August Market Updates and CPI Analysis

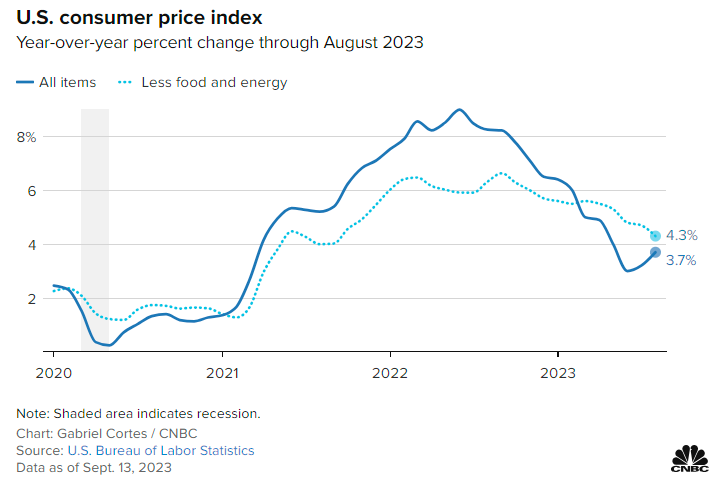

August CPI Data Report

The most recent report, published by the U.S. Department of Labor on September 13th, reveals that surging oil prices had a significant impact on the Consumer Price Index (CPI) for August. The CPI rose by 0.6%, marking the largest increase in 14 months, and reached 3.7%. Concurrently, the continued ascent of the housing index also played a role in the uptick in core CPI for August. This inflationary trend persists above the Federal Reserve’s 2% target, potentially prompting the Fed to consider further interest rate hikes before the year’s end.

