Cooling CPI Sets the Stage for a Rental Rebound

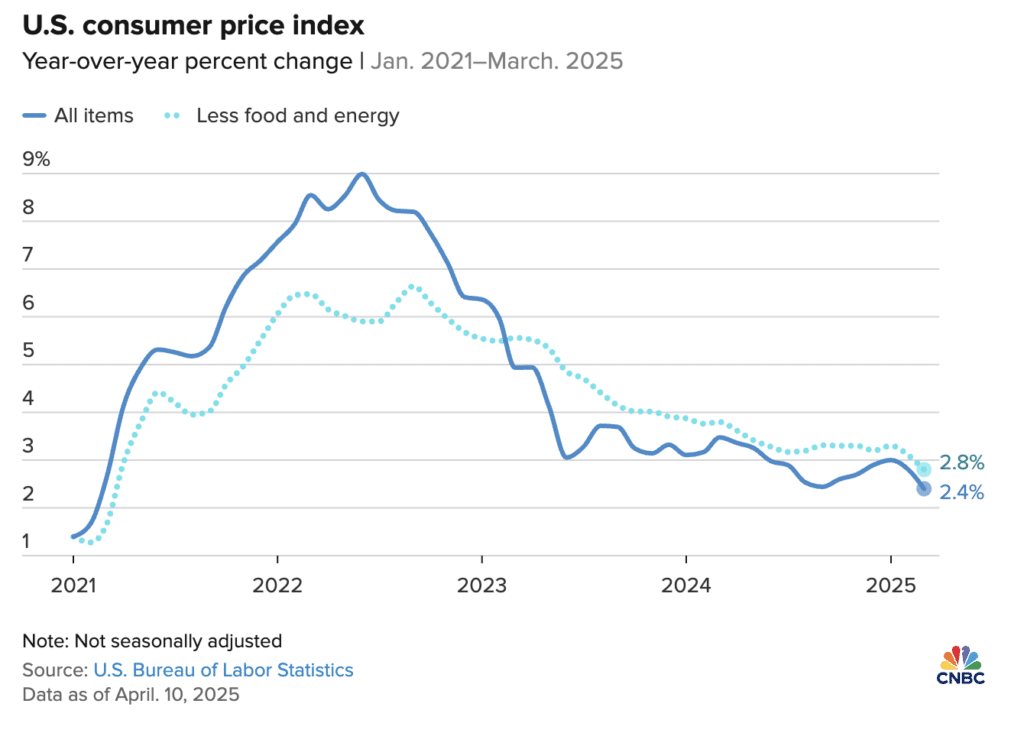

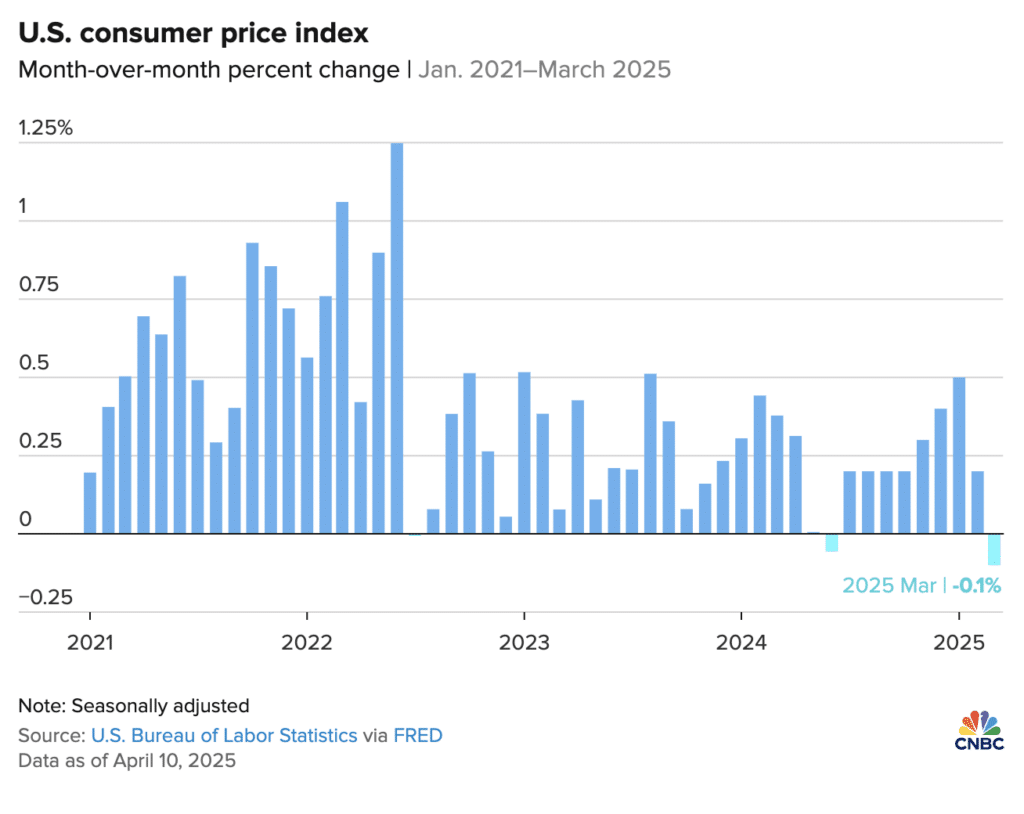

In March 2025, the U.S. Consumer Price Index (CPI) dropped to 2.4% year-over-year, with core inflation (excluding food and energy) at 2.8%. Even more telling, month-over-month CPI turned negative at – 0.1%, marking the first monthly dip in over a year.

This trend reflects growing stability in prices and raises expectations for potential rate cuts later this year.

As inflation nears the Federal Reserve’s 2% target, the economic outlook is improving. For renters and investors, this means:

Lower financing pressure

Greater purchasing and leasing confidence

A likely uptick in housing market activity heading into summer

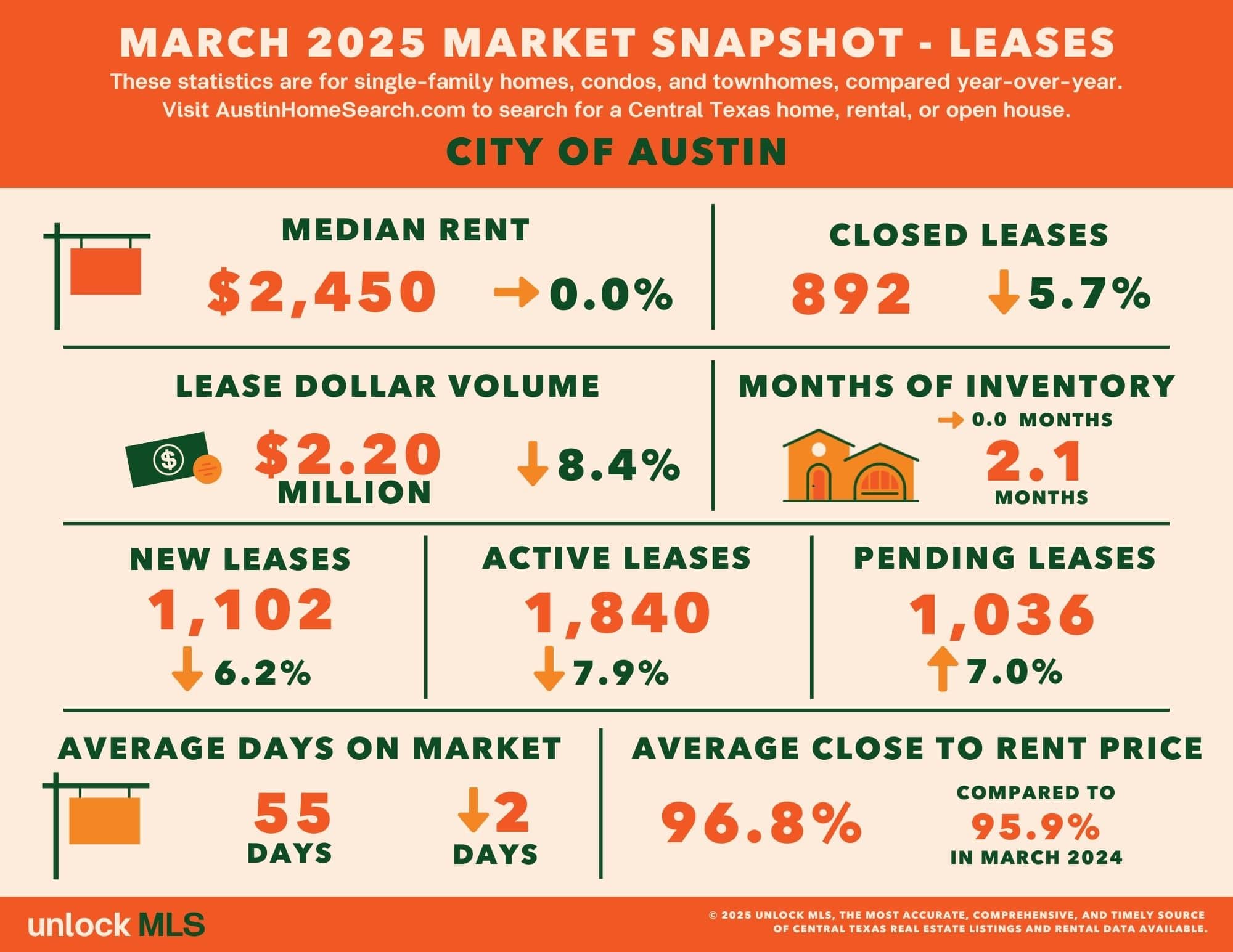

Greater Austin Lease Market Snapshot – March 2025

The Austin-Round Rock-San Marcos MSA is showing early signs of a market shift. While rents are down, leasing activity is heating up as affordability improves.

Key Metrics:

Median Rent: $2,200 (↓ 4.1% YoY)

Pending Leases: 2,283 (↑ 10.9%)

Lease Dollar Volume: $3.94M (↓ 8.4%)

Average Days on Market: 55 (↑ 4 days)

Inventory: 1.8 months (flat)

📌 Key takeaway: Renters are returning as prices soften, leading to more signed leases and increased competition.

