Austin Slows, Suburbs Surge: What Census Trends Reveal

According to the latest U.S. Census data (as of July 2024), Austin’s population growth has noticeably decelerated. The city added just over 4,000 new residents, growing by only 0.4% year-over-year, and slipped to the 13th largest city in the U.S. – behind San Jose, Fort Worth, and Jacksonville. It is now also the fifth-largest city in Texas, trailing Fort Worth in total population.

The city’s relatively slow growth is likely tied to higher housing costs, with a median home price of $438,000, the highest among major Texas metros.

While Austin slows, the suburbs are booming:

Hutto grew 9.4% YoY, ranking 13th fastest-growing city in the U.S. (among cities over 20K population), fueled by affordability, new housing, and proximity to Samsung’s mega-site in Taylor.

Georgetown reached 101,344 residents, joining Round Rock as the only Austin-area suburbs over 100,000 people.

Other fast-growing nearby cities include Leander (+8.7%), Dripping Springs (+16.9%), Liberty Hill (+15%), and Bastrop (+8%).

This suburban momentum underscores a regional population shift driven by affordability, industrial expansion, and strategic infrastructure investment – a key backdrop for understanding today’s housing market trends in both leasing and sales.

📍 Want to learn more about real estate opportunities in fast-growing suburban hubs like Hutto? Contact us to explore the potential.

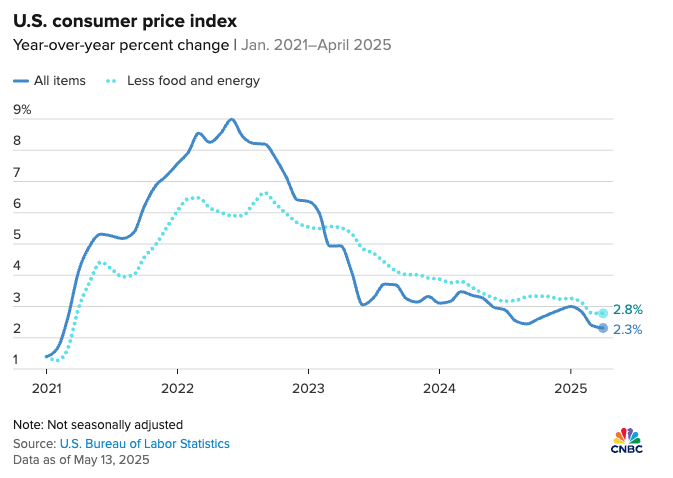

Cooling CPI Sets the Stage for a Market Reset

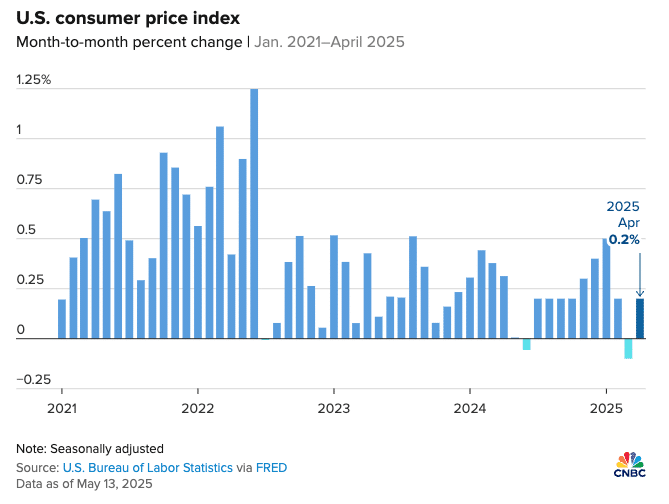

In April 2025, the U.S. Consumer Price Index (CPI) dropped to 2.3% year-over-year, with core inflation (excluding food and energy) at 2.8%. The month-over-month CPI held at +0.2%, reinforcing the soft-landing trajectory.

This continues a trend of slowing inflation – an encouraging signal for interest rate cuts later this year.

✅ Key Implications:

- Buyers may gain access to lower-cost financing as rate cut expectations build.

- Renters may benefit from greater price flexibility amid market rebalancing.

- Investor sentiment is improving as inflation nears the Fed’s 2% target.