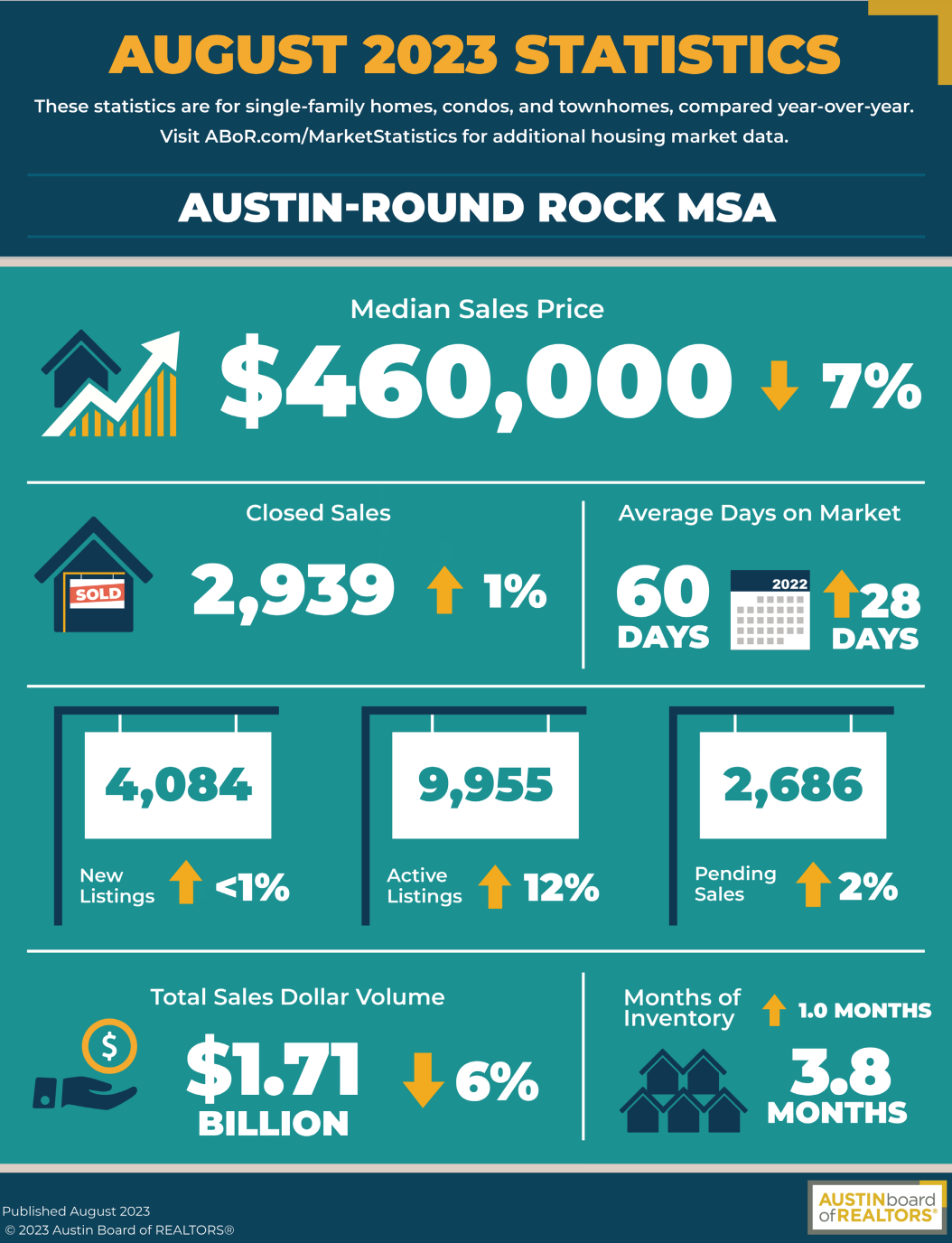

August Housing Price Data Report

A market report recently released by the Austin Board of REALTORS® sheds light on the real estate landscape in the greater Austin metropolitan area (Austin-Round Rock) for August. It indicates that new listings and transaction volumes were nearly identical to those of the previous year. The median home price experienced a 7% year-on-year decline, settling at $460,000. Properties averaged 60 days on the market, with inventory at 3.8 months.

