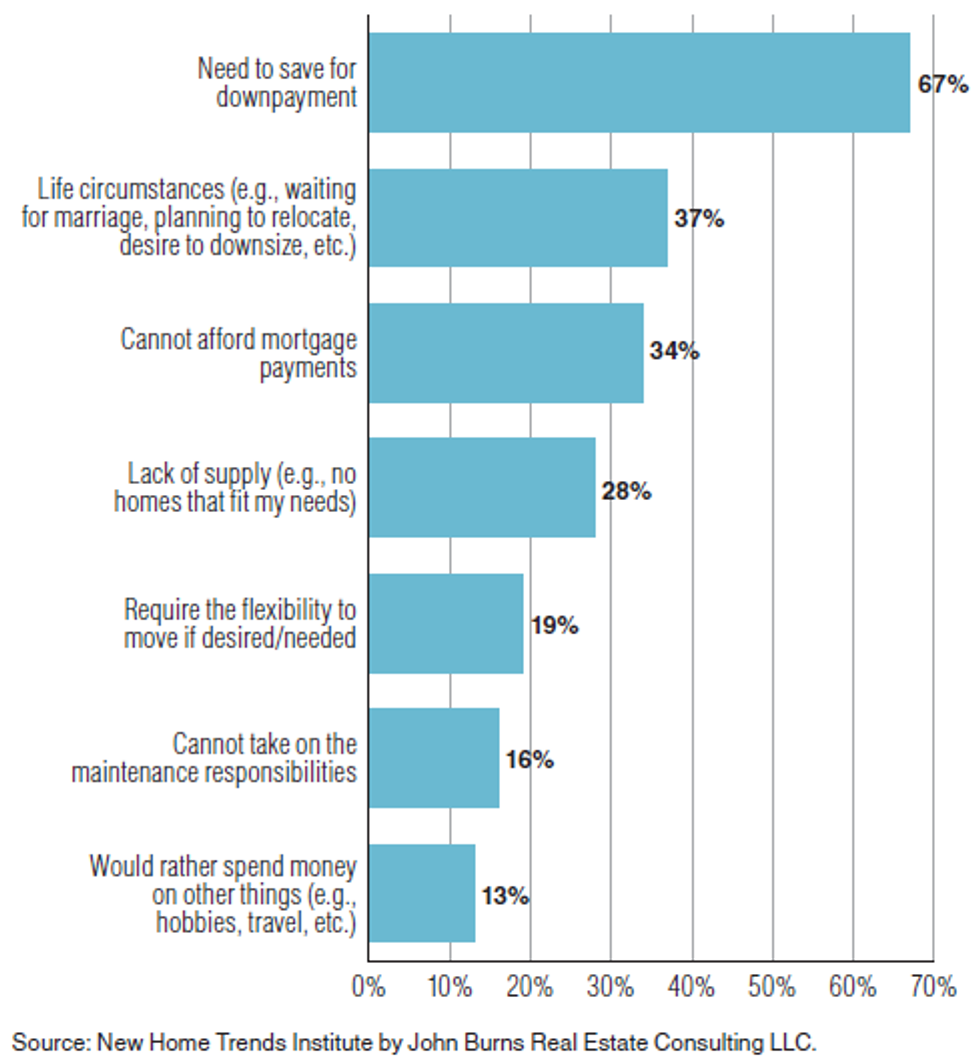

Why do renters continue to rent?