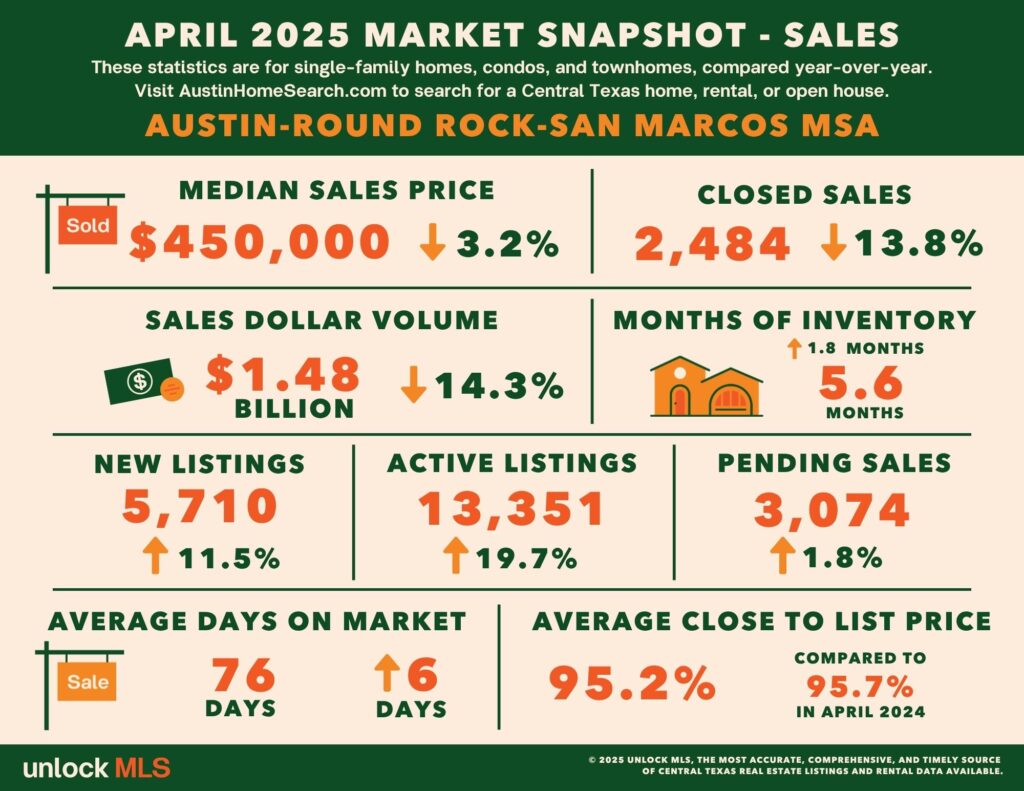

Greater Austin Market Snapshot – April 2025

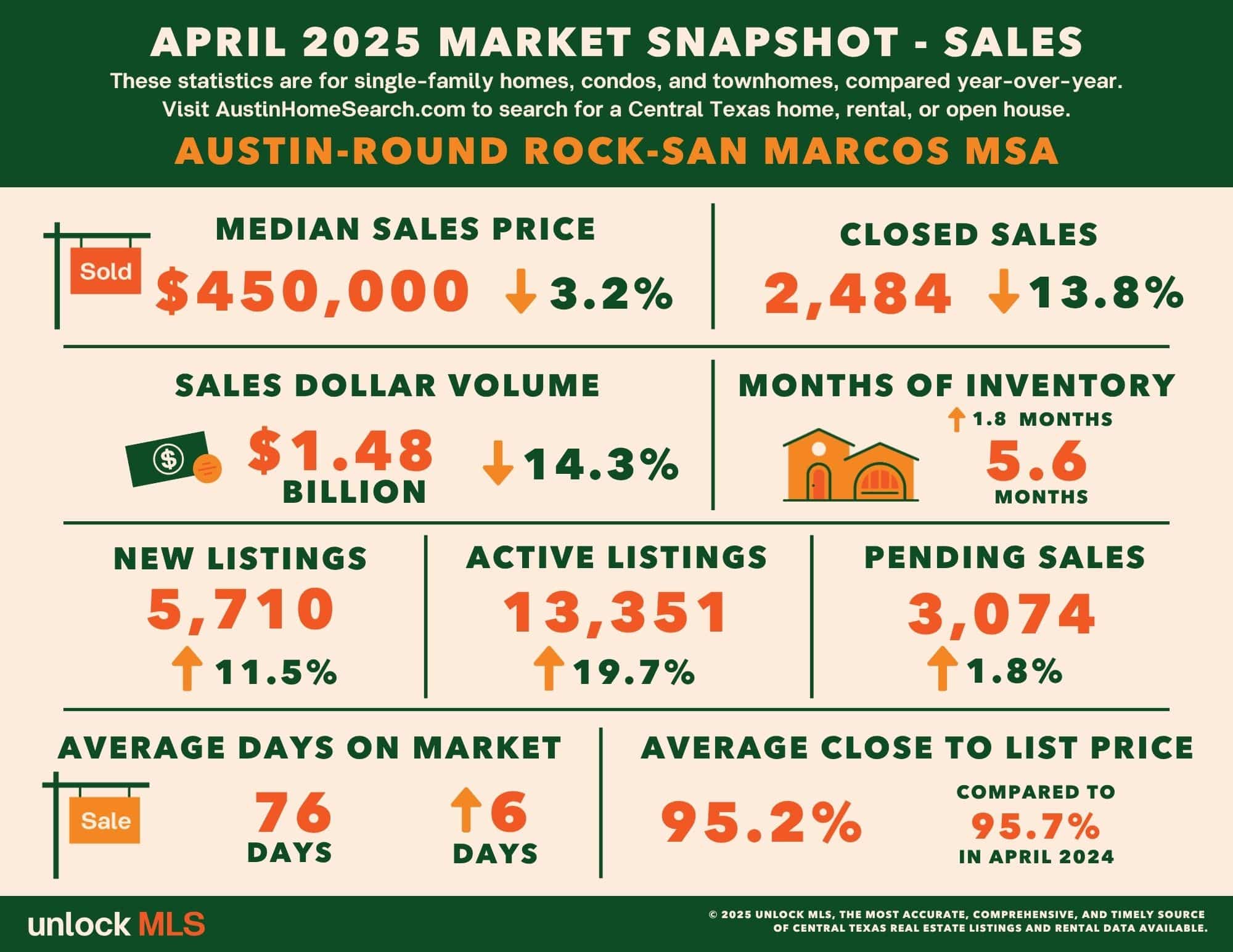

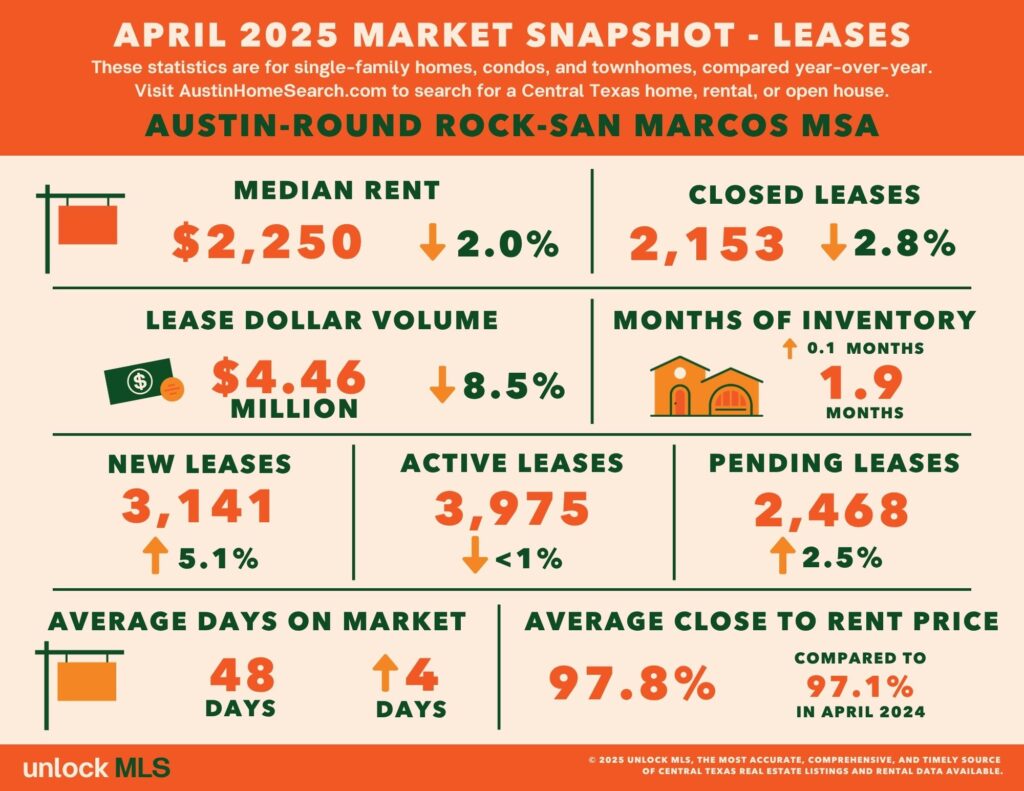

April data reveals a mixed but stabilizing picture across Greater Austin. On the sales side, prices softened, and inventory rose. On the rental side, lease activity improved despite slight dips in rent levels.

Key Sales Metrics (MSA-wide):

- Median Sales Price: $450,000 (↓ 3.2% YoY)

- Closed Sales: 2,484 (↓ 13.8%)

- Pending Sales: 3,074 (↑ 1.8%)

- Inventory: 5.6 months (↑ 1.8 months)

Key Lease Metrics (MSA-wide):

- Median Rent: $2,250 (↓ 2.0%)

- Pending Leases: 2,468 (↑ 2.5%)

- Lease Dollar Volume: $4.46M (↓ 8.5%)

- Inventory: 1.9 months (↑ 0.1 months)

📌 Key takeaway: As inflation cools and rates stabilize, buyers and renters are re-entering the market, pushing up contract activity even as price growth moderates.