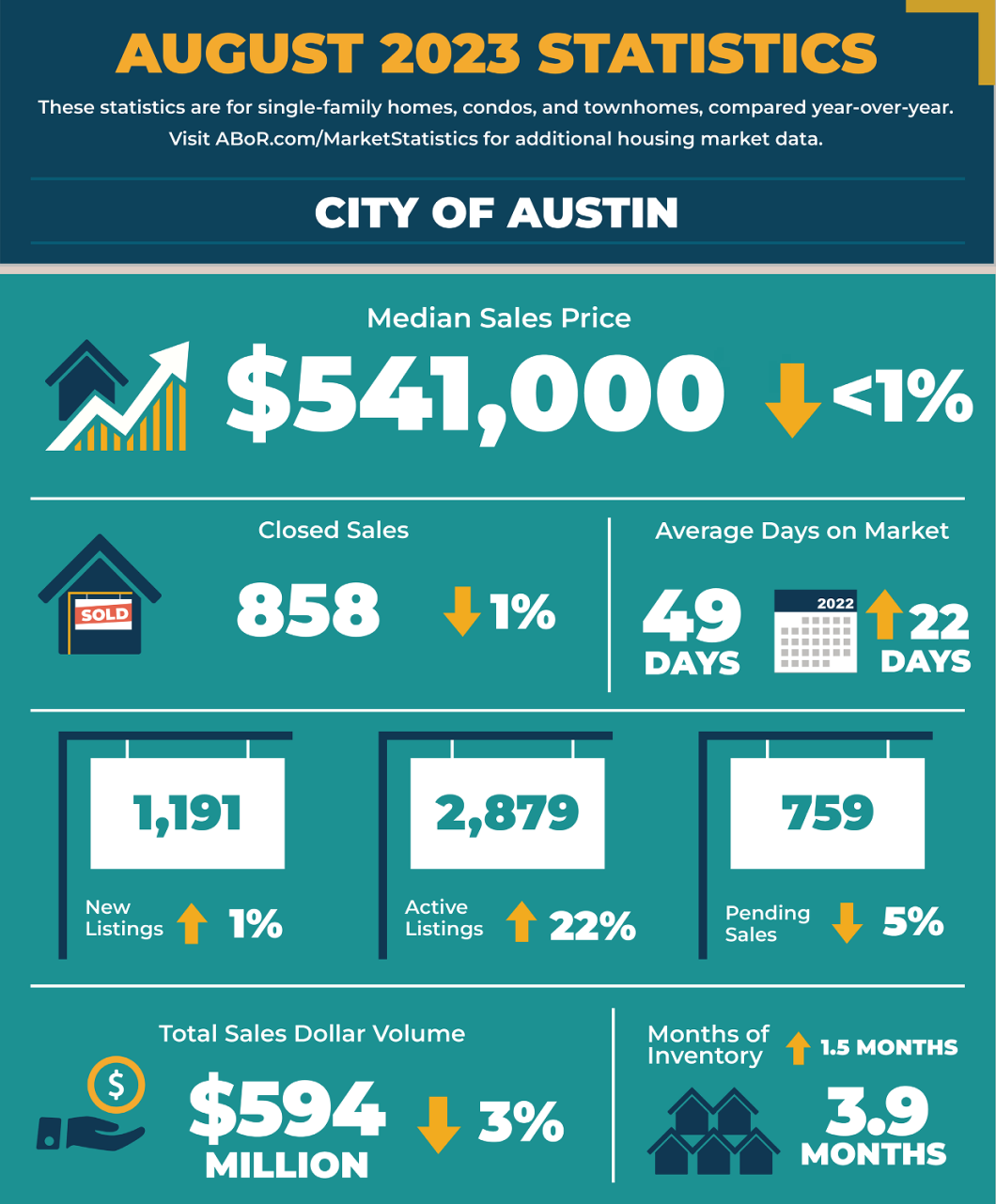

City of Austin

In August, the median home price, new listings, and transaction volume in the Austin metropolitan area remained unchanged from the previous year, holding steady at $541,000. Notably, downtown Austin demonstrated resilience despite rising interest rates, underscoring the advantages of this core real estate area. The month of August saw only 1,191 new listings hit the market, resulting in a year-on-year decline of 5%. Housing inventory stood at 3.9 months, with total sales amounting to $594 million, down by 3% compared to the previous year.

The performance of Austin’s core area is a testament to the promise of the Real International Crystal Line Opportunity Zone investment project! Real International Crystal Line plans to construct 23 single-family homes (BFR) in the core area and along the new light rail line. Leveraging the U.S. government’s policy support for “Opportunity Zones,” the project provides investors with a 10-year exemption from capital gains tax, enhancing the value of every investment dollar.