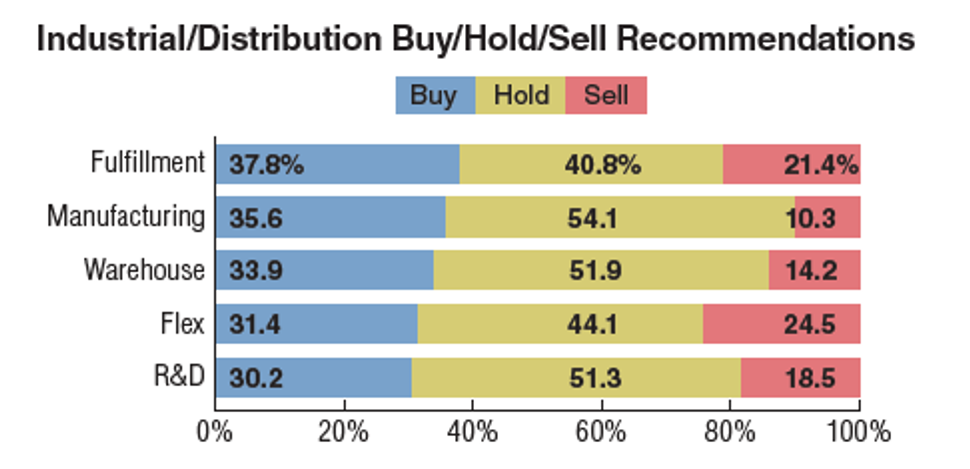

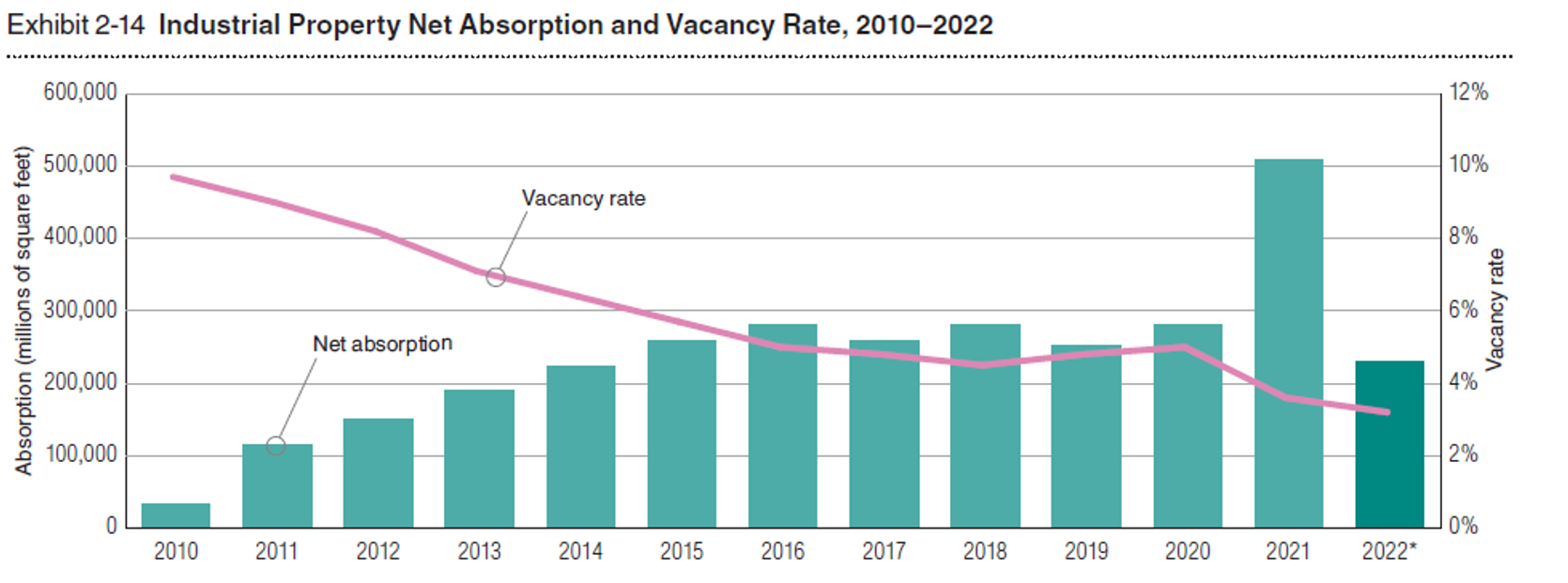

Industrial/distribution real estate prospects

E-commerce supply chains are being built to accommodate faster delivery timetables.

Post-COVID expectations for e-commerce to slow are being knocked down as demand for e-commerce continues to grow.

