Understanding the Recent U.S. Mortgage Fee Adjustment: Debunking Rumors and Misconceptions.

Recently, there has been a lot of buzz about the adjustment of mortgage fees in the US, with some media outlets reporting that the new rules are punishing people with high credit scores. This has led to some people considering lowering their credit score to get a lower interest rate on their mortgage. However, these rumors are misleading, and it’s important to understand what is really going on before taking any action.

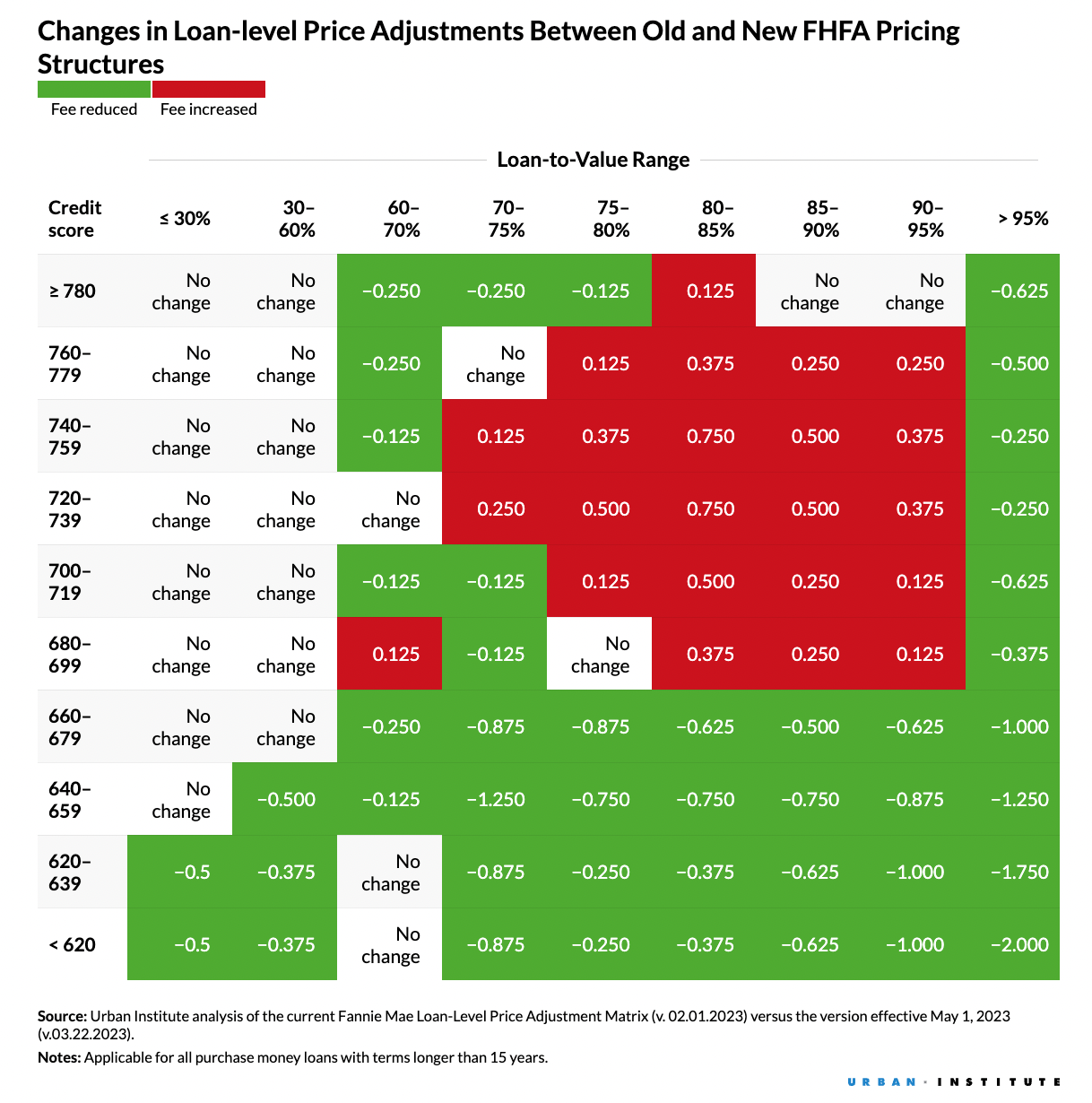

The adjustment in question is called Loan-Level Price Adjustment (LLPAs) by Fannie Mae and Credit Fees by Freddie Mac. These two major mortgage lenders are controlled by the federal government, and the decision to adjust the fees comes from the Federal Housing Finance Agency (FHFA).

Our team at Real International discussed the adjustment with senior loan brokers and determined that the rumors about the new rules are untrue. The main adjustment this time is the conventional loan fee (Origination Fee), which is a variable fee that FHFA will adjust appropriately based on the overall US housing market situation and factors such as demand and risk.

It’s important to note that most people do not pay attention to FHFA’s fee adjustment on a regular basis. Once the media makes a big deal about credit scores and interest rates, people with generally high credit scores will naturally feel their interests are extremely damaged. However, historically, it is normal for FHFA to adjust the fees for various loans.

The new fee adjustment benefits buyers of owner-occupied homes with 5% down payment, regardless of the credit range, as the Origination Fee has been reduced to varying degrees. For buyers with a high credit score of 30% or more down, the fees are also reduced or almost unchanged. Only buyers with credit scores in the 720-759 range and 15-20% down have the largest fee increase of 0.75.

For those with a credit score below 620, the largest decrease in fees is 2.0 for a 5% down payment. However, it’s already difficult to get approved for a loan with a credit score below 620, so a larger decrease is meaningless.

Therefore, the higher the credit score, the better, as this little loan fee is not worth risking a lower credit score. For this fee adjustment by FHFA, it’s best to carefully screen the information on the internet and not over-interpret it, but try to maintain and improve your credit score to get the best interest rate.

In conclusion, it’s important to understand that the new mortgage fee adjustment in the US is not punishing people with high credit scores. Rather, it’s a normal adjustment based on the overall US housing market situation and other factors. Therefore, it’s not necessary to lower your credit score to get a lower interest rate, and it’s actually best to maintain and improve your credit score to get the best deal.