For many investors, buying a property is only the beginning.

The real challenge begins right after: Should the home be renovated? How much should you spend? How do you ensure it rents quickly – and at the right price?

After all, the final step in real estate investing isn’t just closing – it’s turning that asset into reliable, steady income.

And when you’re buying from another state, the complexity only grows. You’re not around for site visits, tenant issues, or unexpected curveballs. Yet every day the property sits idle is lost income.

This was exactly the situation our client faced.

A Promising Opportunity in the Domain Area

The client, based in California, had a previous property in Austin managed by our team. Impressed with the experience, he turned to us again when another investment opportunity came up.

He found a 1970s duplex near the Domain, one of Austin’s fastest-growing districts. Great location, solid structure – but dated interiors and unclear tenant situations.

He asked us: “Is this worth it?” We stepped in immediately.

In this part of Austin, similar duplex units typically rent for $2,800-$3,000 per month. But launching the property “as-is” would’ve likely meant a long vacancy – possibly one or two months – costing the investor over $6,000 in lost rent, not to mention a weaker market perception.

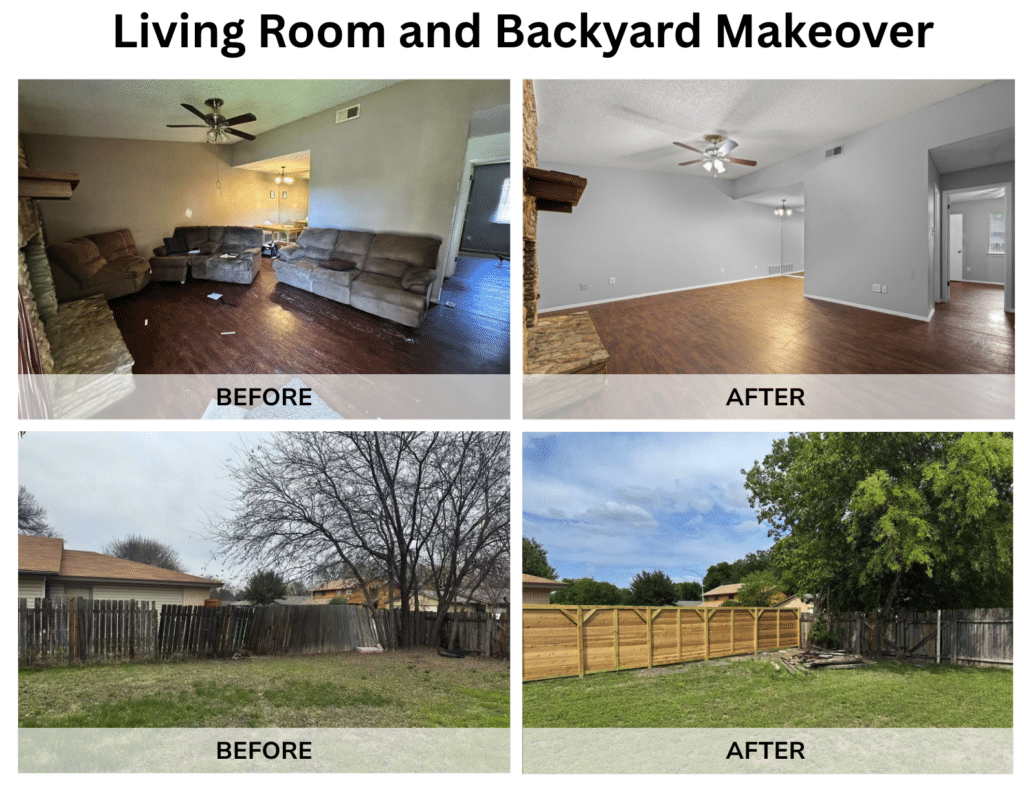

Instead, we planned from day one. Our team coordinated a clear renovation strategy – targeted updates that would maximize appeal without blowing the budget. This included full interior repainting, equipment upgrades and minor layout adjustments, backyard cleanup and enhancements.

Just two months after closing, both units were leased – at $3,200/month. That’s not just above the neighborhood average – it’s a direct return on strategic planning and timely execution.

Real Work Behind the Scenes

The process wasn’t without its bumps.

Both former tenants didn’t speak English, we also arranged a remote walkthrough with the help of the seller’s agent – ensuring our client, even from out-of-state, had a clear picture of the property’s condition and could confidently move forward.

Midway through renovations, we noticed the shared fence needed repairs. We initially proposed a commonly used, budget-friendly option. However, the neighbor pushed back, concerned it might affect the appearance and quality of the shared boundary.

Rather than escalate, we pivoted. After some back-and-forth, the neighbor agreed to co-fund the new fence – on the condition that we removed a few trees leaning into his property. We accepted. The issue was resolved, the relationship remained intact, and our client saved on upgrade costs.

These behind-the-scenes efforts rarely show up in a financial model – but they often make or break a project’s success.

One Partner, Every Step of the Way

From investment analysis and negotiation, to closing, renovation, and finding the right tenants – our team handled it all. We managed the process with care and precision, so our client didn’t need to set foot in Austin once.

As Jay, our buyer’s agent, put it:

“Even remote investing can run smoothly – with the right team on your side. We handle the details, so you can focus on the bigger picture.”

📌 Looking for your next investment property – or struggling to rent or sell an existing one? Let’s talk.

At Real International, we help investors move forward with confidence.

Contact us: info@realinternational.com