At the start of 2025, global asset manager Brookfield sold 13 properties across logistics hubs in Chicago, Dallas, and the Bay Area to Realterm for $277 million. These weren’t office buildings or traditional warehouses. Instead, they belonged to a property type that has rapidly evolved from a niche sector to a mainstream investment class in the past few years: Industrial Outdoor Storage (IOS).

What may appear to be little more than “open land” has become essential infrastructure for logistics fleets, construction companies, and trucking operators, and it’s increasingly on the radar of global capital.

What Is IOS?

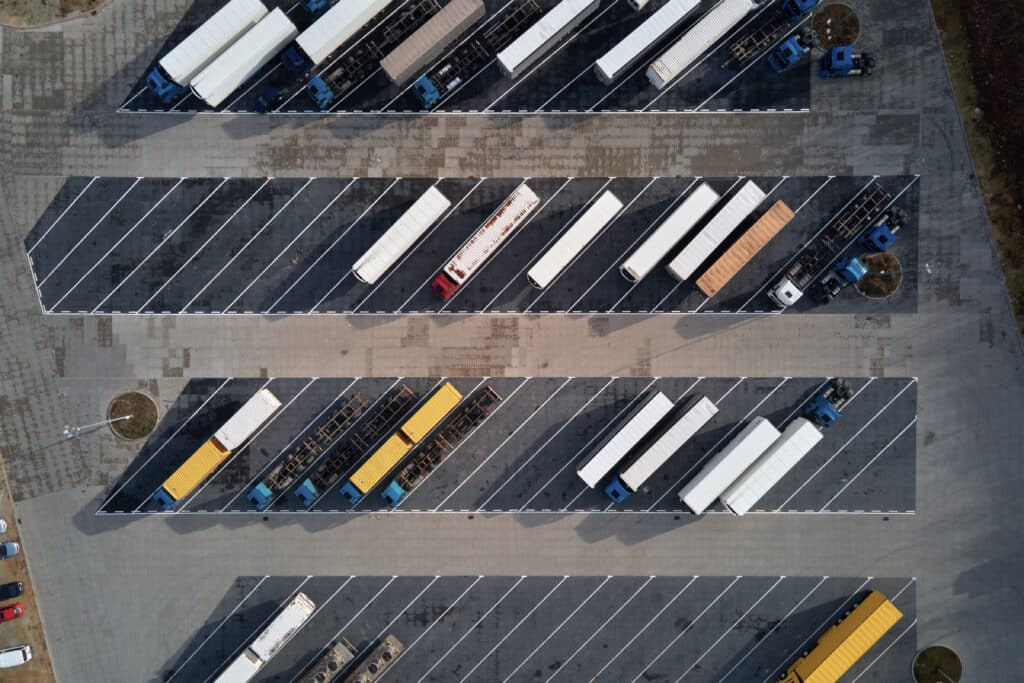

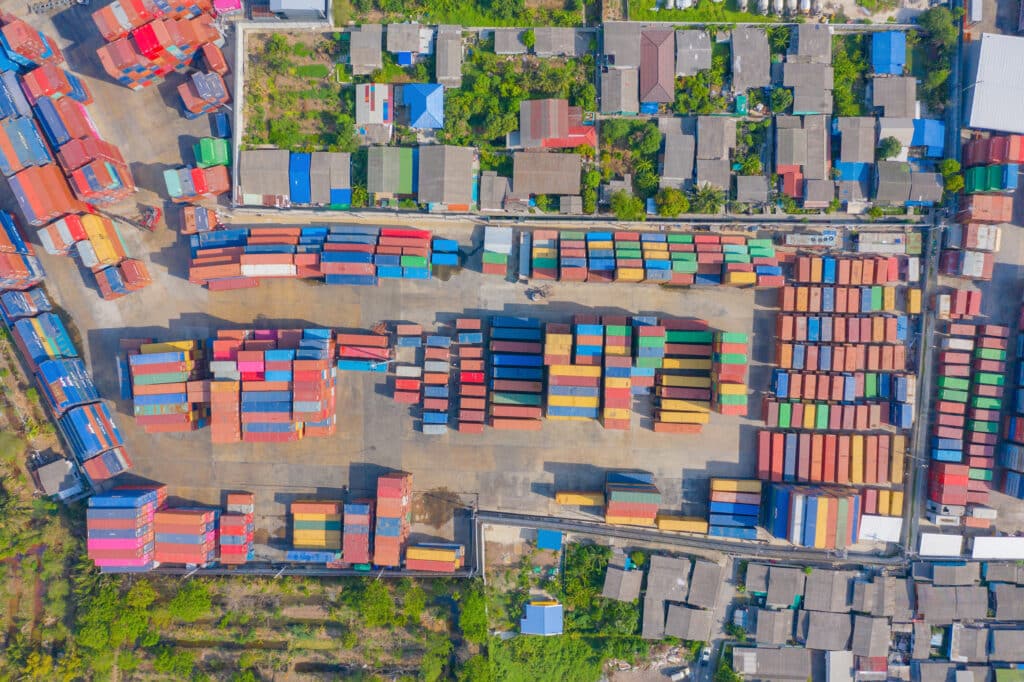

IOS refers to outdoor storage facilities located in industrial zones and major transportation corridors.

