The Harvest Portfolio: A Sneak Peak (Pt. 1: Introduction and Purpose)

Intro

The current market is undoubtedly characterized by turbulence, with prices fluctuating across various niches, categories, and locations. Such volatility poses challenges in predicting the trajectory of prices. Understanding the importance of providing comprehensive information to potential real estate investors, we have taken the proactive step of conducting our own feasibility assessment to highlight the reasoning behind our newest investment portfolio, Real Harvest.

This assessment leverages the invaluable insights gathered from meticulous studies conducted by our team of expert analysts. Our aim is to empower investors with the necessary knowledge to make informed decisions and navigate the dynamic landscape of the current market.

Properties situated in areas with strong economic fundamentals, such as a growing population and a diverse economy, have demonstrated resilience during market downturns. Austin, Texas, exemplifies these criteria, making it an attractive location for real estate investments. As the housing market exhibits signs of renewed activity, distressed and discounted properties are gradually becoming scarce. Savvy investors are seizing these opportunities and reaping the rewards. However, it is imperative for investors to act promptly, as this window of opportunity is closing.

Moreover, real estate stands out as one of the most stable forms of long-term investment. Throughout each business cycle, real estate values consistently appreciate. Historically, every dip experienced in the housing market has been followed by a recovery, without exception. While conventional investment methods like stocks and bonds have their merits, real estate offers unparalleled advantages for long-term wealth-building.

Investing in real estate provides the advantage of tangibility, as it involves owning physical properties that can generate cash flow and potential appreciation over time. Additionally, real estate investments can serve as a hedge against inflation and provide tax benefits. These characteristics, combined with the enduring nature of real estate values, make it an exceptionally favorable choice for individuals seeking long-term financial growth and stability.

Taking Advantage of the State of the Market

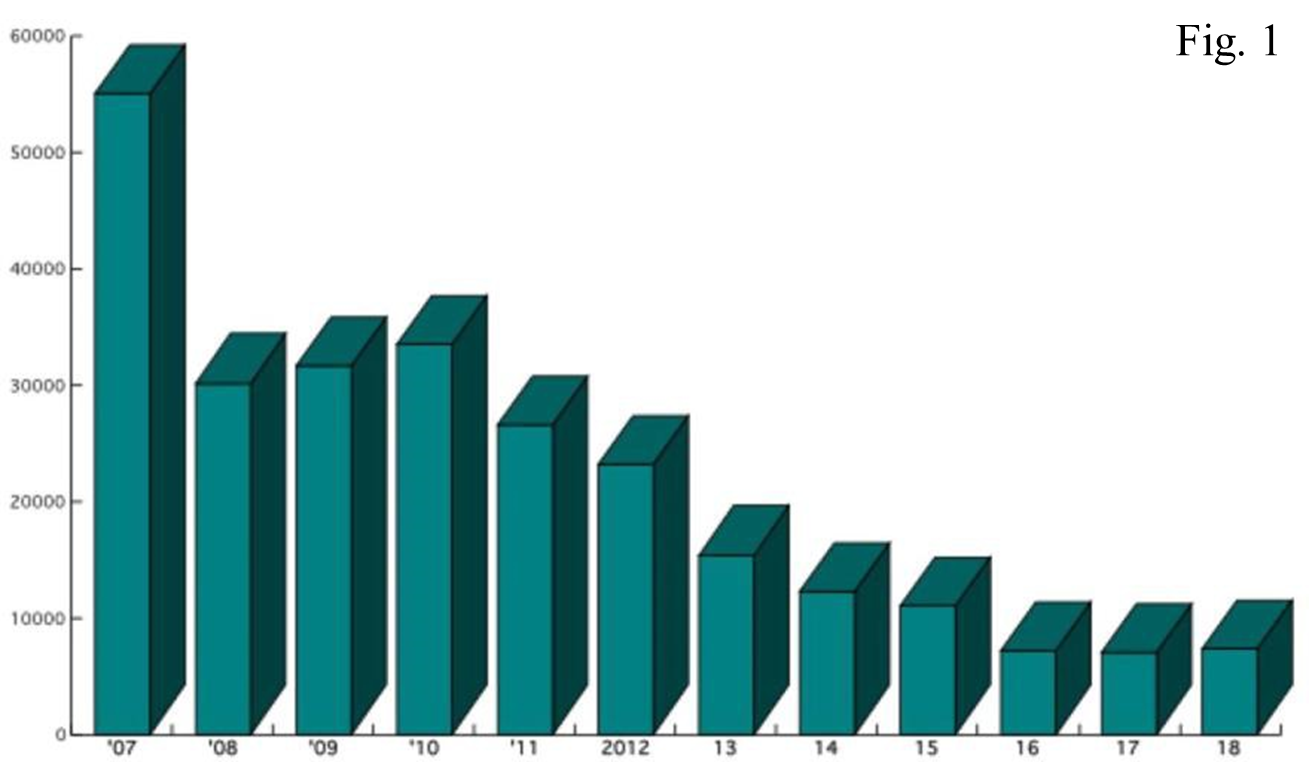

The housing market faced one of the most severe downturns in 2022. However, there has been a notable rebound in market activity, and experts predict further growth in the coming months. It is worth noting that the number of developers facing foreclosures during recessions is now declining (Figure 1). These foreclosures present highly lucrative investment opportunities, with the potential for significant gains as the market naturally adjusts from the downturn.

A prime example of capitalizing on such opportunities is the well-known case of BlackRock’s distressed property investments. During the 2008 recession, the Wall Street giant purchased heavily discounted foreclosed properties through distressed loans and auctions, ultimately profiting immensely from flipping these homes. Similarly, Real International has actively acquired distressed real estate for our portfolio projects, recognizing the potential for substantial returns. As we anticipate the market to recover by 2025, distressed land developments are expected to witness a solid increase in demand once again. This, in turn, can offer investors significant returns within a relatively short time frame.

By seizing the opportunities presented by the current market conditions, investors can benefit from the market recovery and capitalize on the potential growth in distressed real estate.

For further questions, comments, or inquiries about our newest investment portfolio, “Real Harvest,” please direct them to:

The Investment Team

investment@realinternational.com

Real International