A Major Fed Rate Cut and Austin’s August Real Estate Market Insights: Seize the Moment!

As the Fed announced a 50 basis points interest rate cut in September, the real estate market is poised for a major shift. This is the first rate cut since 2020, lowering the benchmark interest rate from 5.3% to 4.8%. The move is aimed at countering slowed economic growth and a weakened job market, while also solidifying the success of inflation control, which is now down to 2.5%, close to the Fed’s 2% target.

Read more here about the recent rate cut.

What Does This Mean for Real Estate in Austin?

For real estate markets, particularly in regions like Austin, which has recently seen a slower price increase, this rate cut will likely reduce borrowing costs and boost demand, injecting fresh energy into the market. Austin has witnessed rapid home price increases over the last few years. This rate cut offers a new opportunity for buyers, potentially bringing more investors and higher transaction volumes in the coming months. Should the Fed implement further rate cuts as expected, Austin could attract even greater interest from investors nationwide.

Austin’s August Real Estate Market Update

In August, the Austin-Round Rock-San Marcos metropolitan area saw its median home price fall by 4.4% year-over-year, landing at $439,990. 2,591 homes changed hands, and 3,781 new listings were added, leaving 12,334 active listings. With homes staying on the market for an average of 70 days, and inventory standing at 4.9 months, the market remains well-stocked, giving buyers more options and negotiation power.

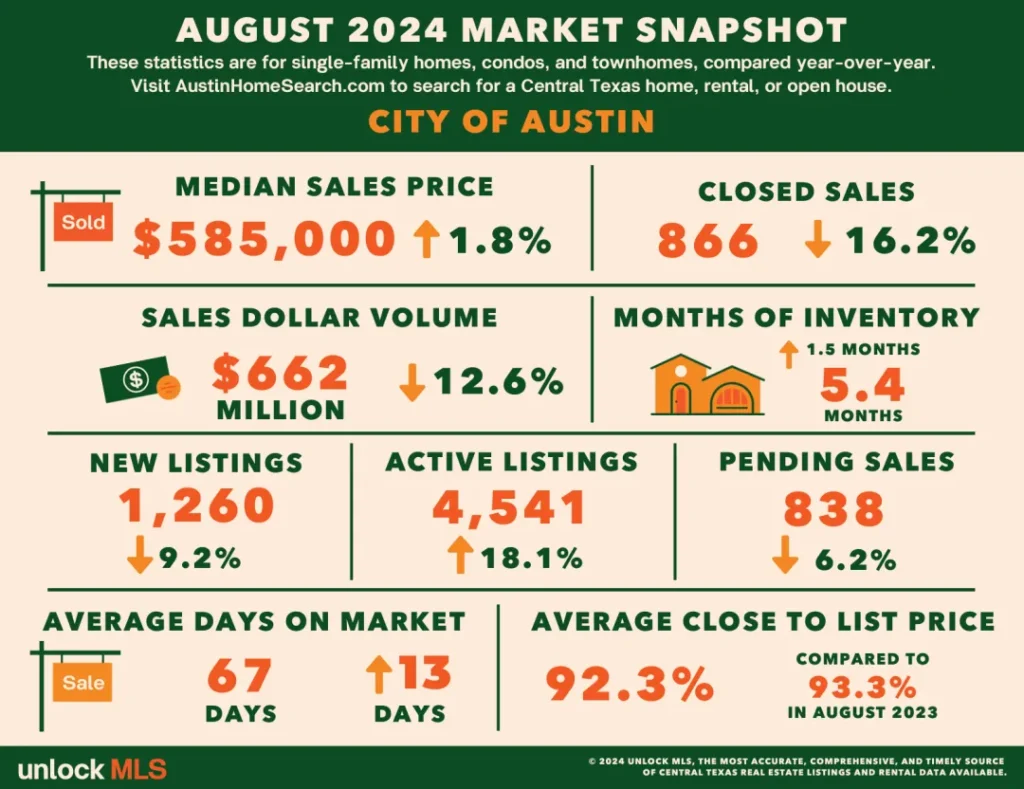

City of Austin

The median home price within Austin city limits rose 1.8% year-over-year to $585,000. Though new listings dropped by 9.2% with 1,260 homes coming to market, there are still 4,541 active listings, and the average time on the market is 67 days.