Primary use: Parking and storage for trucks, trailers, containers, and heavy equipment.

Facilities: Some sites include small office or warehouse structures, but the value lies in the vast, usable yard space.

Key distinction: Unlike raw land, IOS generates cash flow; unlike traditional warehouses, it requires far less capital and upkeep. In effect, IOS combines the scarcity value of land with the functionality of logistics real estate, delivering both appreciation potential and stable income.

Positioned near ports, airports, and rail hubs, IOS has become an essential link in modern supply chains, providing critical space for utilities, energy companies, and construction staging.

Why Is IOS Moving From “Niche” to “Mainstream”?

1. Scarcity Meets Surging Demand

E-commerce and cross-border trade have fueled record demand for trailer and container storage. Yet new IOS development is extremely limited due to strict zoning and community pushback (NIMBY). According to Green Street, IOS vacancy nationwide sits at just ~2%, compared with 5-6% for broader industrial. This supply-demand imbalance continues to push rents and asset values higher.

2. Strong Yields and Reliable Cash Flow

IOS properties are often leased under triple-net structures, shifting maintenance and tax obligations to tenants. Rents can reach $25-30 per square foot, well above many traditional industrial facilities. Cap rates also trade wider than Class A warehouses, reflecting IOS’s relative nascency and liquidity constraints. For investors, that means stable income today plus an attractive yield premium.

3. Institutional Capital Is Pouring In

Bloomberg estimates that more than $3 billion of institutional capital has entered IOS in the past two years. Beyond Brookfield’s $277M sale, Blackstone provided $231M in financing in June 2025 for Jadian Capital’s IOS portfolio spanning 13 states and 43 sites, with tenants such as Amazon and Waste Management. This demonstrates IOS’s transition into a mainstream investment for institutions.

4. Future-Proofed by Technology

As electric truck fleets and smart logistics systems scale, IOS sites are expected to evolve into charging hubs and dispatch centers. As CBRE notes, “The convergence of electrification and logistics technology is reshaping the industrial land market, and IOS is a natural beneficiary.”

Takeaways for Investors

A decade ago, self-storage was viewed as an overlooked niche before becoming one of the most sought-after property types. Today, IOS is on a similar trajectory.

With institutional money flowing in and the sector still early in its growth cycle, the timing favors individual and mid-sized investors looking to establish positions.

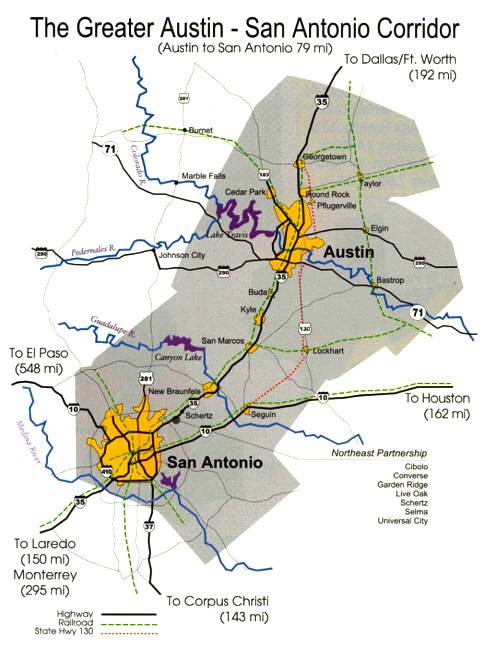

The opportunity is particularly acute in Texas. Reshoring and nearshoring are reshaping supply chains, positioning the Austin-San Antonio-Laredo I-35 corridor as a strategic stronghold. This corridor serves both as Texas’s technology and population growth axis and the nation’s most critical north-south trade route, linking Austin and San Antonio’s innovation hubs with Laredo, the largest U.S. land port handling nearly 40% of U.S.-Mexico trade.

On August 27, 2025, Realterm and Stotan Industrial announced a 25.82-acre Class A IOS development in Laredo, including nearly 20,000 square feet of maintenance space, evidence of sustained demand in America’s busiest border crossing.

Conclusion

Industrial Outdoor Storage is no longer a side note in the industrial market. With limited supply, resilient cash flow, growing institutional adoption, and technology tailwinds, it is quickly becoming a mainstream asset class.

At Real International, we’ve been actively researching IOS and already secured specific opportunities in the Texas market.

📩 Interested in learning more? Contact us at info@realinternational.com.