County-Level Rental Market Highlights

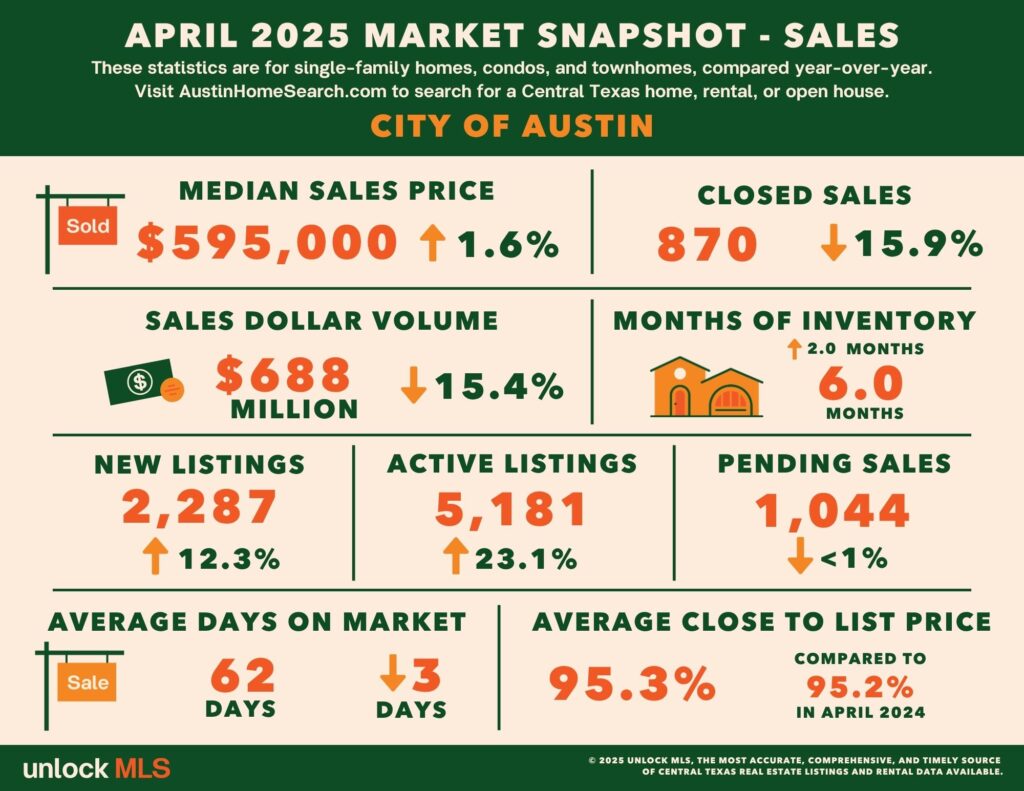

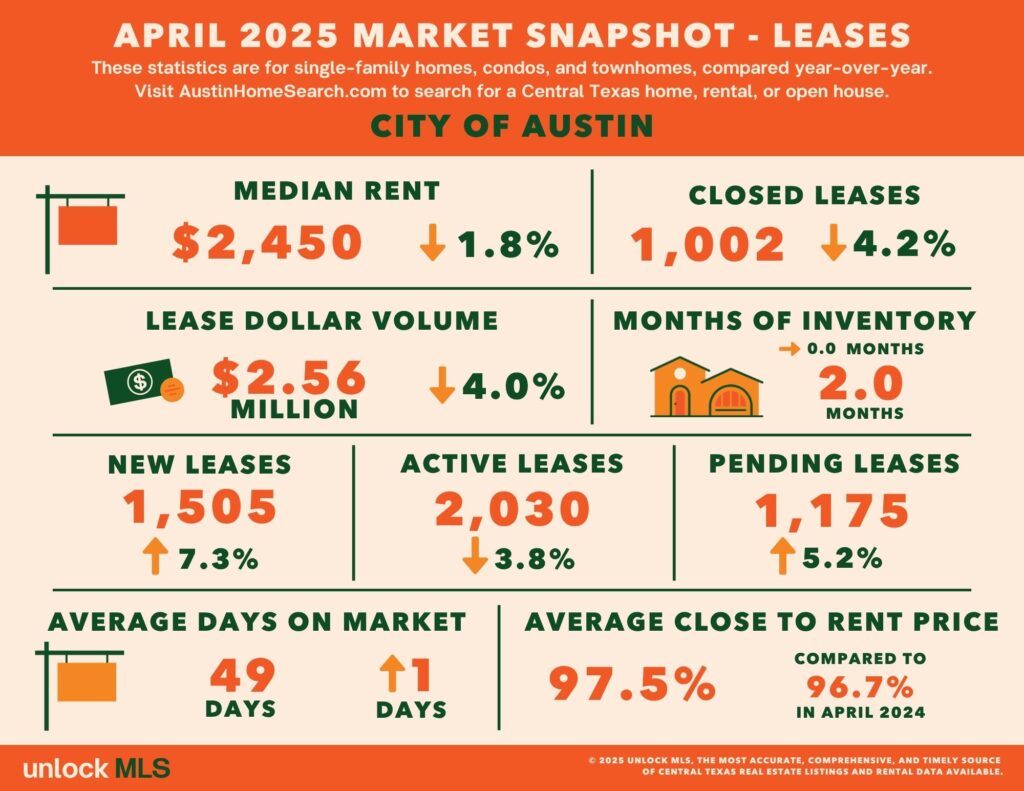

City of Austin

- Sales: Median price rose 1.6% to $595,000; closed sales fell 15.9%; inventory surged to 6.0 months.

- Leases: Rent declined 1.8% to $2,450; pending leases rose 5.2% to 1,175; days on market averaged 49.

➡️ Takeaway: Prices remain firm but competition has thinned. Lease market signals healthy demand recovery.