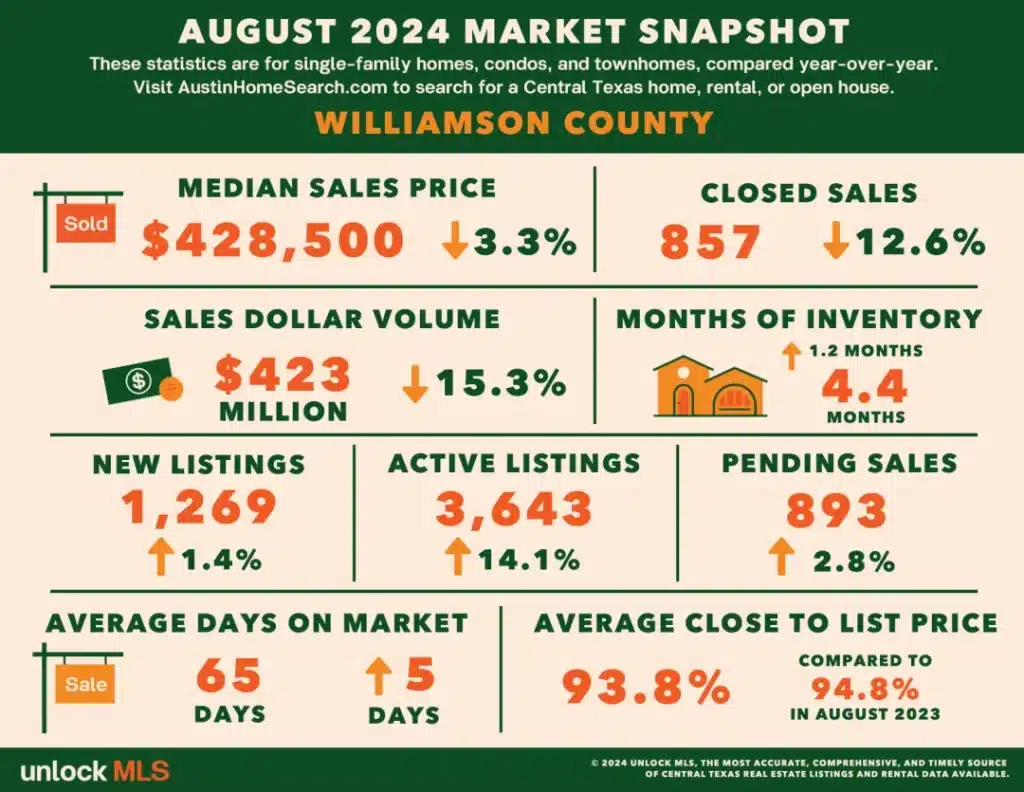

Williamson County

In Williamson County, the median price remained stable at $428,500, with 857 transactions completed in August. New listings totaled 1,269, while 887 homes were under contract, with inventory lasting 4.4 months.

