Austin’s Industrial Real Estate Market Flourishes Amidst Strong Demand and Rapid Growth

CBRE recently released its first-quarter industrial real estate market report for Austin, offering a detailed analysis for investors seeking opportunities in the thriving market.

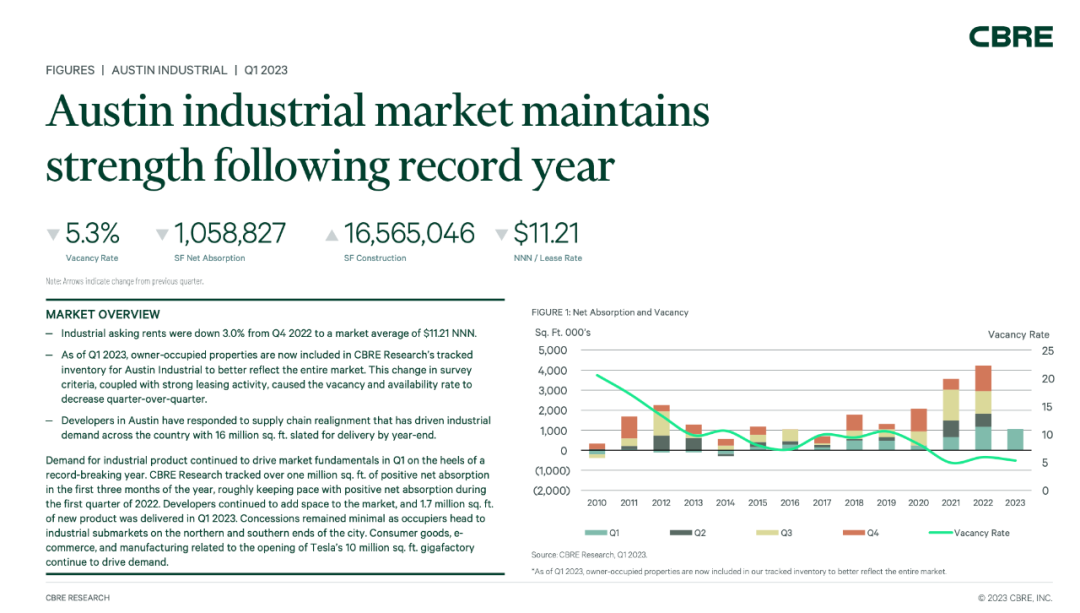

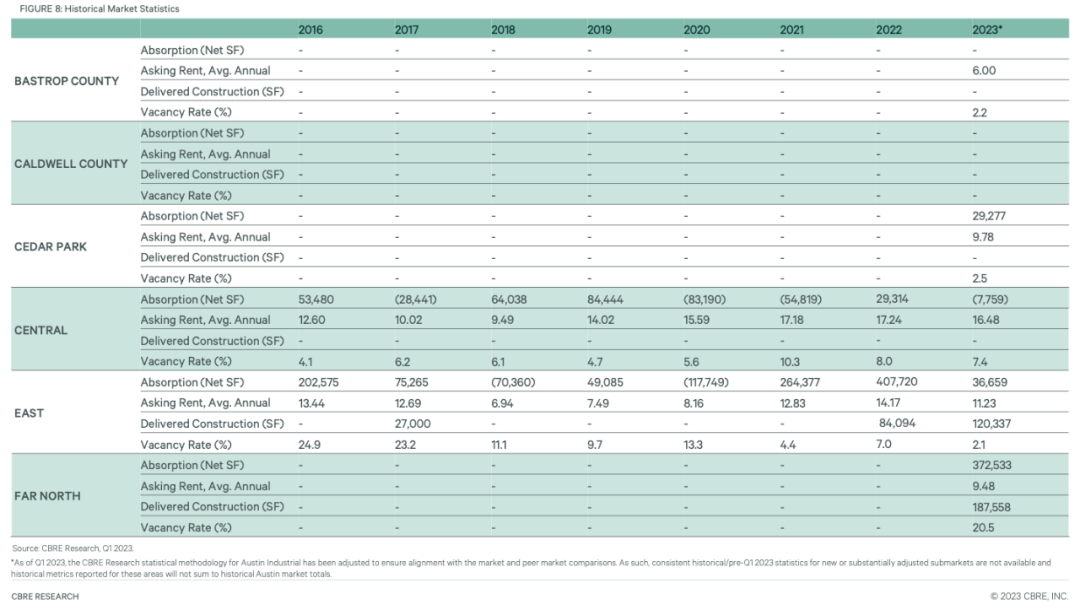