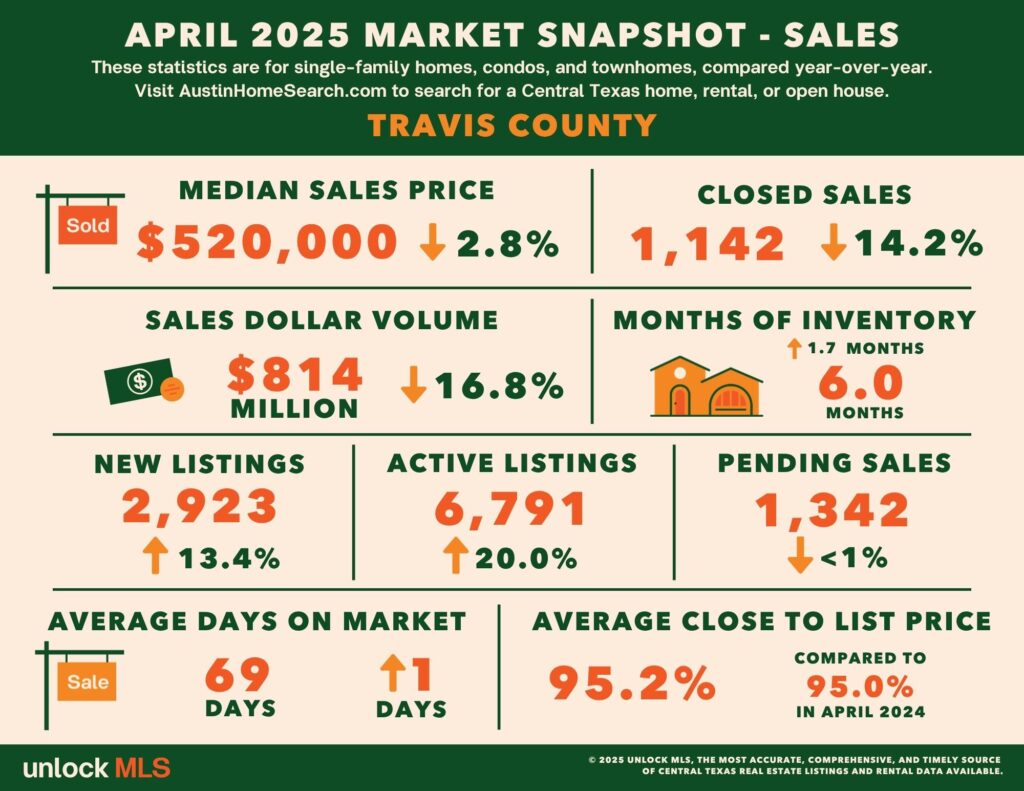

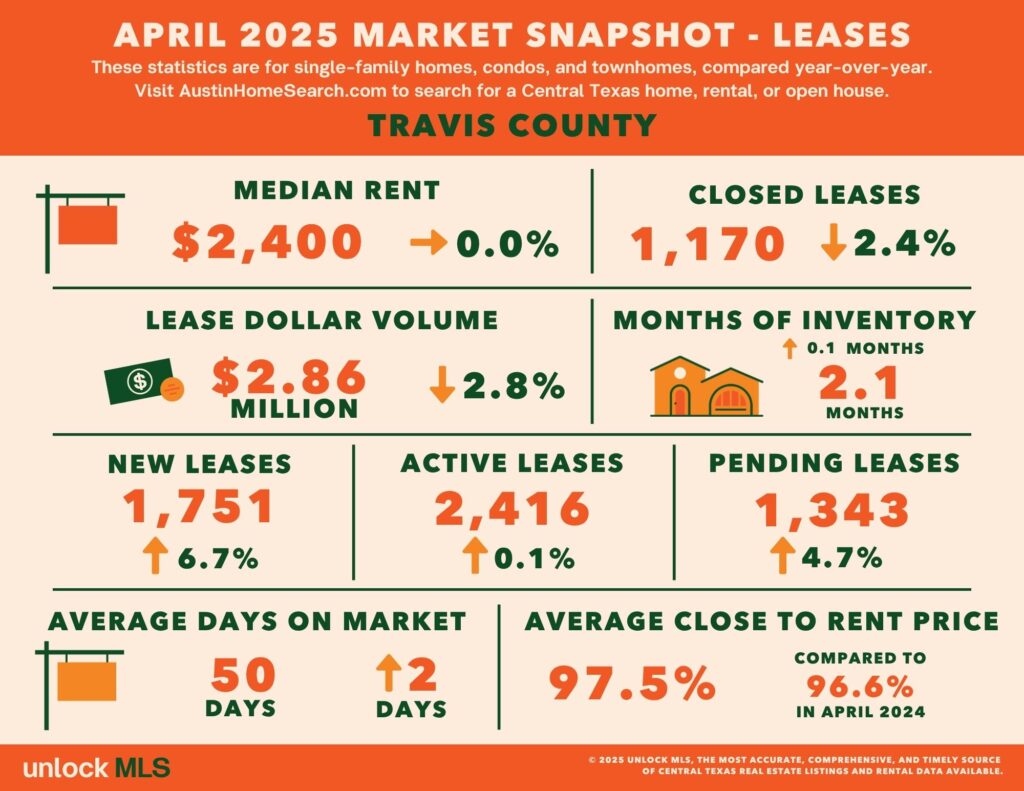

Travis County

- Sales: Median price fell 2.8% to $520,000; inventory rose to 6.0 months; closed sales dropped 14.2%.

- Leases: Rent held steady at $2,400; pending leases rose 4.7%; inventory remained low at 2.1 months.

