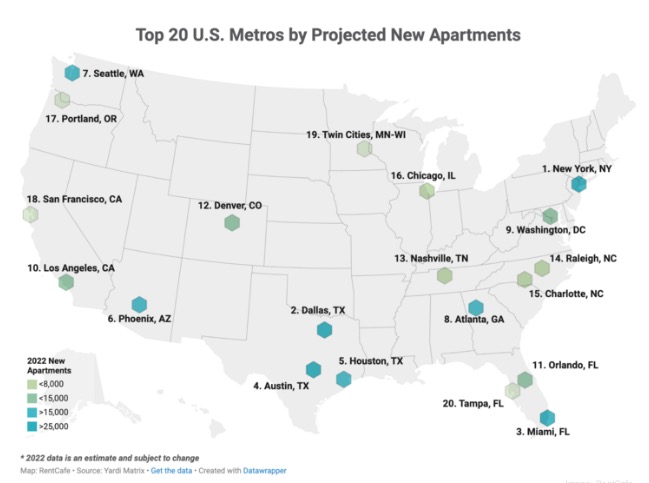

By year’s end, Austin is projected to rank No. 4 among major metros nationwide for new apartments brought online, a welcome sign of relief in a region starving for both rental and for-sale housing.

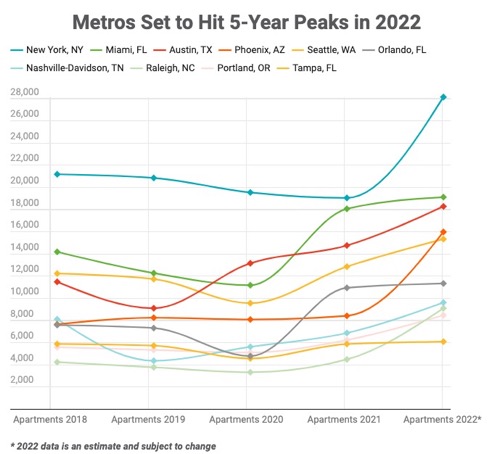

That’s according to an Aug. 23 RentCafe study which found that Austin is projected to deliver 18,288 apartments in 2022.

That would be a five-year high and continue a trend of increased apartment construction since 9,107 units were delivered in 2019.

Already this year, the Austin metro ranks No. 2 in the nation with 4,236 apartments delivered, according to RentCafe. Houston ranks No. 1 with 4,746 apartments delivered and Seattle ranks No. 3, with 3,232.

Multifamily builders are rushing to meet a huge level of demand. A July study by Hoyt Advisory Services and Eigen10 Advisors estimated the Austin area would need 100,000 new apartments by 2035.

“It might be a high, a historical high, but we may be at a sort of a new normal with some of the numbers based on the demand that is here in this market,” Austin Apartment Association Executive Vice President Emily Blair said.

If the metro continues to see the kind of economic growth common in recent years, that could help sustain or increase this year’s level of production, she said.

If this level of production is sustained through 2035, Austin would be on pace to deliver 256,032 apartments. That would far outpace the 100,000 apartments the July study — commissioned by the National Apartment Association and the National Multifamily Housing Council — determined Austin would need to deliver to keep up with demand.

“We’re at unprecedented levels of housing demand here,” Blair said, adding that as of Aug. 25 apartment occupancy rates were 92.1%.

There are of course challenges to bringing the needed apartments online, Blair said.

One challenge is purely economical: Austin is more expensive than other cities for both raw land and development fees, which can “create some pause for developers, certainly,” she said.

A recent study from the Texas Real Estate Research Center at Texas A&M University showed that development fees are drastically higher in Austin than in the state’s other big cities.

While that study focused on the development of single-family homes, Emily Chenevert, CEO of the Austin Board of Realtors, said in July that development fees are a major barrier to development across all types of housing.

Supply chain issues have also been a major barrier in recent years, Blair said. At various points, supply chain issues have impacted construction by limiting access to everything from windows to doors to microchips used in appliances. Currently, transformers are a hot item that are difficult to procure.

Because of these challenges, the time it takes to bring an apartment complex online has grown, she said. Whereas it used to be normal to see a complex come online in two to three years, it now often takes three to four.

Map: The top 20 U.S. metros for projected new apartment delivery by end of 2022, according to RentCafe.

The focus should not be solely on the number of apartments needed to come online, Blair said.

Instead, there should also be a focus to bring on a variety of apartments that serve multiple levels of affordability.

Housing affordability is one of the most pressing issues in Austin. Median home sale price grew 26% from 2010 to 2021 and rent grew 27%, while median family income increased 12%, according to the latest annual report from HousingWorks Austin.

One of the tools the city of Austin is employing to bring more affordable housing online is by use of the Affordability Unlocked program. The program allows developers to build more units in exchange for including a significant amount of affordable housing. If a builder sets aside half of a development’s units as affordable, they are given bonuses that include height and density increases, parking and compatibility waivers and reductions in minimum lot sizes.

The Article is from Austin Business Journal, copyright belongs to owner