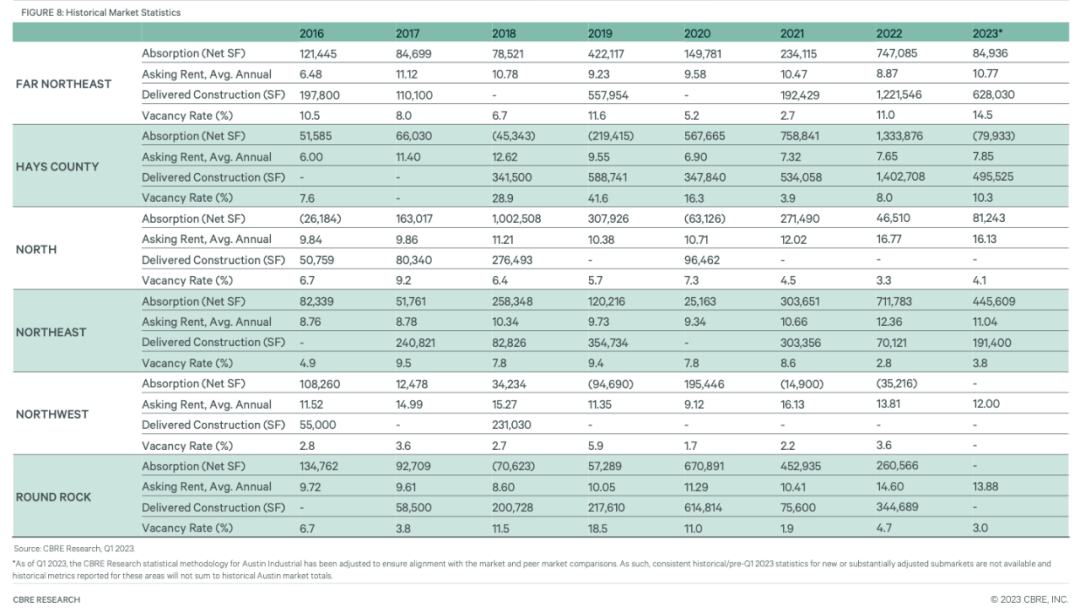

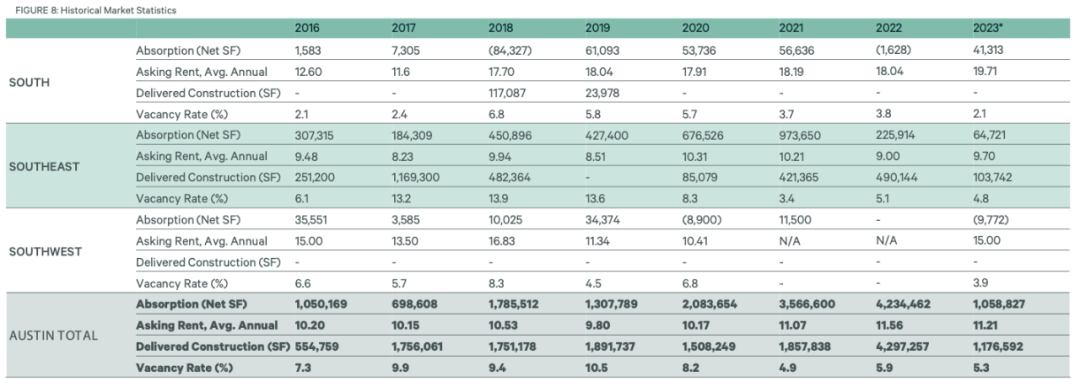

Demand for industrial properties in Austin remained robust through Q1 2023, with a net absorption of 1,058,827 square feet, similar to the first quarter of the record-breaking previous year. The average rent stands at $11.21 per square foot, with minimal price concessions, and a low vacancy rate of 5.3%.