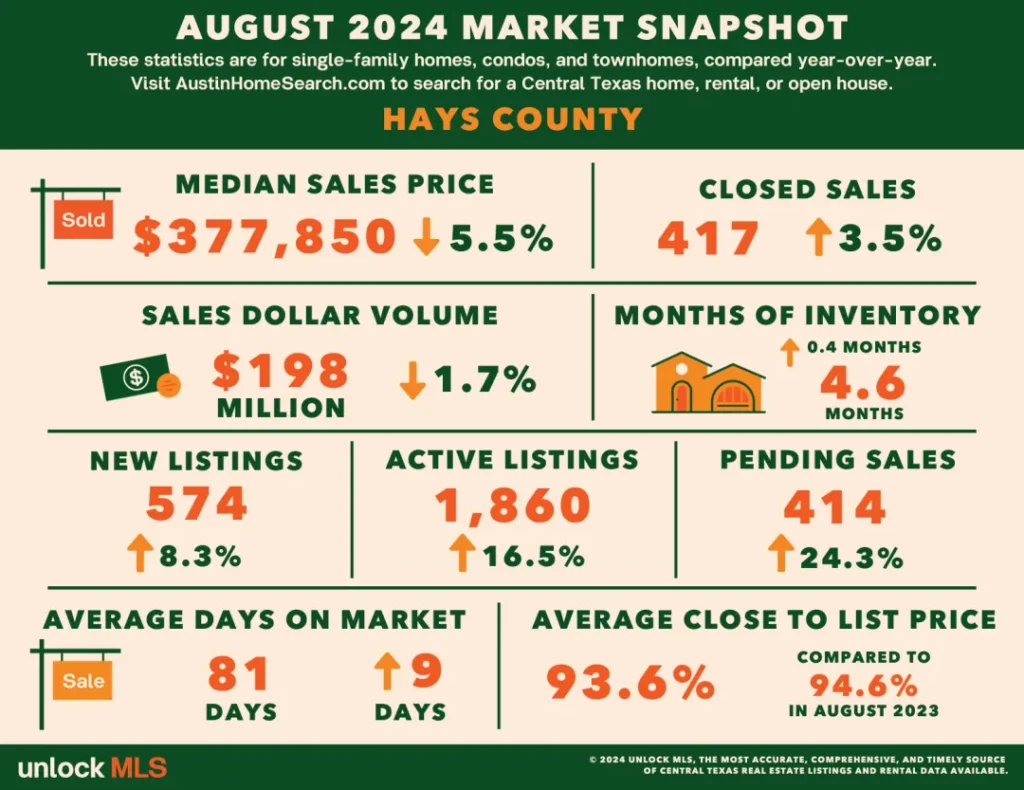

Hays County

Hays County, home to cities like San Marcos and Kyle, saw its median home price dip by 5.5% to $377,850, but the number of transactions rose by 3.5% to 417. The market has 1,860 active listings, and homes stayed on the market for an average of 81 days.

