Depending on where you live and your salary, your house may’ve made more money than you in the red-hot housing market of 2021.

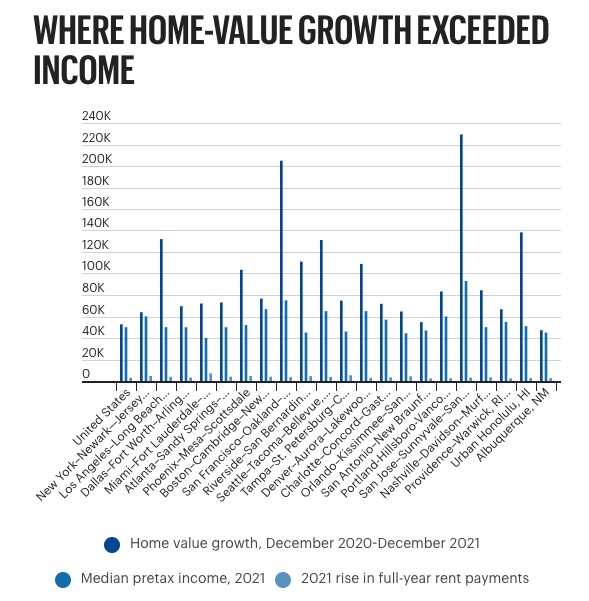

That’s according to a new study conducted by Seattle-based Zillow Group Inc. (NASDAQ: ZG), which found home values in 2021 grew more than the median income in 25 of 38 metro areas it studied. Appreciation of homes grew by $100,000 in 11 of those markets.

Leading the way was San Jose, California, with typical home values increasing $229,277 in 2021, nearly the same amount as oral surgeons make in that market annually.

Nicole Bachaud, economist at Zillow, said the study was a way to look at home-price appreciation differently. It further illustrates how much people who already owned a home gained equity last year.

It also shows how challenging it’s become for first-time buyers to save up for a down payment, Bachaud continued. Rates for rental housing also rose significantly during the same time, at a rate of 16% nationally last year and 25% or more in Sun Belt cities, Zillow found. That’s eroding the ability for renters to save up to buy a house.

“It’s just one year of appreciation, but it’s one year when a lot of millennials and Gen Zers are aging into prime homebuying years, at a very unfavorable time for them, when inventory is extremely low,” she said.

So far, 2022 is off to a busy start. The U.S. median home sale price grew 7% in the four-week period ending March 13, according to Seattle-based Redfin Corp. (NASDAQ: RDFN) That’s the largest month-over-month increase in at least five years.

Redfin found, in that same time frame, the median home sale price was up 17% annually, to a record high of $376,350, and up 36% from the same time in 2020.

Income growth has, until more recently, kept pace with inflation, Bachaud said. But while incomes are rising even in an elevated inflation environment, home-price appreciation in many metros is outpacing even that.

With existing homeowners seeing such outsized appreciation in their homes, it’s possible that could compel more households to list their homes on the market during the prime spring housing market, which has already begun. Bachaud said it’s too early to tell but Zillow has seen some slight increases in raw inventory numbers in recent weeks.

When March housing data is finalized next month, that’ll be a better indicator of whether more resale homes are hitting the market, she continued.

“Hopefully, we can say inventory is finally picking up,” Bachaud said. “We’ve been waiting to say that for the past few years.”

The Article is from Austin Business Journal, copyright belongs to owner