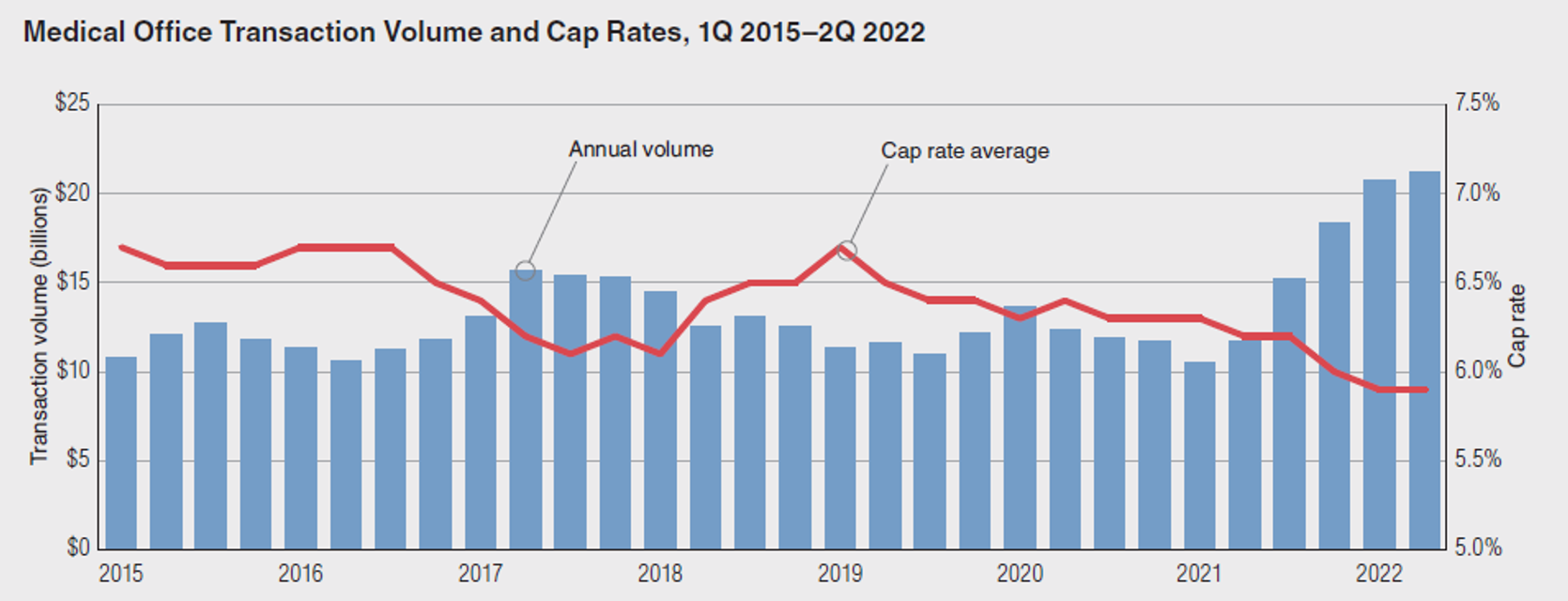

Medical Offices have a bright future as a niche commercial investment prospect. Why?

Policies and an aging population require lower-cost, higher-efficiency outpatient settings.

Tenants of medical office buildings tend to sign much longer lease terms than tenants of other types of commercial real estate—sometimes up to 15 or 20 years.

Rent growth is very steady, while cap rates decrease.

Chpt. 3

Overall Stats.

“Growth is expected to be greatest in the Supernova subgroup”, a group used to describe small cities that exploded into prominence. These cities are characterized by brisk growths in population and jobs, and are projected to grow at a uniquely fast pace in future years. PwC notes that a key impetus to this growth is the lack of availability for housing and lack of affordability caused by potential infrastructural deficiencies and home-building deficits that can’t match the growth of the city. Supernovas “have above-average levels of economic diversity and white-collar employment, which explain their strong investor appeal and should help them sustain high growth in the years ahead.”