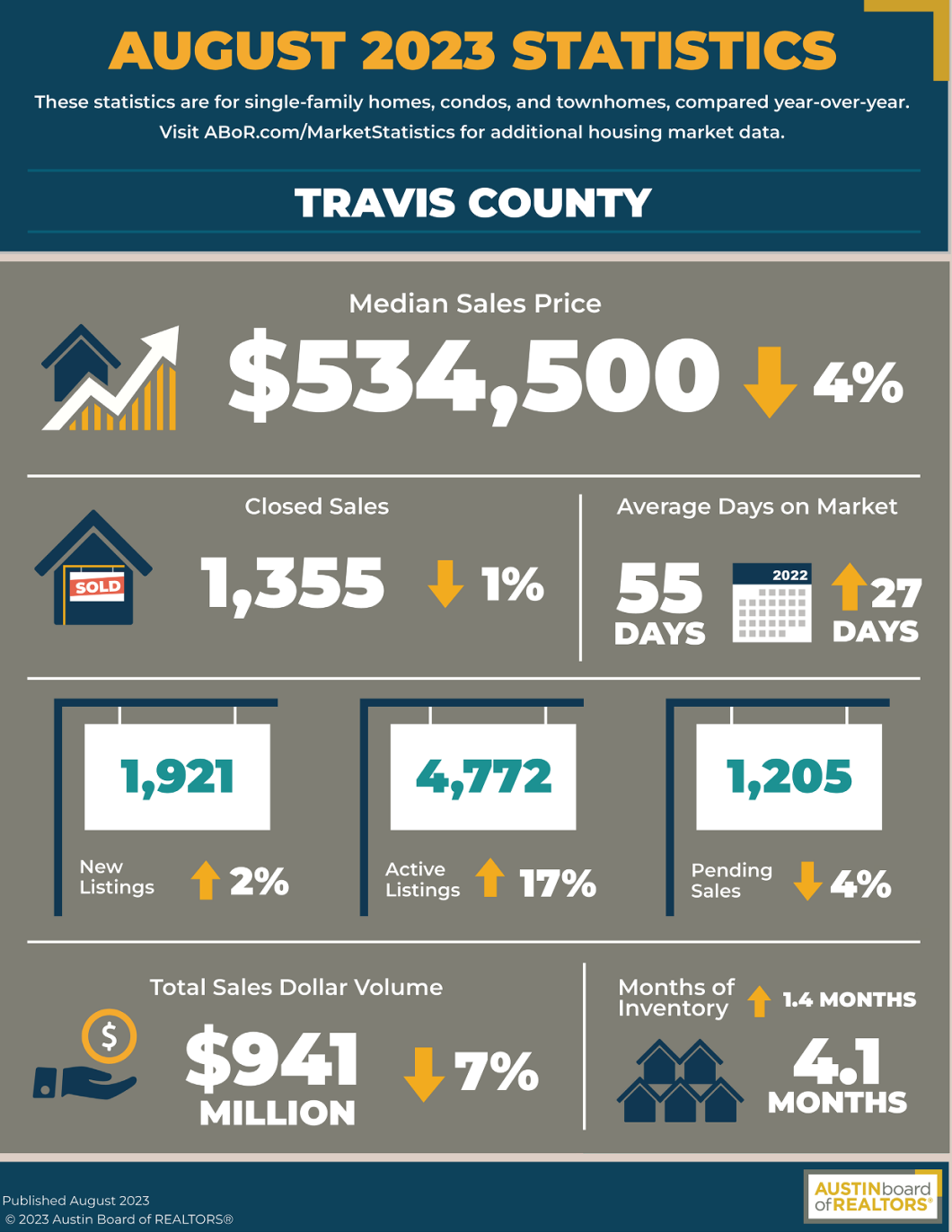

Travis County

In Travis County, the median home price witnessed a 4% year-on-year decline in August, settling at $534,500. New listings and transaction volumes remained relatively consistent year-over-year. The inventory level stood at 4.1 months, with total sales reaching $941 million—a 7% year-on-year decrease.