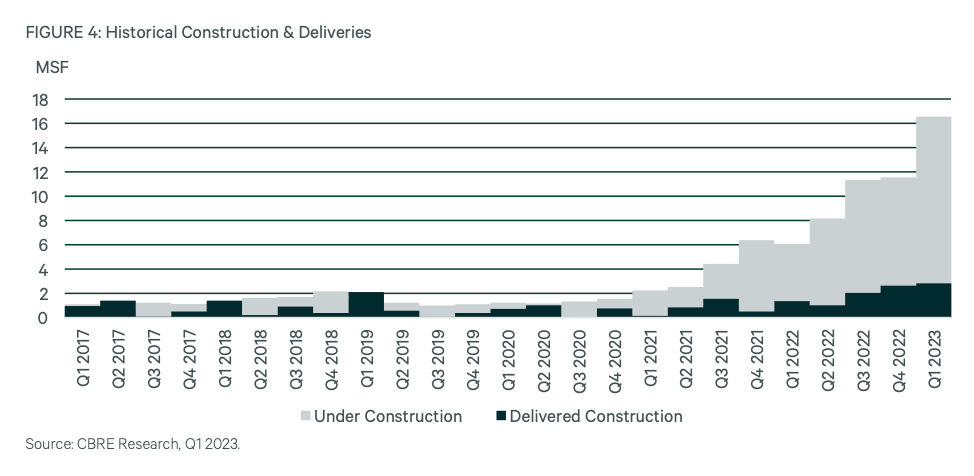

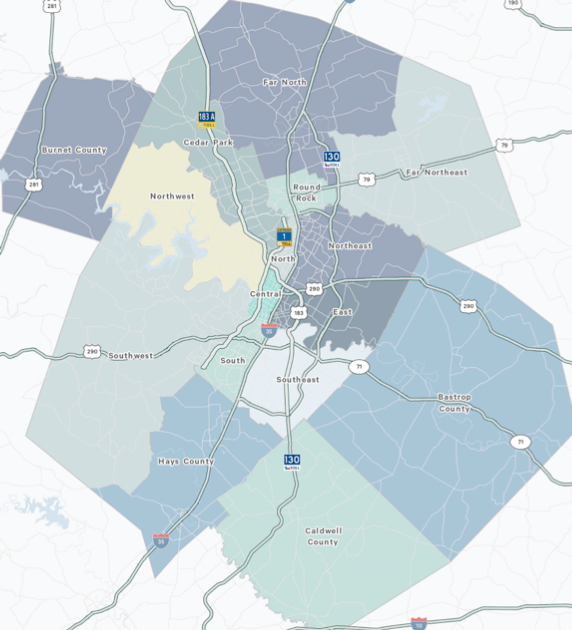

Currently, 16,565,046 square feet of property is under construction, with 1.7 million square feet delivered in the first quarter, of which 24.7% were pre-leased mainly for tenants at the north and south ends of Austin. Reflecting the market’s vibrancy, CBRE anticipates 16 million square feet of property to be delivered by year-end, signaling developers’ confidence in the future of Austin’s industrial market. Industries driving the demand for industrial properties include consumer goods, e-commerce, semiconductor manufacturing, and Tesla’s new factory.

As one of the fastest-growing emerging cities in the United States, Austin is experiencing an influx of people and commercial activities. This is leading to not only a shortage of residential real estate but also insufficient industrial property support. In recent years, companies have been adjusting their logistics networks and expanding their “last mile” delivery scope, fueling demand in distribution markets like Austin’s “non-traditional bulk warehouse markets.” This has resulted in 35 consecutive quarters of positive industrial property demand in the city.

Moreover, Austin is strategically located along the I-35 highway, which stretches from Bajio, Mexico, to northern Texas. This makes the city a vital logistics hub for the Texas auto manufacturing industry and a top choice for parts suppliers. PwC’s recently released “2023 National Real Estate Outlook Report” named Austin a “supernova” city, further highlighting its prominence.

According to CBRE research, approximately 16.6 million square feet of properties are under construction in the greater Austin area, with 24.7% pre-leased. The most active development areas remain the north and south of Austin, with industrial real estate “players” ranging from institutional developers to local and regional ones. Notable new projects include a Samsung Semiconductor factory in Hutto.

