This article provides an analysis of the July 2025 U.S. Consumer Price Index (CPI) inflation data, as well as leasing and sales activity across major areas in the Austin-Round Rock-San Marcos Metropolitan Statistical Area (MSA).

(Note: All housing market charts are sourced from Unlock MLS.Due to slight differences in reporting periods and geographic coverage, minor discrepancies in numbers may exist. Please focus on overall trends and market structure when interpreting these signals.)

August CPI: Inflation Edges Higher

In August, the CPI jumped 0.4%, the biggest one-month increase since January, lifting the annual inflation rate to 2.9%. Core CPI rose 3.1%, right in line with expectations.

The broader downtrend in inflation remains intact, but the August rebound is a reminder that price pressures are still lingering.

The path forward remains uncertain: higher inflation may delay rate cuts, but a softer labor market also makes it harder for the Fed to tighten further. In practice, mortgage rates will likely stay elevated in the near term, but the longer-term trend still points lower, creating space for housing activity to recover.

Austin Metro Housing Landscape

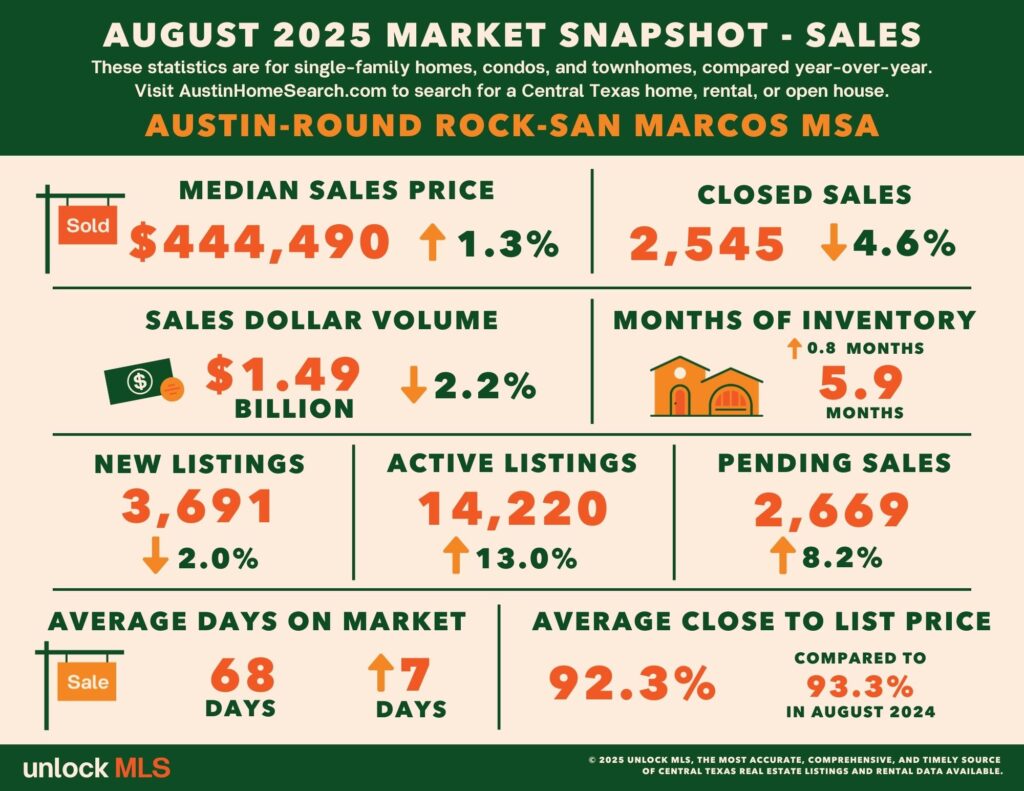

In August, the Austin metro’s median home price edged up slightly, but sales volumes fell and inventory climbed. There were also positive signals: mortgage rates stabilized in the low 6% range, and pending sales picked up modestly, showing that buyers haven’t disappeared, but many are waiting for more favorable conditions.

With inventory now at 5.9 months, Austin’s housing market has tipped firmly into buyer’s market, giving buyers greater leverage at the negotiating table. Even with the seasonal patterns will influence the fall market, but underlying trends hint a gradual improving in the coming months.

The rental market has stayed tight. The metro’s median rent climbed to $2,362 in August, up 5% YoY, but performance diverged across the region. Core areas such as Austin, Travis, Hays, and Williamson counties saw softer rents and slower leasing activity, while Bastrop and Caldwell counties recorded strong gains in both rents and signed leases. This reflects a spillover effect, as renters facing higher costs and fewer options in the core are increasingly turning to the outer counties. Across the metro, rental inventory averaged just 2.6 months, and the typical days on market shortened to 41 days.

Pricing Trends

The metro’s median sales price reached $445,000 in August, up 1.3% from last year. This extends nearly two years of notable price stability, with no meaningful appreciation but also no significant decline.

📈 Sales and Contracts

Closed sales fell 4.6% YoY, underscoring a slower overall pace of activity. Pending contracts, however, rose 8.2%, suggesting demand is gradually reemerging. That said, the lift from lower mortgage rates has been weaker than many anticipated. Analysts note that if rates stay steady or edge lower this fall, more pent-up demand could start to flow back into the market.

🏡 Listings and Inventory

New listings dipped 2% from a year ago, but active inventory jumped 13% to 14,220 homes. Months of supply climbed from 5.1 last year to 5.9 today. Buyers now have a broader set of options, while sellers are facing stiffer competition.

🌐 Macro Backdrop

Current mortgage rates is in the low 6% range, the lowest since 2024, nearly a full percentage point lower than early 2025. If borrowing costs hold or decline further, they’ll provide meaningful support for housing demand.

💡 Takeaways for Buyers and Sellers

Buyers: Rising inventory, steady pricing, and lower mortgage rates are creating a more favorable environment. With the right preparation, buyers can secure both a desirable home and manageable payments. Patience and readiness are key right now.

Sellers: With more homes on the market, competition is intensifying. Strategic pricing and strong presentation are critical. The upside is that prices remain stable, and motivated buyers are still out there.

📩 Ready to Explore Your Options?

Whether you’re looking to buy, sell, or invest, our Real International team is here to deliver tailored strategies to help you succeed in today’s market.

👉 Contact us today at info@realinternational.com to uncover opportunities in the Austin.