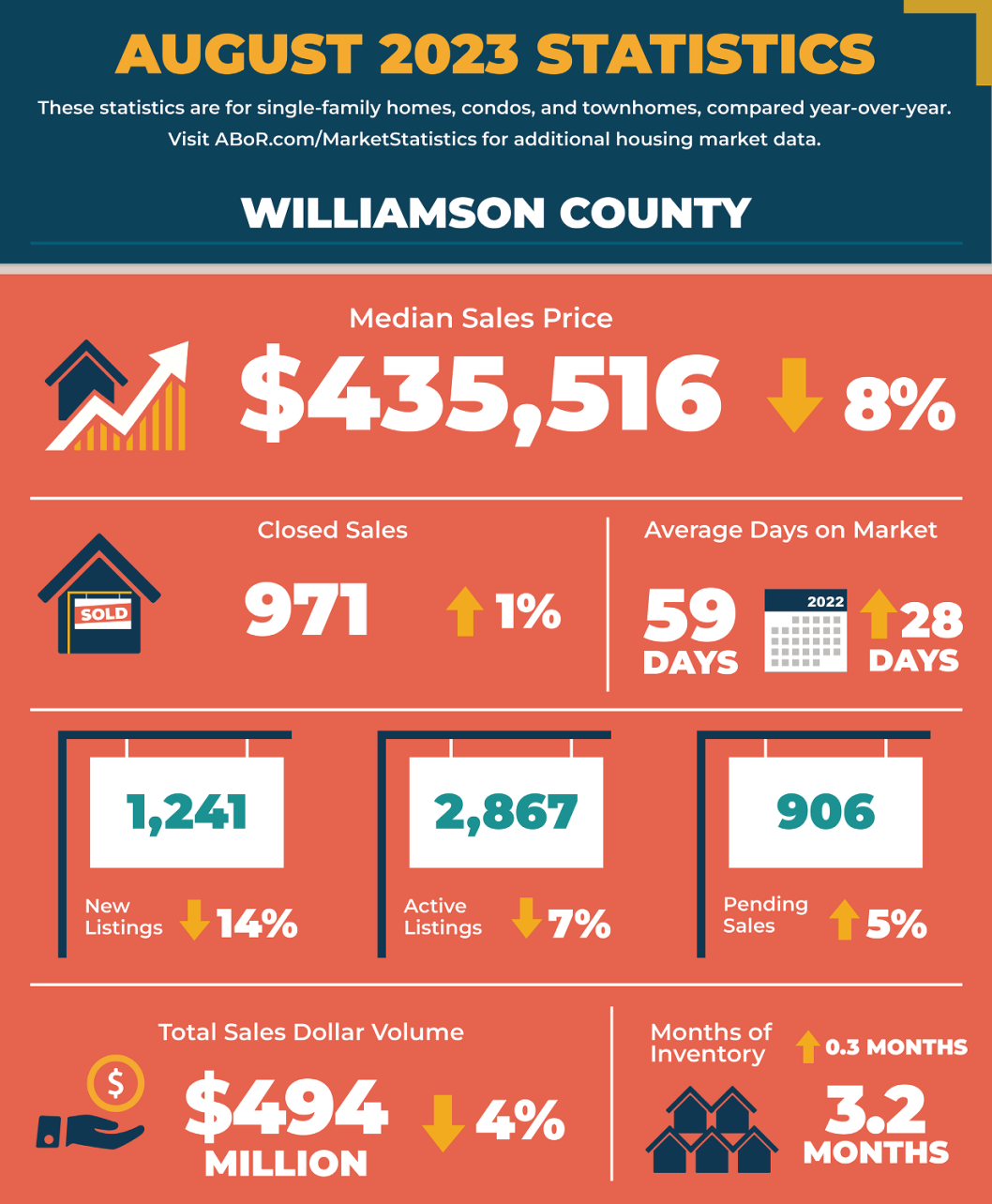

Williamson County

Turning our attention to Williamson County, the largest area, the median home price dropped by 8% year-on-year in August, amounting to $435,516. There were 971 transactions and transfers, reflecting a 1% year-on-year increase. Despite the decline in the median price, Williamson County, one of the regions experiencing significant population growth, observed a substantial drop in new listings (14% decrease). However, there were 906 pending sales in August, marking a 5% year-on-year increase. The inventory level stood at 3.2 months, with total sales amounting to $494 million—a 4% year-on-year decrease.