County-Level Rental Market Highlights

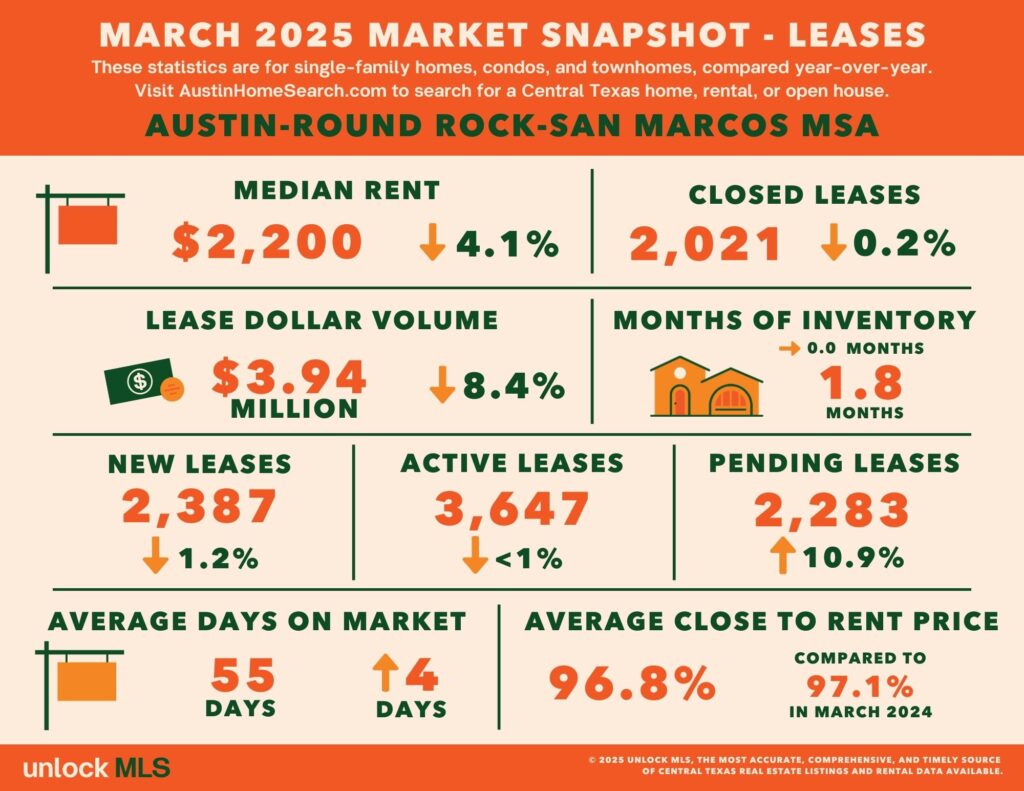

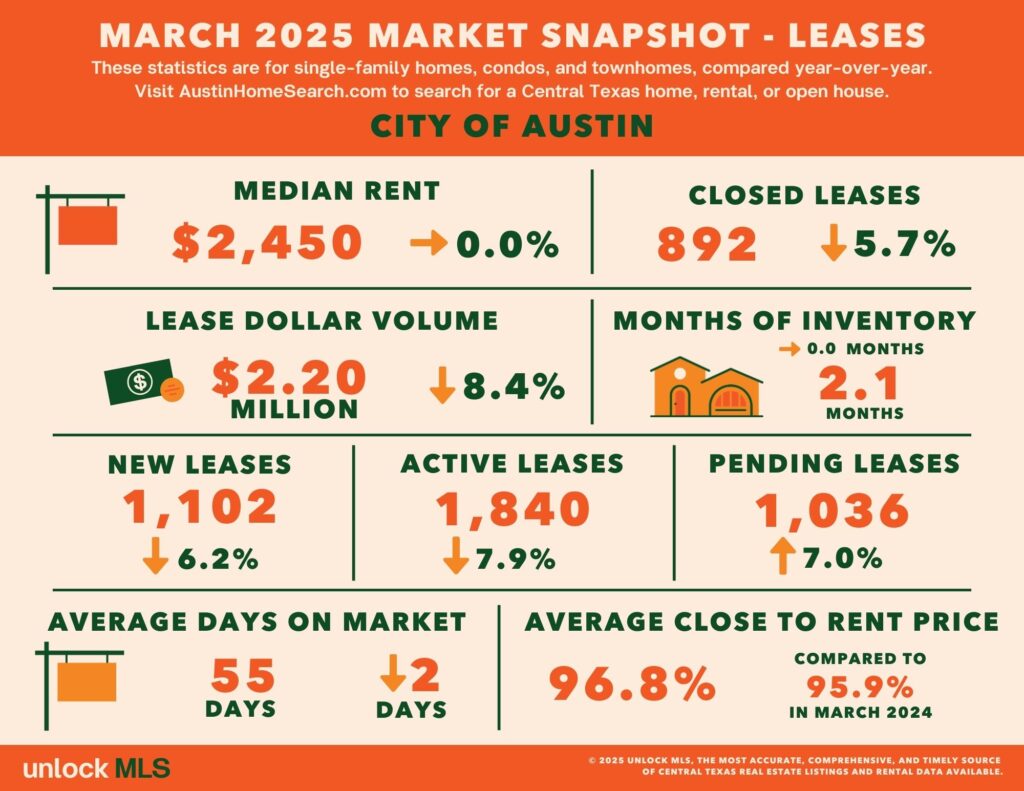

City of Austin

Median rent held flat at $2,450, but closed leases dropped by 5.7%, suggesting that while prices stabilized, fewer leases were finalized due to increased competition or seasonal pause.