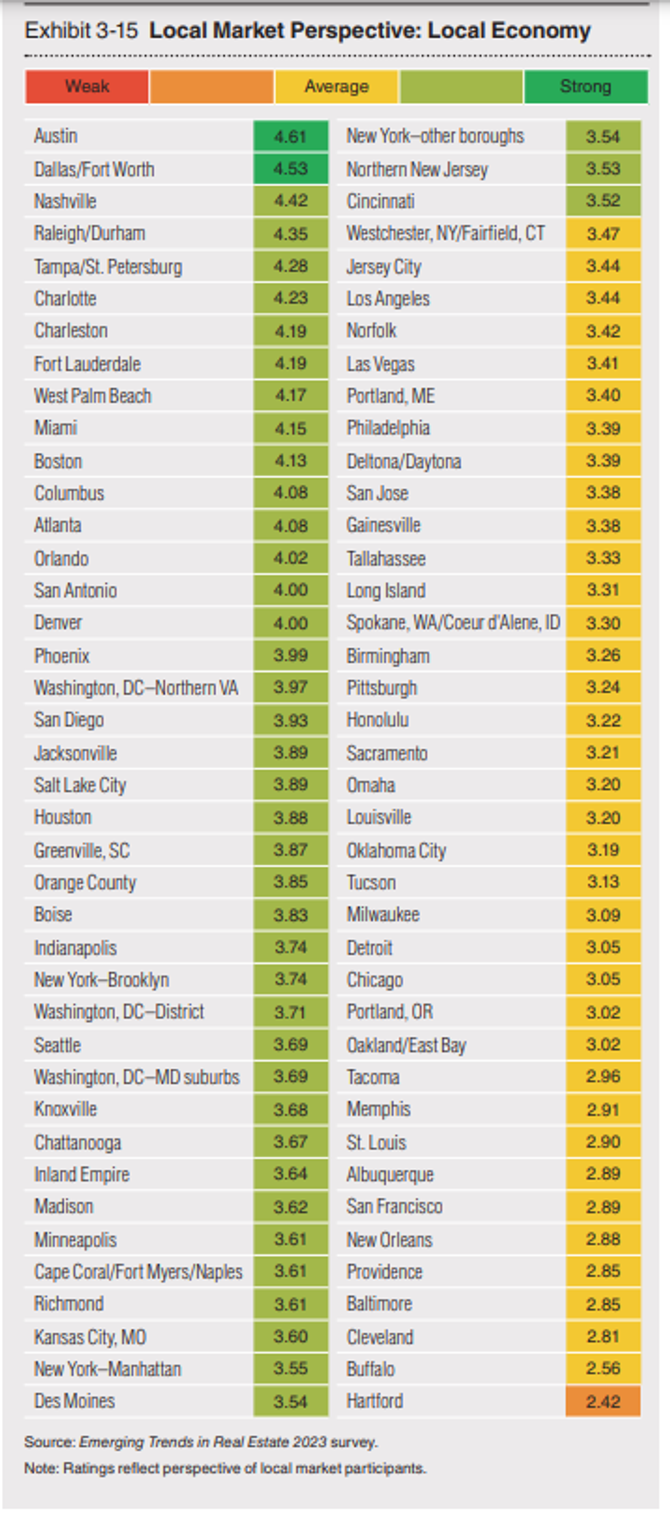

Austin’s local economy is ranked #1 in the US, meaning that it has huge potential for growth and a very strong backbone, showing that Austin should not be dismissed as just another high-volatility market.

According to Ex. 3-18 and 3-19 (not pictured), Austin’s economy and housing are predicted to grow at the fastest pace in the US by a significant margin.

Residential Stats.