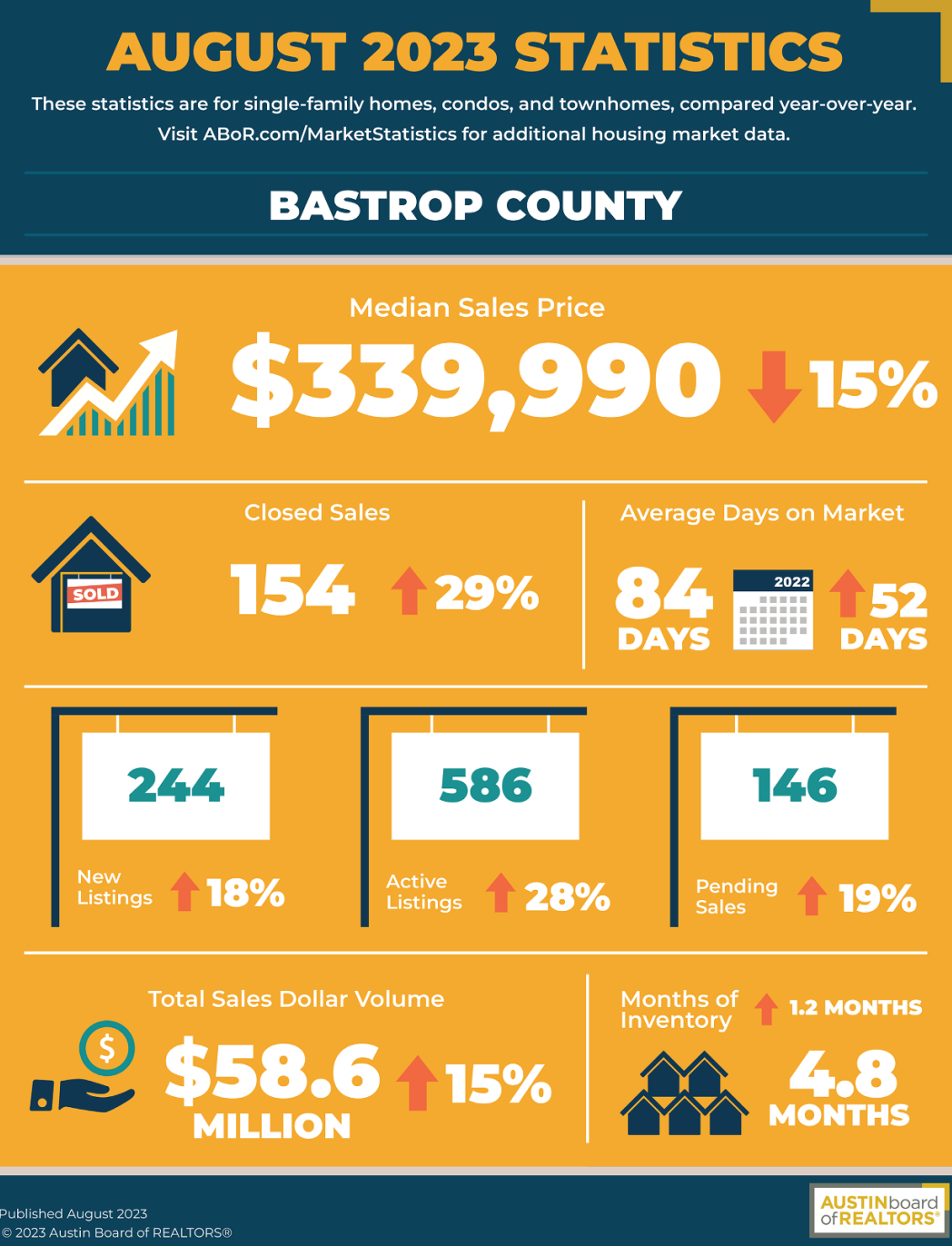

Bastrop County

In the relatively remote satellite city of Bastrop County, the median home price dropped 15% in August to $339,990 . However, transaction volume also increased by 29%. There were only 244 newly listed houses, and the number of active houses was 586, a year-on-year increase of 28%. 146 households entered Pending Sales, a year-on-year increase of 19%. Total sales volume was US $58 million, an increase of 15% compared with August last year.