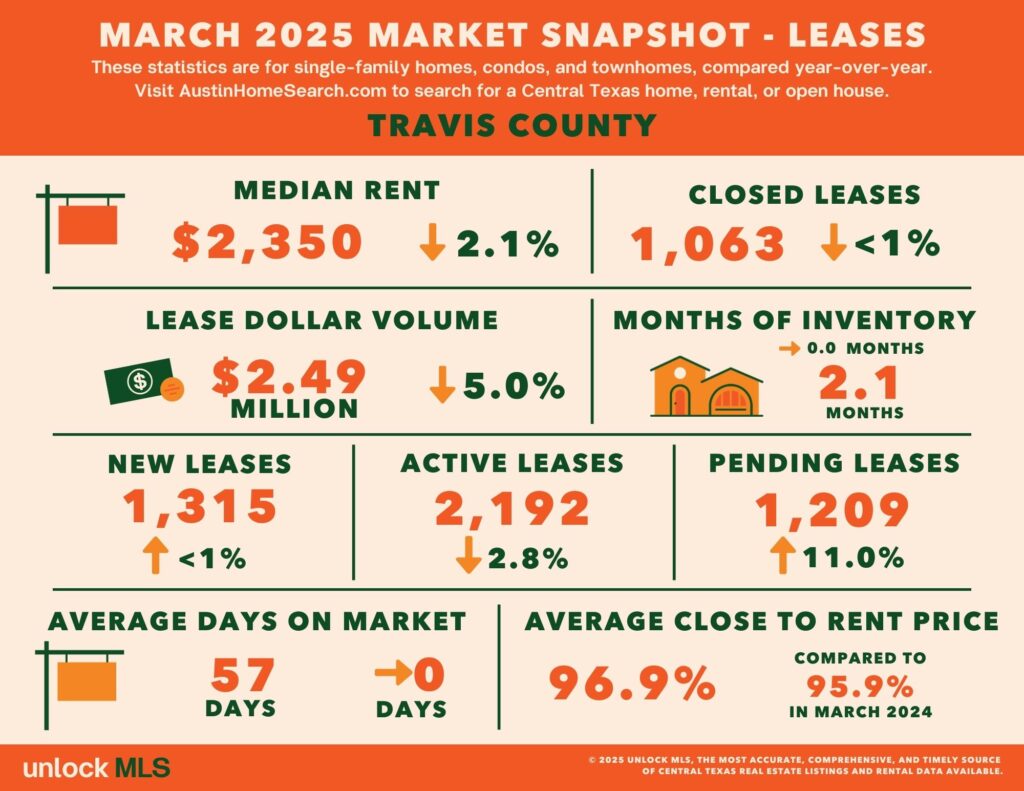

Travis County

Rents slipped just 2.1%, but pending leases rose 11%, pointing to strong forward-looking renter activity despite mild price adjustments.

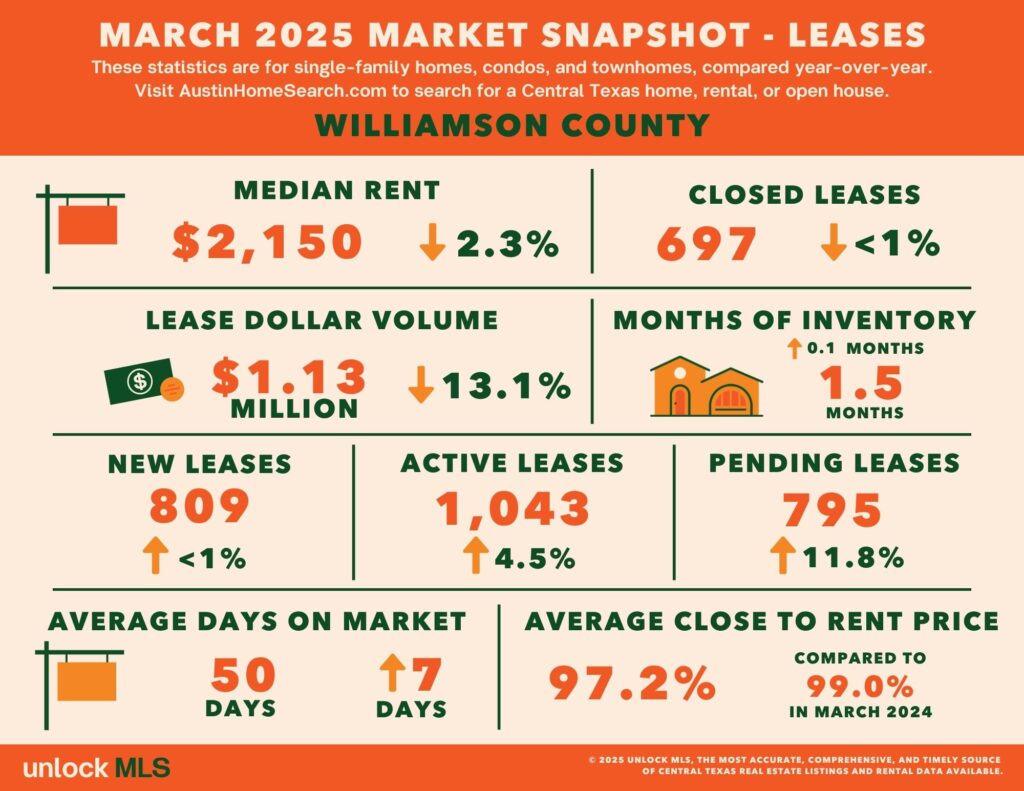

Williamson County

With a rent drop of 2.3% and the highest close-to-rent ratio (97.2%), landlords are still seeing strong tenant commitment.