➡️ Takeaway: Buyer caution grows while rental activity continues to rise, keeping market balanced.

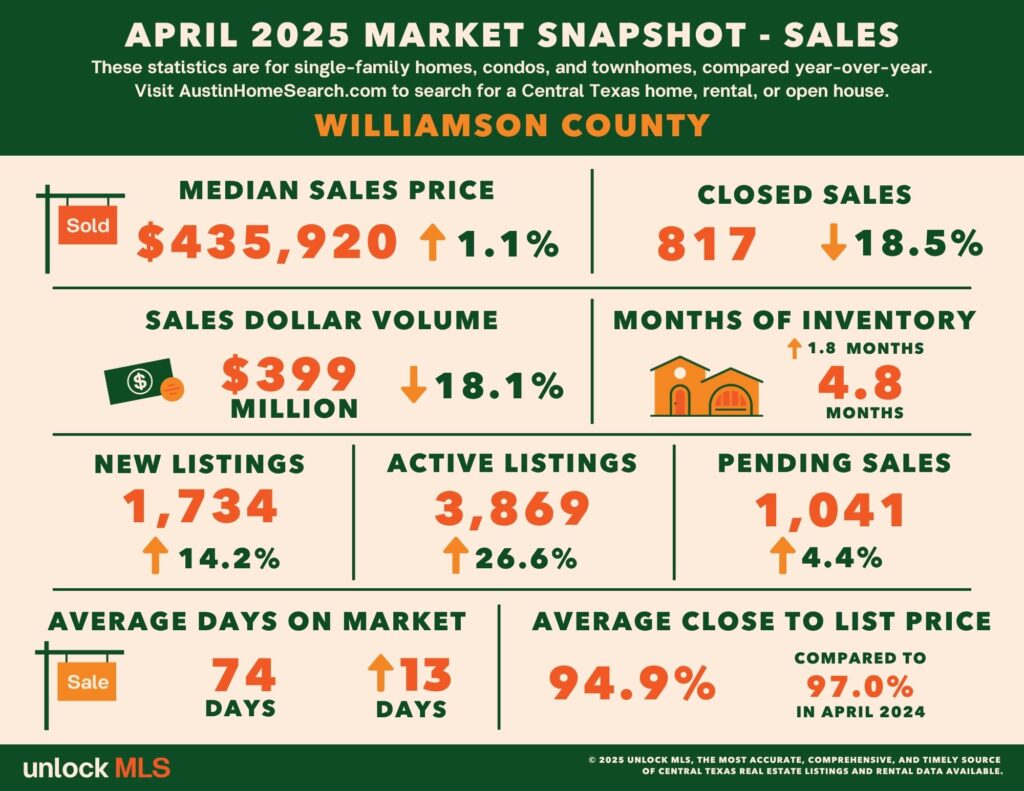

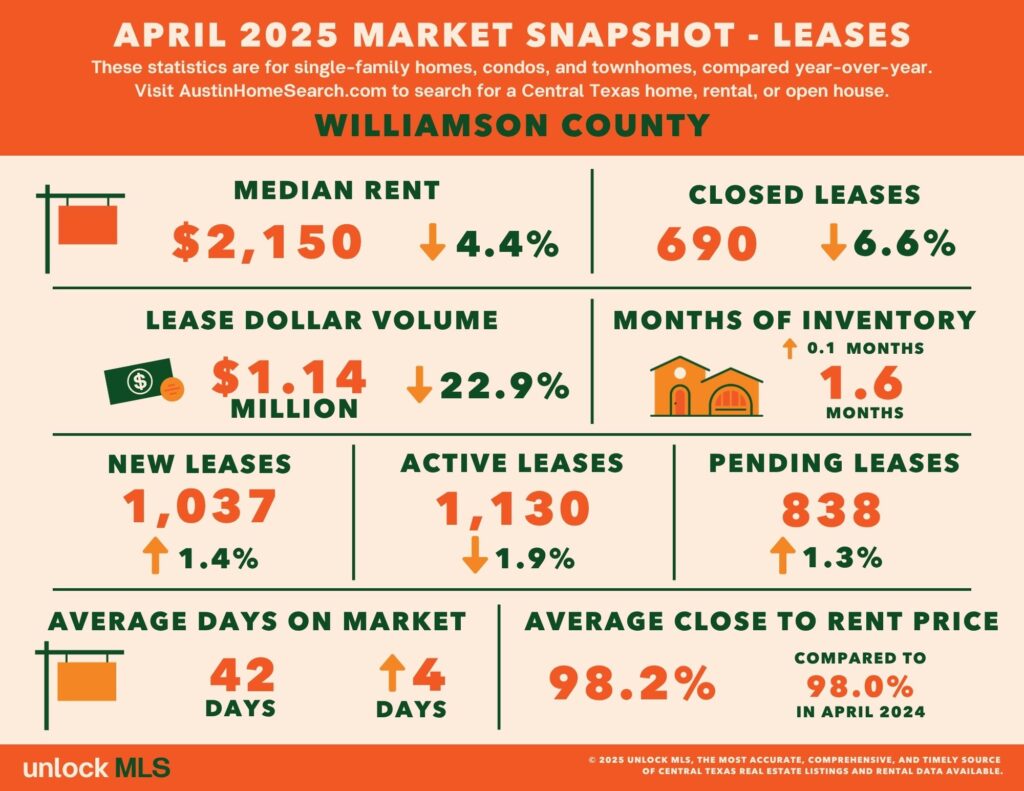

Williamson County

- Sales: Median price increased slightly to $435,920 (↑1.1%); pending sales up 4.4%; inventory at 4.8 months.