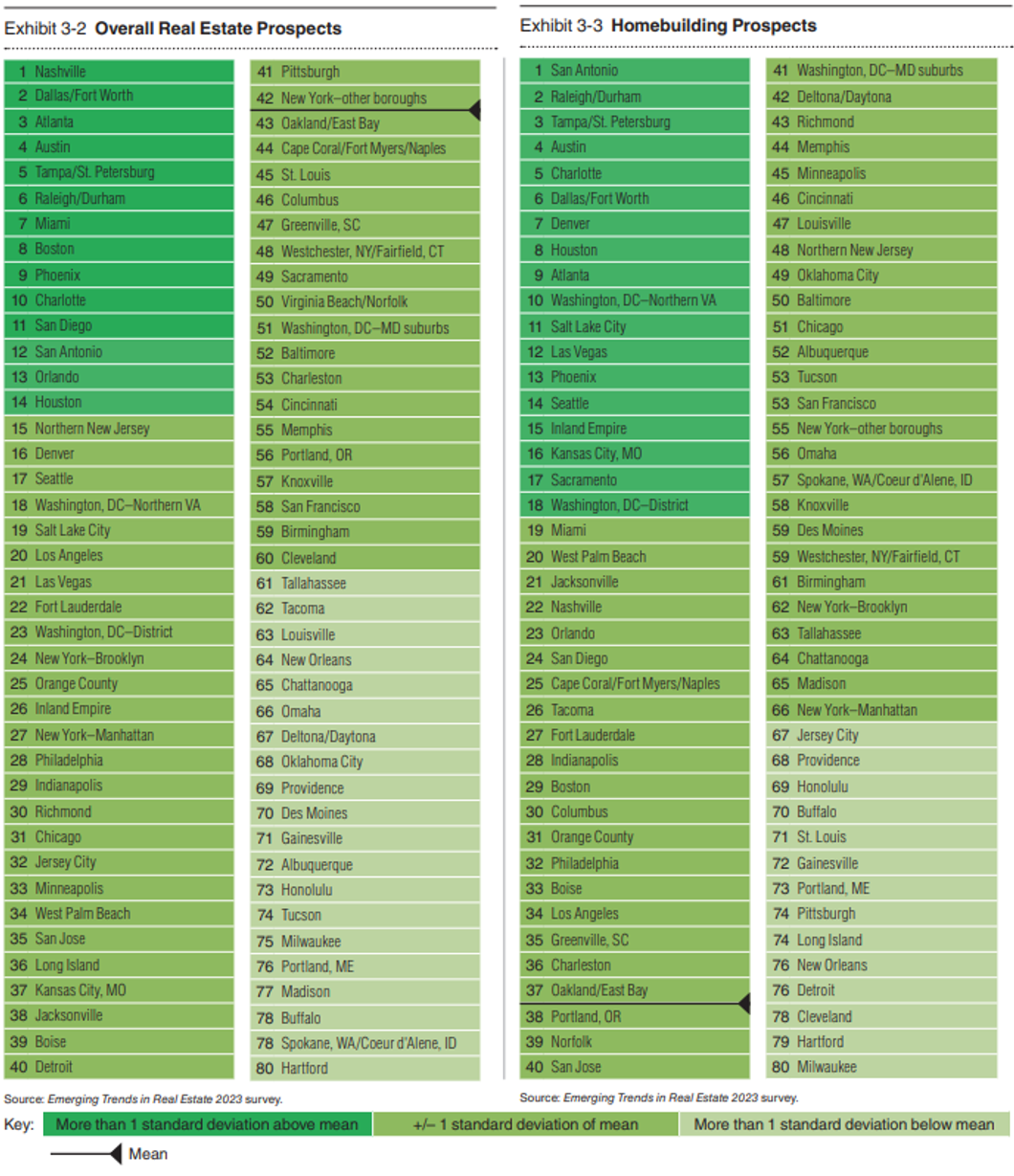

Austin ranks 4th on both real estate and homebuilding prospects – showing it still has a lot of potential in the future. (Ex. 3-2) Homebuilding prospects has went from 5th → 4th over the past year, reflecting the consistent high demand for housing that Austin has seen in the past years.