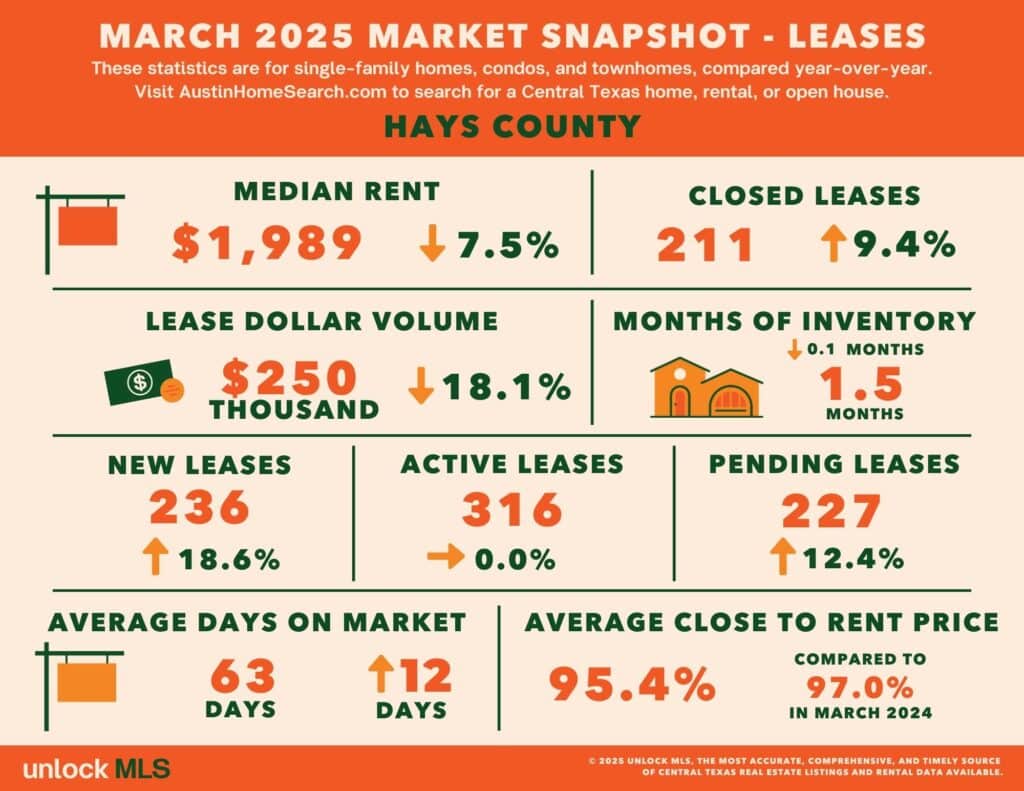

Hays County

While median rent dropped by 7.5%, the county saw pending leases jump 12.4%, a sign that affordability is fueling leasing interest.