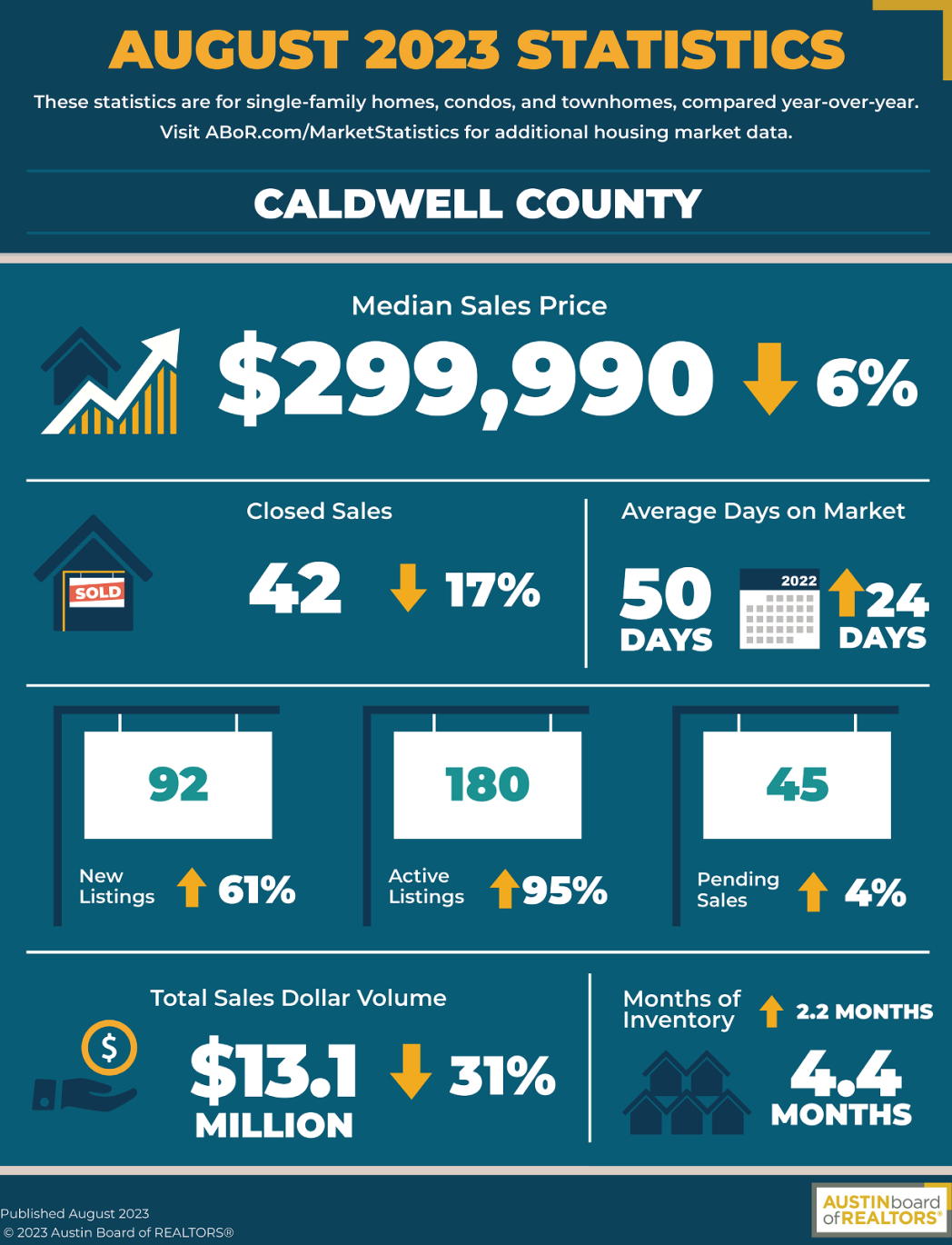

Caldwell County

The median home price in Caldwell County in August was $299,990 , down 6% year-over-year. Transaction volume fell 17% year-on-year to 42 transactions. There were 92 new listings, a year-on-year increase of 61%. 45 entered Pending Sales, a year-on-year increase of 4%.