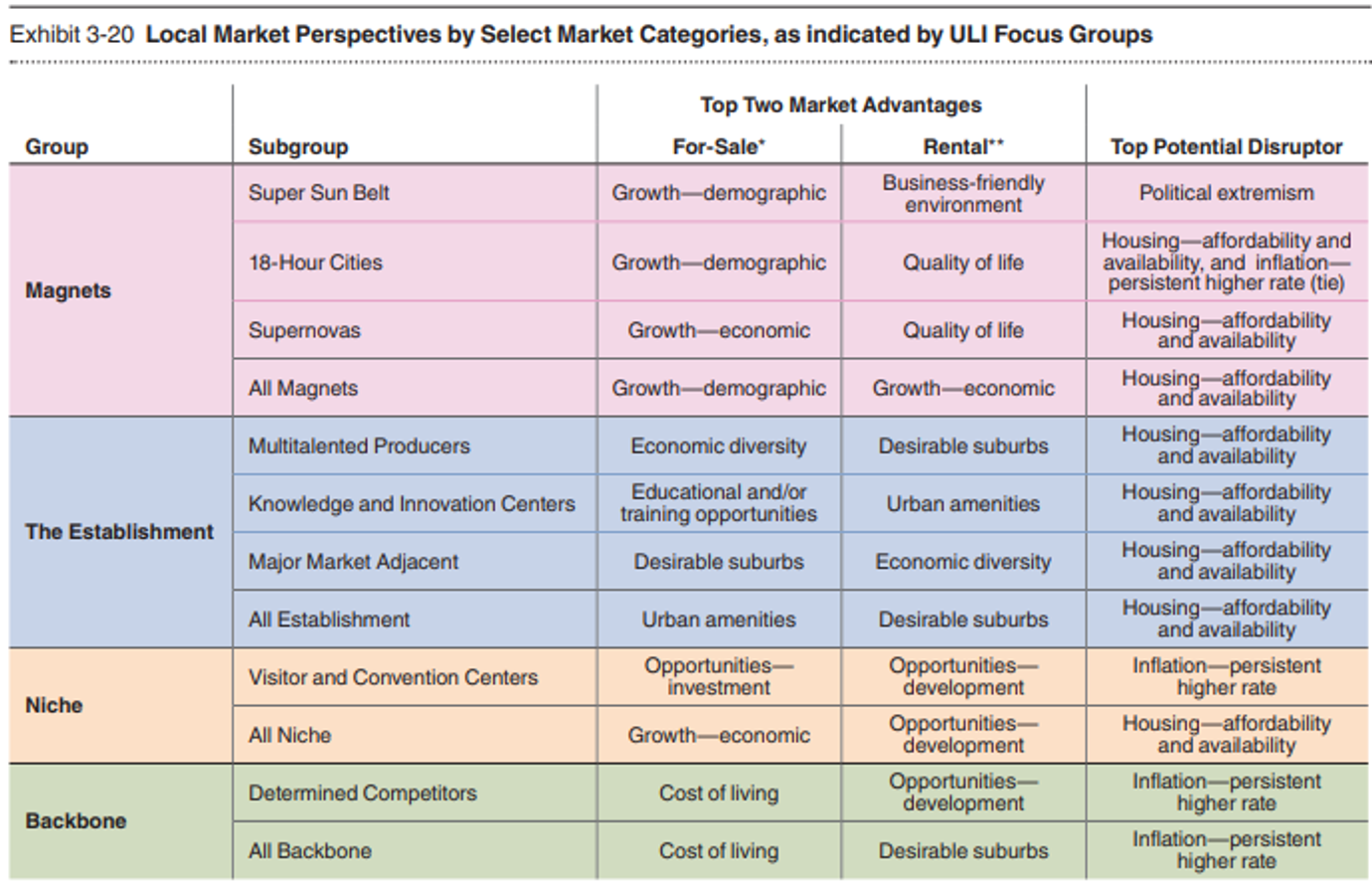

Ex. 3-20’s greatest takeaway is that Austin’s largest disruptor is potentially housing unavailability and unaffordability. However, demographic and industry-similar comparables have been through the same kind of issue, without stunting it growth dramatically as PwC’s concerns reflect (”their unfettered growth has invited some big-city problems like congestion and rising living costs. Last year’s shooting star, Boise, fell sharply after two years in the top 20. Raleigh has continued its modest decline, from the top-rated market in 2021 to number six in the 2023 survey.”)

Commercial Stats.

Among the niche markets, according to investor opinion, Austin is the 5th, 6th, and 7th highest, respectively, in the US in the “Buy” recommendation rating for retail properties, hotels, and offices, meaning that Austin’s niche development opportunities may appeal very well to institutional investors. “Niche” markets coming into their own, exploding into prominence. (”workforce housing and data centers, as well as life-sciences facilities, medical office, and single-family rental housing.”)

Determined competitors, as well as niche properties, are characterized by PwC as having a significant advantage in development opportunities (Ex. 3-20)

Investment Stats.

Austin is currently among the hottest markets in the US, according to the highest investor demand and high ranking for opportunities. (Ex. 3-13)

According to Ex. 3-16 and 3-17, debt and equity capital is most available locally in Austin. Public and private investments are among the best as well, and Austin climbed the ranks in this category. (see Ex. 2-16)