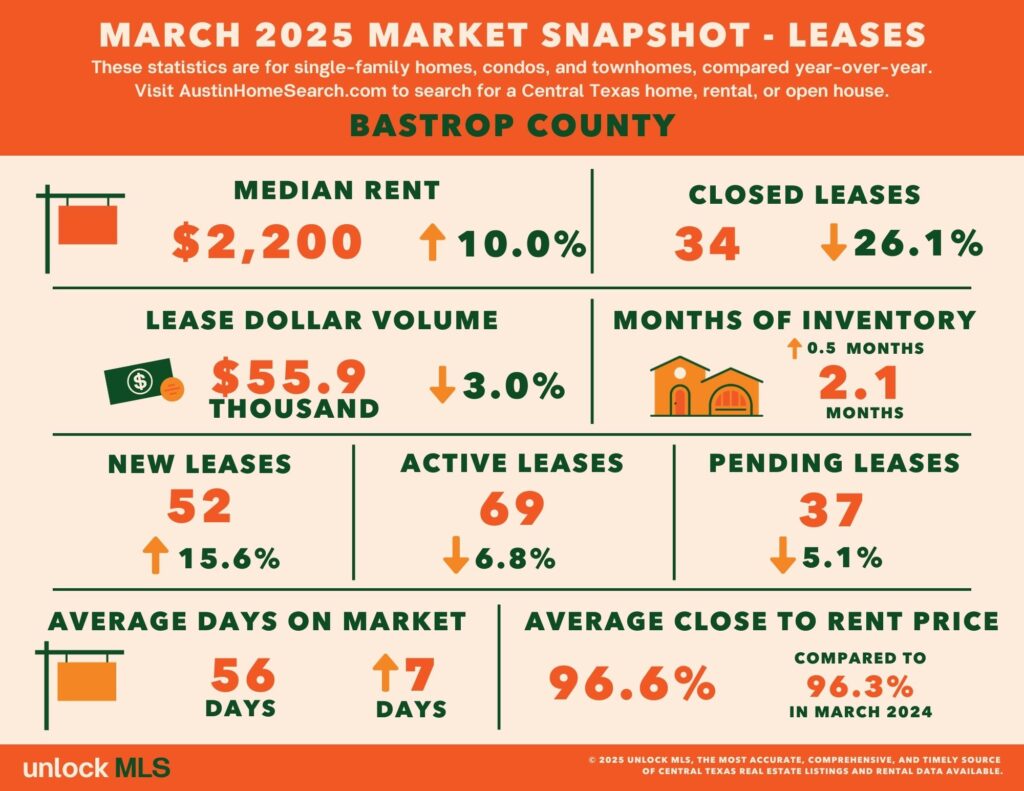

Bastrop County

Median rent spiked 10%, but closed leases dropped 26.1%, indicating possible tenant resistance to pricing in this smaller submarket.

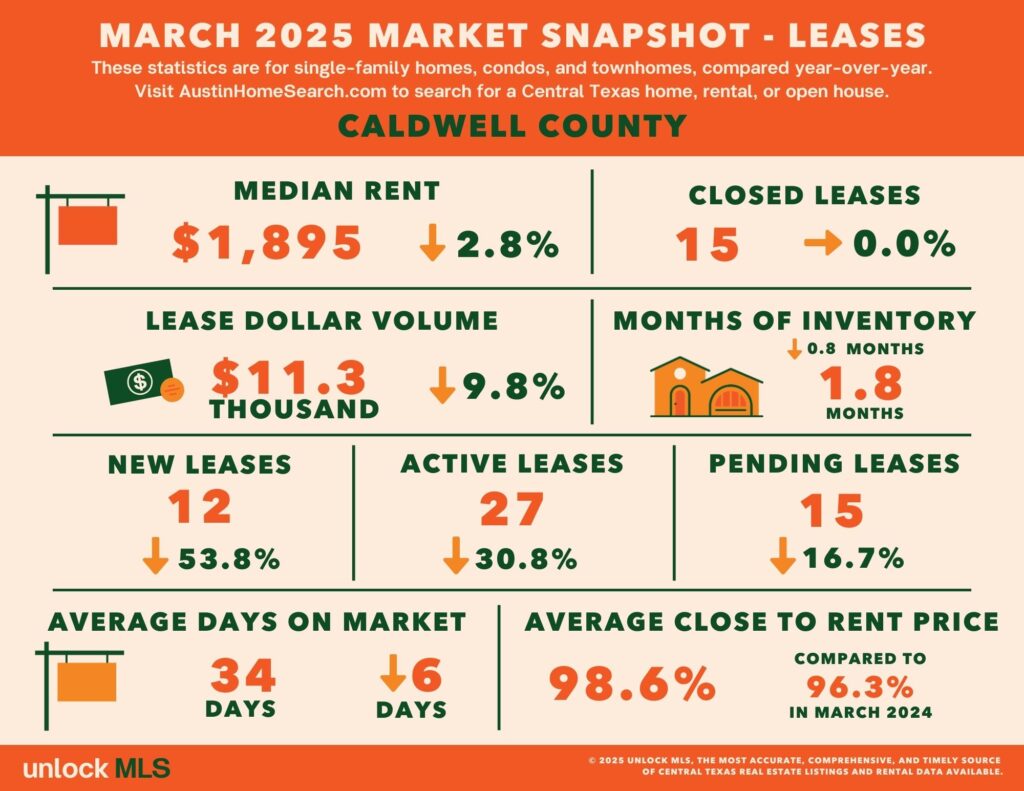

Caldwell County

With a 2.8% drop in rent and a close-to-rent ratio of 98.6%, Caldwell leads the region in tenant pricing compliance despite low volume.

Conclusion: Smart Moves Start Now

With inflation easing and leasing activity on the rise, March 2025 presents a strategic window for renters, landlords, and investors across the Austin metro. For tenants, this is a chance to secure favorable rates before peak season pricing kicks in. Landlords can benefit from proactive pricing strategies to reduce vacancy and attract qualified applicants. Meanwhile, investors watching for long-term value may find this a timely moment to re-enter a market poised for seasonal momentum.

If you’re ready to make informed moves in today’s shifting market, the Real International team is here to help you act with clarity and confidence.