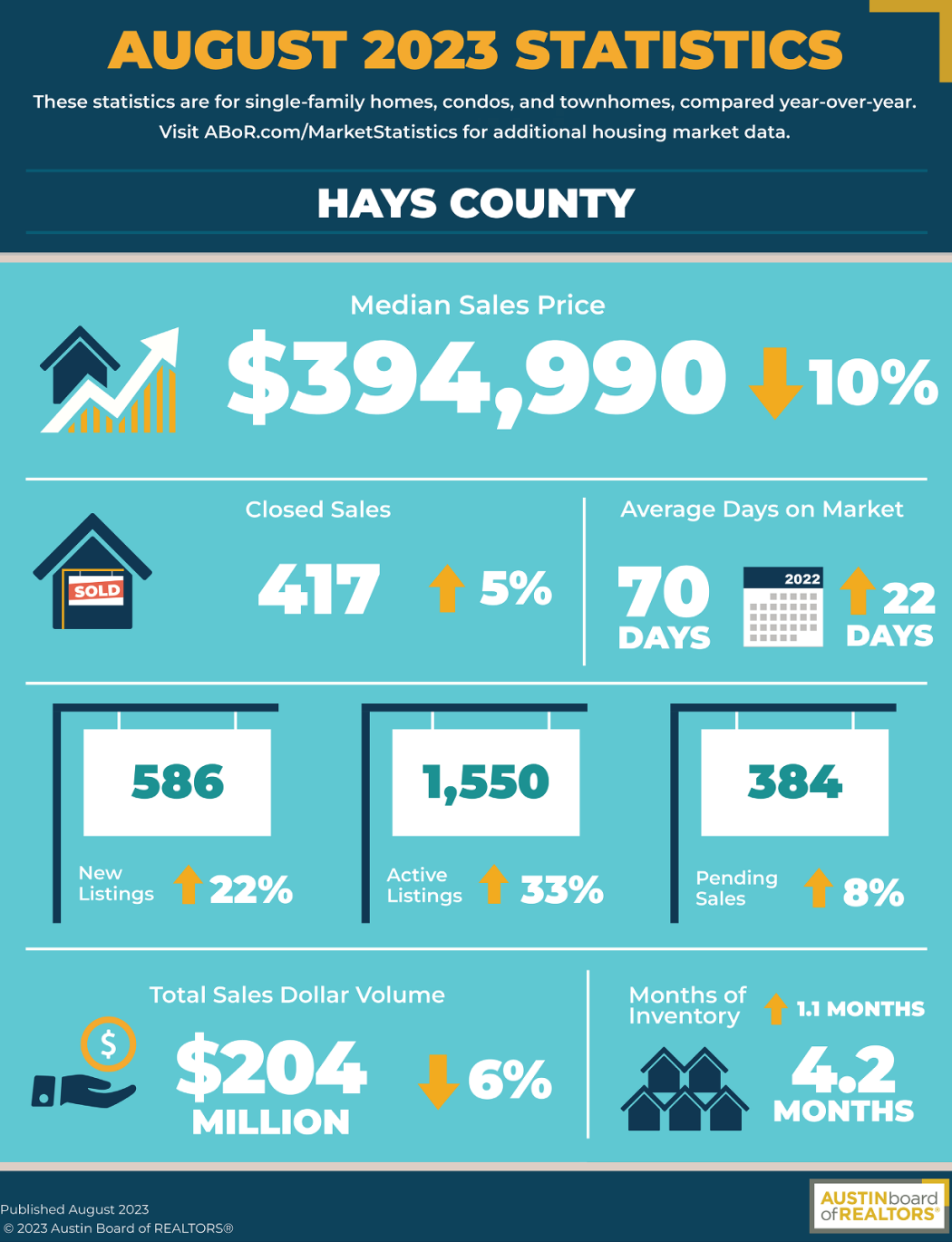

Hays County

In August, the median home price in Hays County was $394,990, indicating a 10% decrease from the previous year. There were 417 transactions transferred, reflecting a 5% year-on-year increase. Additionally, 586 newly listed properties entered the market, with 384 properties achieving Pending Sales—an 8% year-on-year increase.

If you’re interested in acquiring a new home at an attractive price, Real International is currently procuring an institutional deal offering a discount of 10% below market value on new construction homes in Hays County. This location is situated within a 15-minute commute to Tesla’s new warehousing and logistics center and bears close proximity to one of Texas’ largest outlet malls.

The homes in this batch feature 3 bedrooms and 2 bathrooms, making them ideal for rental purposes. This community does not impose the many new area construction fees, and its low land taxes and HOA fees translate to substantial savings for investors.

If interested about any of the opportunities we currently offer, please message Lynn on Linkedin or shoot us a quick email expressing your interest at info@realinternational.com.