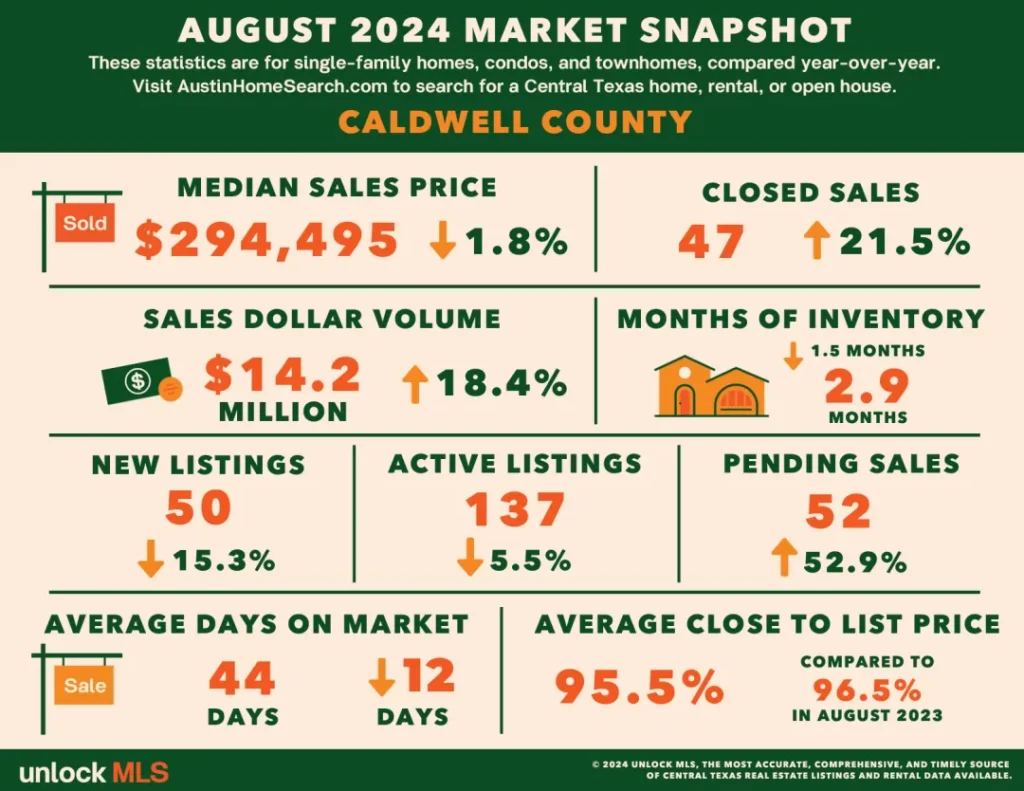

Caldwell County

Lockhart, located in Caldwell County, experienced a slight drop in median home prices by 1.8% to $294,495. However, transactions surged by 21.5% to 47 properties, and active listings now total 137.

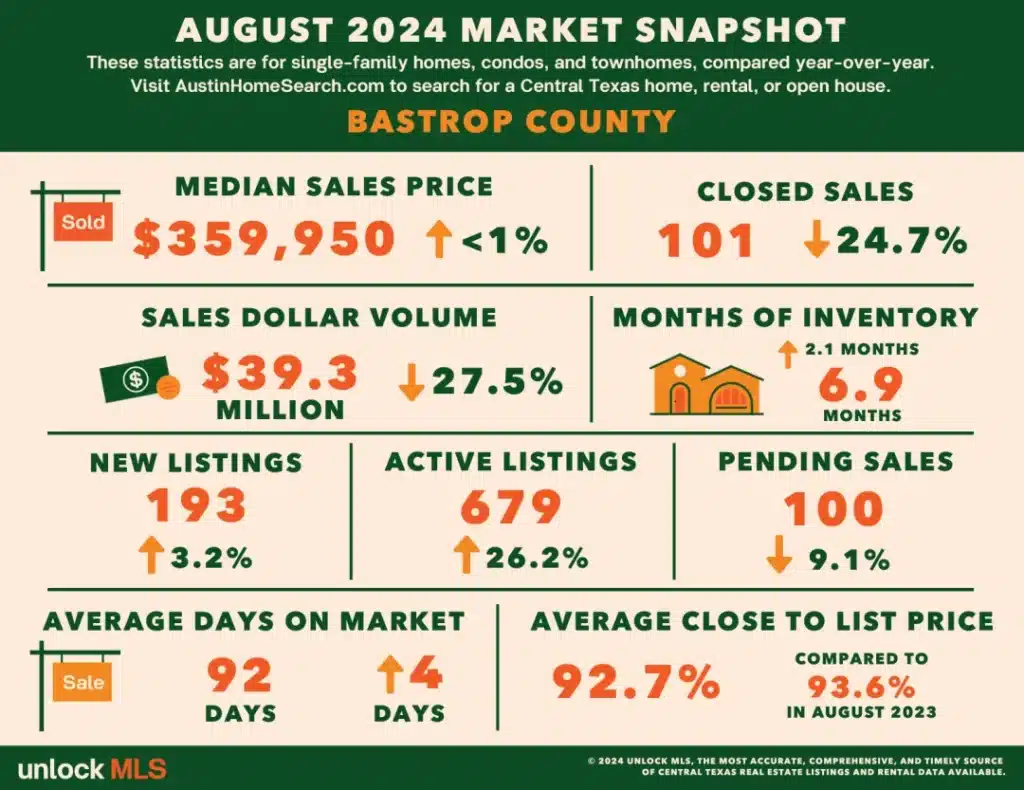

Bastrop County

Bastrop County’s median home price held steady at $359,950. With 101 homes sold and 193 new listings in August, the market is well-stocked with 679 active listings.

Conclusion: Timing is Everything!

The Fed’s rate cut and current market conditions make this an opportune moment for buyers and investors alike. For homebuyers, right now is a great time to plan to secure lower interest rates and negotiate favorable deals. For investors, this is a crucial window to lock in the best deals before the next market upturn. If you’re looking to capitalize on this unique opportunity, get in touch with our team at Real International today!