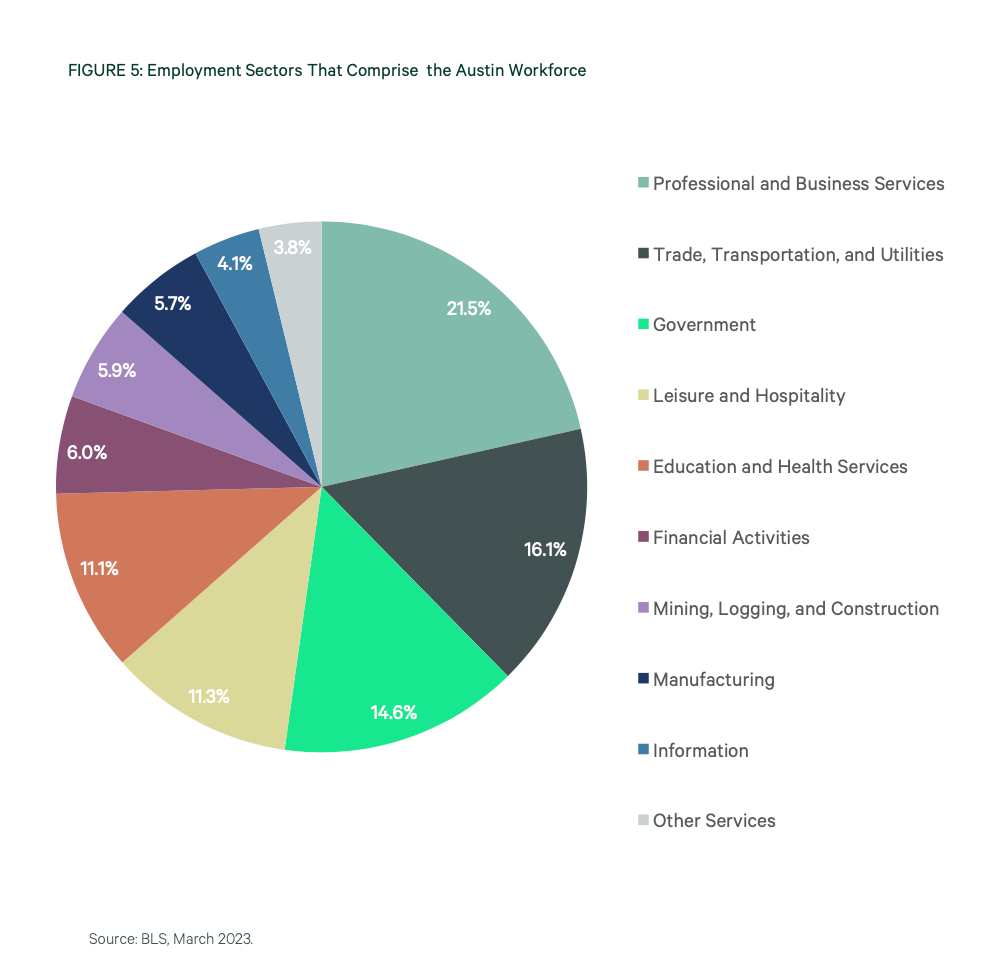

As of March 2023, Austin’s unemployment rate was 3.5%, lower than Texas’ 4.0%. Total non-agricultural employment increased by 5.2% year-on-year, with business services and manufacturing accounting for 21.5% of employment. The leisure and hospitality industry experienced the fastest job growth, increasing by 13.4% year-on-year and providing around 19,600 jobs.

Due to the “Made in America” policy, Texas has the highest growth in manufacturing employment in the United States, adding at least 47,000 jobs annually. Austin has the fastest-growing manufacturing industry in Texas, with a year-on-year increase of 7.6%, and 9,000 of the 47,000 new jobs located in the city. This growth not only generates jobs but also drives demand for industrial real estate in Austin.

CBRE noted that the software technology labor market is facing varying degrees of pressure, and tightening bank credit is restricting investment activities, potentially accelerating the loss of office market value. However, other sectors are less impacted due to strong fundamentals. Inflationary pressures are expected to ease by year-end under the rate hike plan, providing the Federal Reserve an opportunity to relax monetary policy and bring more clarity to the real estate sector.

Real International, a leading brand in Austin real estate investment management with over 20 years of experience in the market, offers individual investors access to investment opportunities typically reserved for institutional investors. With rigorous early-stage analysis and a comprehensive local market relationship network, Real International creates high-quality investment portfolios that deliver satisfying returns while mitigating risks. If you’re optimistic about Austin’s future development prospects and seeking the best investment opportunities, please contact Real International:

Our Email: info@reainternational.com

Office #: (512) 298-1899