- Leases: Rent dropped 4.4% to $2,150; pending leases up 1.3%; strong leasing activity.

➡️ Takeaway: Williamson continues to attract buyers and renters with relative affordability.

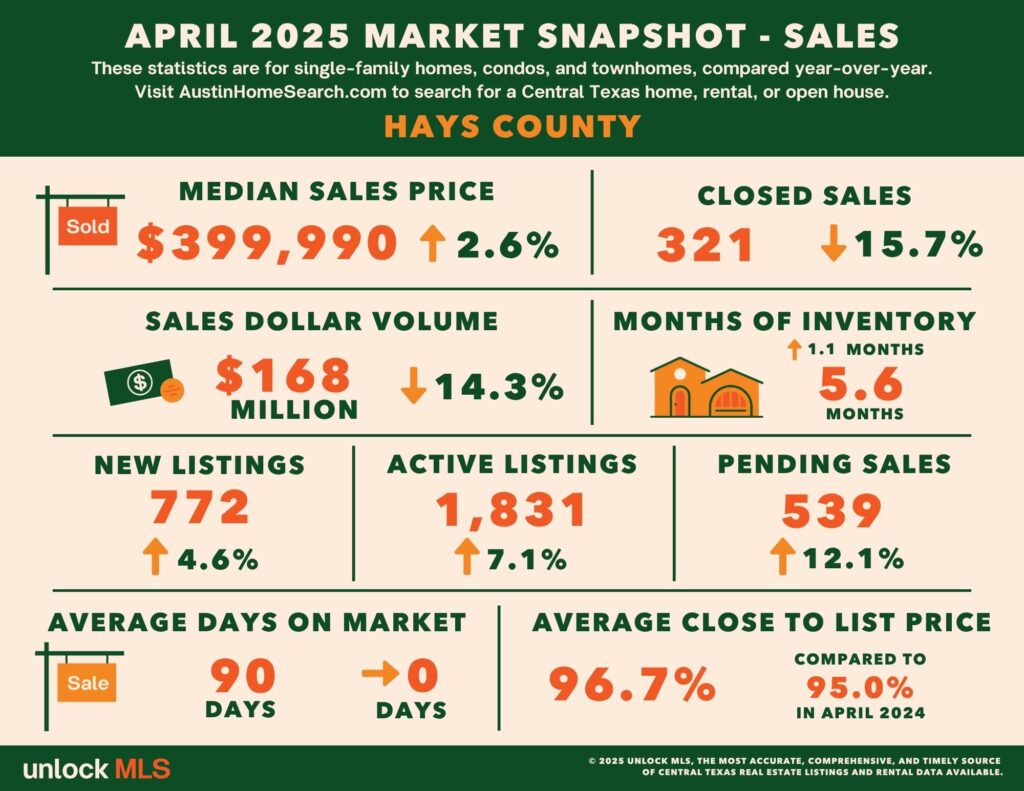

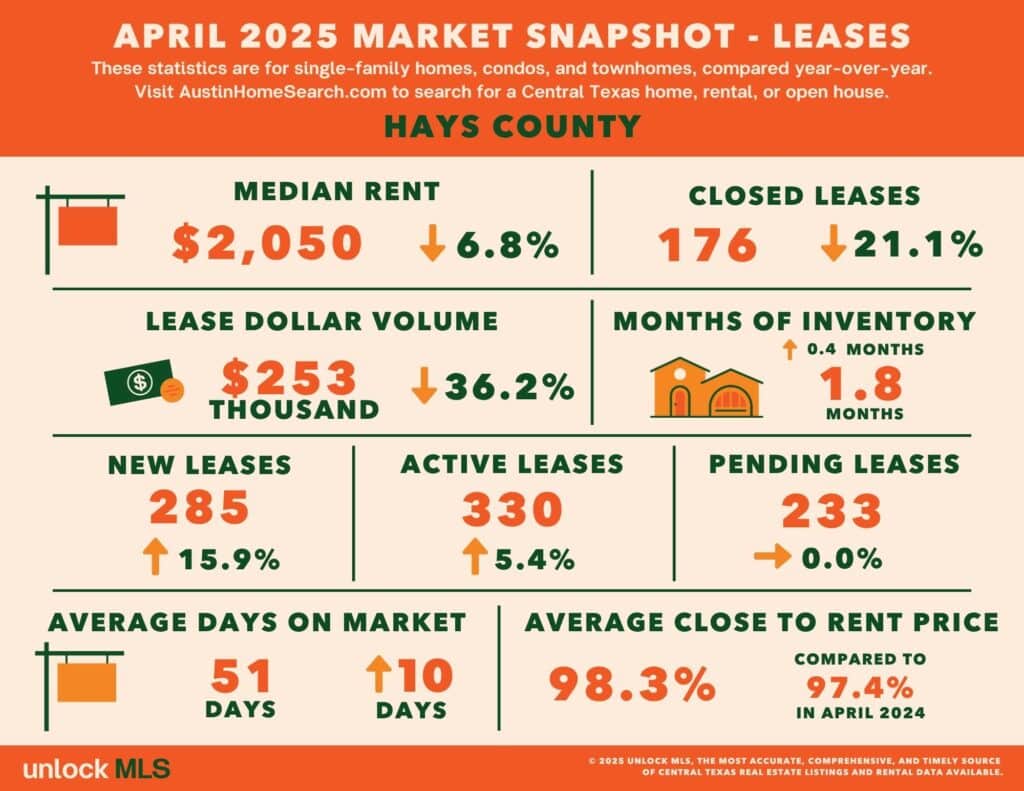

Hays County

- Sales: Median price up 2.6% to $399,990; pending sales rose 12.1%; inventory at 5.6 months.

