The idea of the new-to-town buyer with “California money” driving up home prices in Austin has embedded itself into the region’s housing narrative.

“I would say it’s a little more complicated than that,” said Realty Austin agent Elle Klein Garrison.

She works with a lot of out-of-state buyers and has seen firsthand the types of budgets many of these new residents are working with. Many of them, she said, are first-time homebuyers, meaning they don’t have equity from selling a previous home to put into the Austin market. On average, her clients are spending in the $500,000 range, up to $1.5 million.

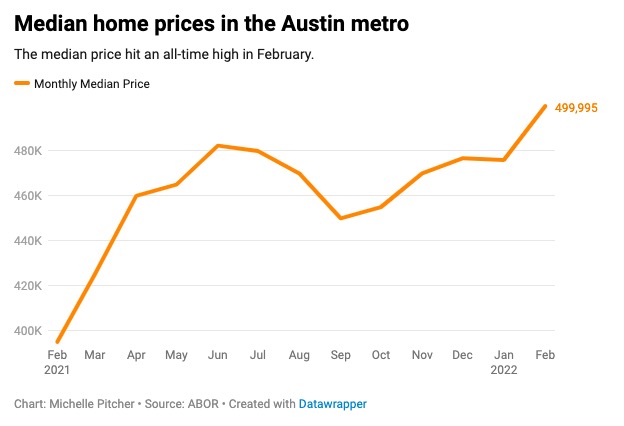

The median home price in the metro hit $499,995 in February, an all-time high for the area, according to the Austin Board of Realtors. This record sticker price is primarily the result of massive demand and persistently low supply in Central Texas — the metro had only 0.4 months of inventory last month, meaning that if new listings stopped, the number of available homes would run out in less than half a month.

But are out-of-state buyers significantly contributing to higher prices in the state? Experts from the Texas Real Estate Research Center at Texas A&M University said probably not.

After analyzing migration patterns into the state and buyer behavior, researchers found no correlation between in-migration and appreciation over 15 years up to 2019.

Researchers relied on migration data from the U.S. Census Bureau, which has not yet released data for 2020-21. Because the data only goes up to 2019, Miller said it’s possible out-of-state buyers played a larger role in the pandemic-era housing market. Still, many real estate experts point out that most of the newcomers to Austin are coming from other parts of Texas. Depending on which study one reads, perhaps one or two out of your 10 new neighbors come from California, the state that traditionally funnels the most newcomers to the Lone Star State.

In the Austin metro, strong job creation points to more people moving into town during the pandemic. In 2021, more than 23,000 new jobs were announced in the metro, an all-time high according to data compiled by Opportunity Austin. High-profile headquarters relocations — including for Tesla Inc. (Nasdaq: TSLA) — portend a wave of new employees moving to the Austin capital.

That said, past trends can help determine what has likely happened since 2020, Miller said.

“It’s important to consider that housing prices have been going up for a decade, so we’re still able to learn and explore this connection between out-of-state movers and prices, even though we don’t have all of the data for the pandemic,” Miller said.

Median home prices in Central Texas have risen steadily since the Great Recession. A housing price peak happened in 2013, when growth reached 9%, researchers say. But even as prices peaked, the number of new residents coming from out of state stayed steady.

About 500,000 new residents come to Texas from another state each year, according to Wes Miller, senior research associate for TRERC at Texas A&M University. This is a small fraction of the state’s total population of 30 million.

There is some truth to the idea that out-of-state buyers come to Texas with larger wallets. The median income of out-of-state buyers began to outpace Texans’ in 2014, researchers say. Buyers from other states have median income levels about about $7,000 higher than Texas-based buyers, Miller said.

On average, out-of-state buyers pay about $60,000 more than in-state ones, but that number has been steady for the past several years.

While people moving to Texas today are, on average, slightly wealthier than in previous years, researchers found no significant difference in the amount these buyers are paying per square foot for a home. The difference between in-state and out-of-state buyers’ purchase prices can largely be attributed to the size of the home — out-of-state buyers tend to go for more square footage, according to Miller.

The demographics of people moving to Texas also affect the kinds of homes they buy when they arrive. The median age for someone moving to Texas is 29, according to Census Bureau data, the result of booming technology labor markets throughout the state. These buyers are more likely to rent or buy a first-time home than they are to put a down payment on a Lakeway mansion.

It’s possible, however, that out-of-state movers can have an outsized effect on particular neighborhoods, if a critical mass of people move to a specific area.

Researchers at Texas A&M were inspired to look into the phenomenon because of the increased scrutiny placed on out-of-state buyers in the past few years.

“There’s been so much discussion about the role out-of-state buyers have played in this environment — in rising home prices and decreased housing affordability,” Miller said. “We thought it was important to see what the data are actually saying, and to either confirm or push back on some of those claims.”

Out-of-state buyers do, however, have an effect on rising prices insofar as they represent more demand for a finite number of homes.

“It’s a fact that more people means more demand for housing means higher prices,” Miller said. “That’s still true. The point is, is that there’s many other factors that seem to be more important here.”

The Article is from Austin Business Journal, copyright belongs to owner