- Leases: Rent fell 6.8%; lease dollar volume down 36.2%, but new listings up 15.9%.

➡️ Takeaway: Market is adjusting to new supply; renters may find bargain opportunities.

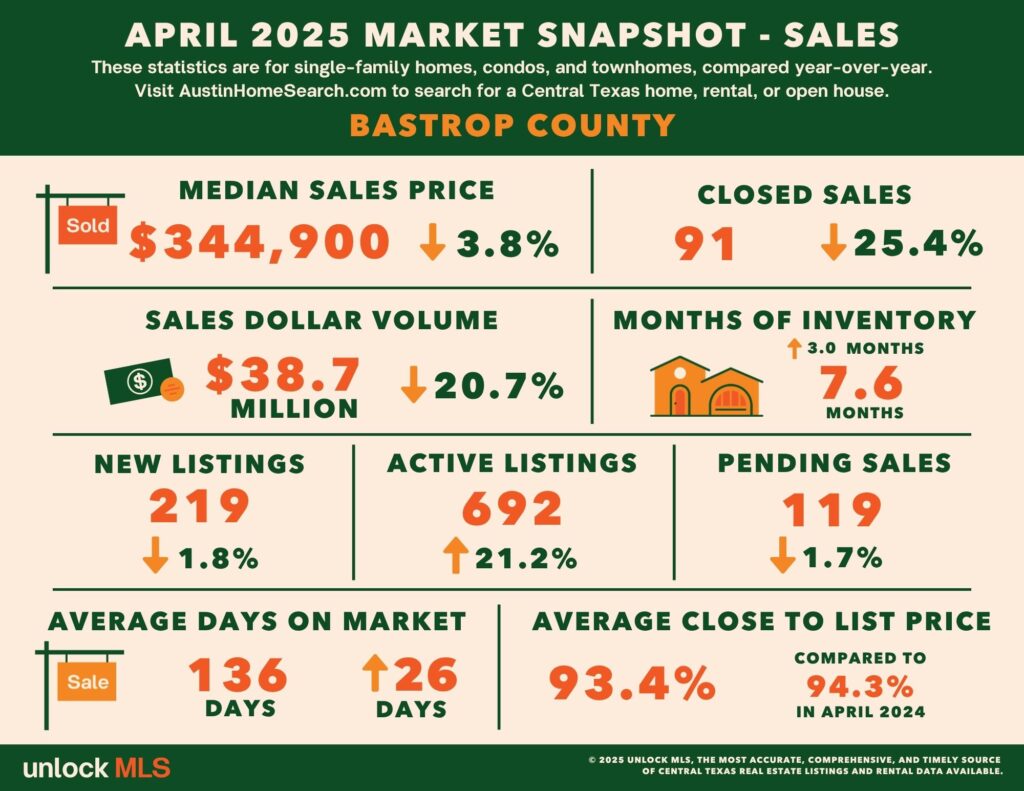

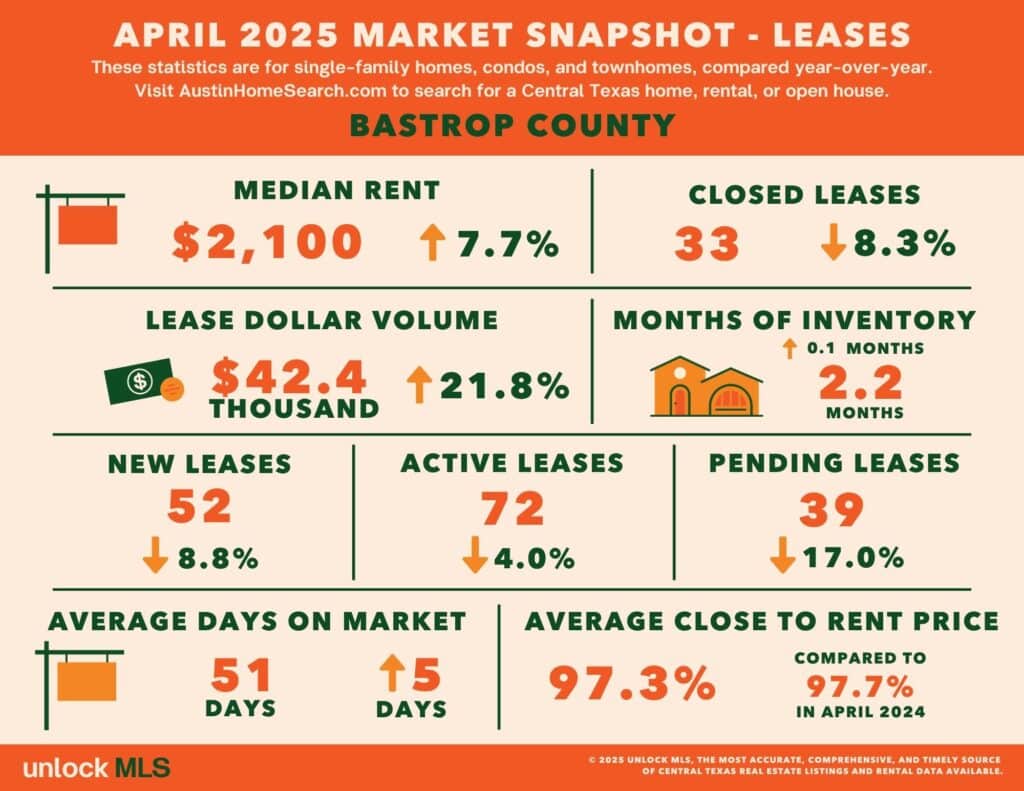

Bastrop County

- Sales: Median price dropped 3.8%; closed sales down 25.4%; inventory spiked to 7.6 months.

- Leases: Rent rose 7.7%; lease volume up 21.8%; pending leases fell 17%.

➡️ Takeaway: Sellers face a slowing sales market, but landlords benefit from rising rents.

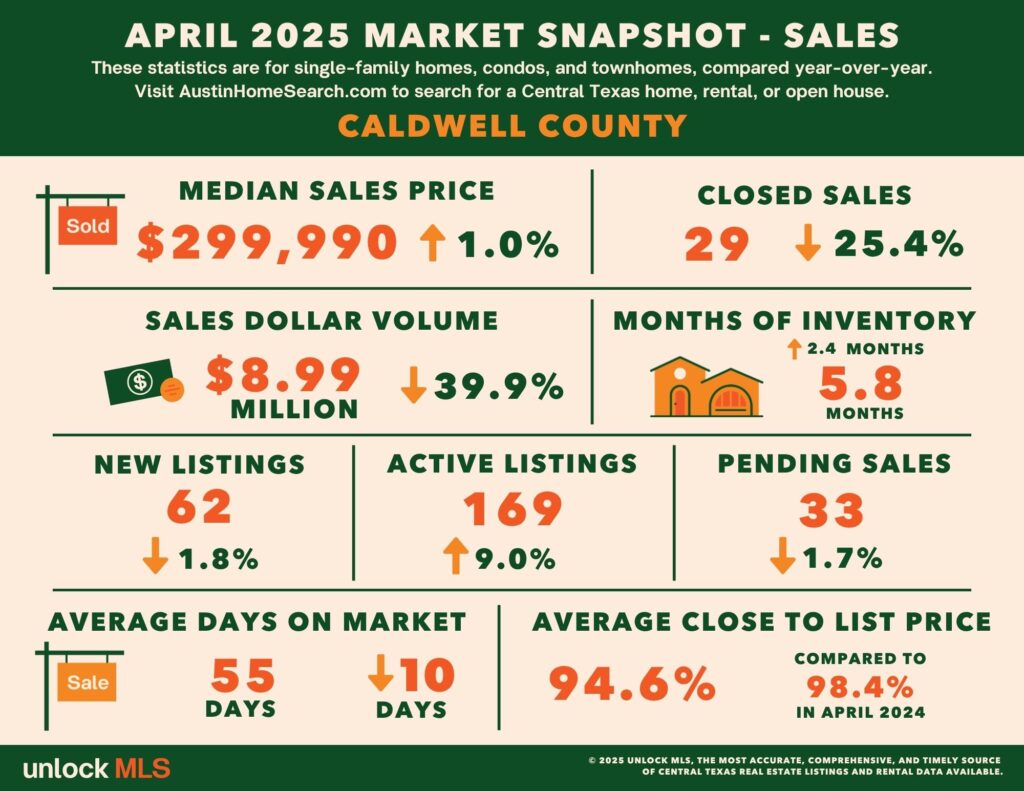

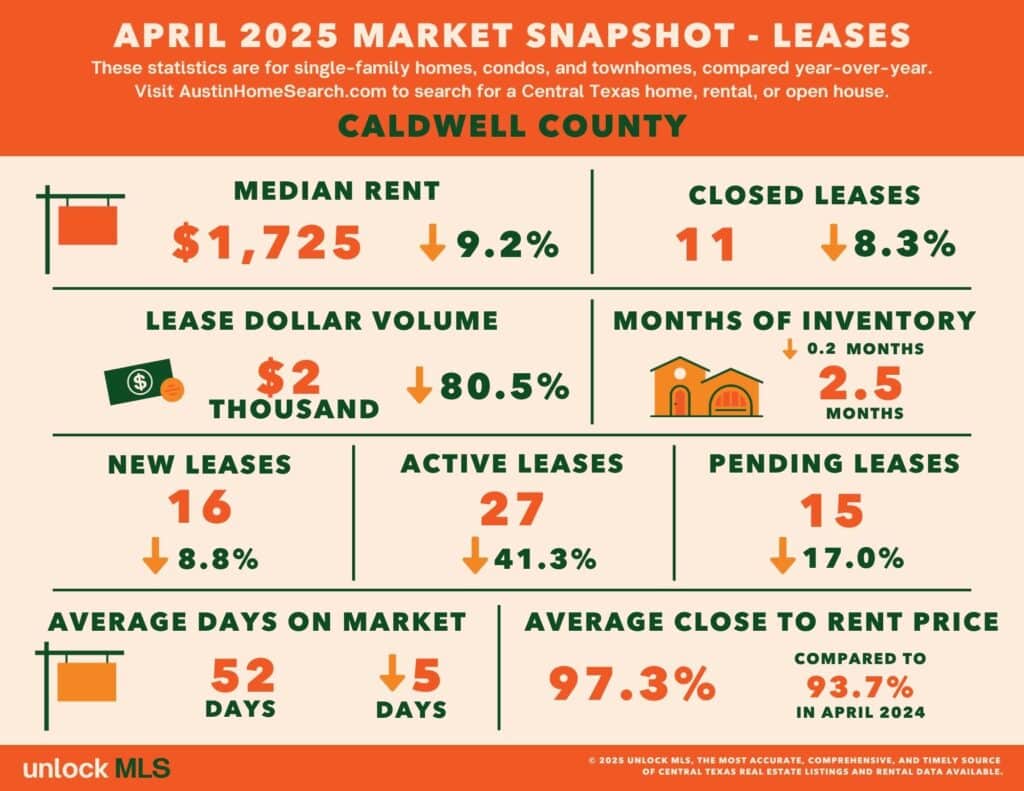

Caldwell County

- Sales: Median price up 1.0% to $299,990; inventory at 5.8 months; closed sales down 25.4%.

- Leases: Rent dropped sharply 9.2%; lease volume plummeted 80.5%; pending leases down 17%.

➡️ Takeaway: Low sales and leasing activity signal limited momentum; pricing volatility persists.

Final Thoughts

While Austin proper may be slowing, the wider metro tells a different story. Suburban markets are drawing new residents and rebalancing supply with demand, offering opportunities for buyers, renters, and investors alike.

As inflation cools and housing inventory rises, the spring-summer season could be a strategic entry point for those who’ve been waiting on the sidelines.

📍 Curious about the next growth corridor? Stay tuned for insights on where Greater Austin’s growth is heading next.