Williamson County 2023 Property Valuation Update

The Williamson County Appraisal District has updated its 2023 property valuations, and some homeowners have reported a reduction in the valuations of their primary and investment homes!

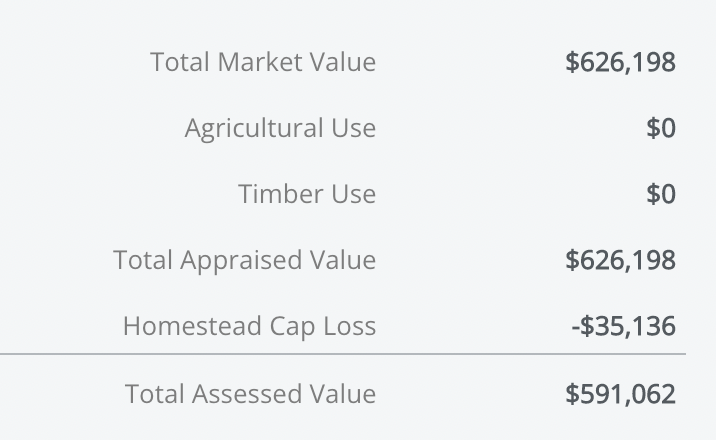

If you’re a homeowner in Williamson County, visit search.wcad.org to find out the value of your home and check the Appraisal District information sheet for Market Value and Assessed Value. Some properties have seen reductions of more than $100,000, providing significant savings on property taxes.

The assessed values for 2023 would be used to calculate property taxes and are even sometimes lower than the market value – an example would be if you have a Homestead exemption. Additionally, if you haven’t already read about it, the Texas Senate has approved a property tax reduction package that offers potential relief to individuals during this challenging economic climate.

It’s important to note that the market value can fluctuate based on market conditions, but it can be protested through property value protest. While it’s common to protest a high valuation, it’s also recommended to protest a lower valuation to ensure that you’re paying the correct amount of property taxes.

According to statistics, only 20% of homeowners take the initiative to defend themselves against property tax valuations, and 6 out of 10 homeowners pay more property taxes than they should. Homeowners can either defend themselves or hire a professional to submit the protest by May 31.

The Appraisal District will hold an informal hearing to attempt to agree on a valuation with the homeowner. If an agreement isn’t reached, a formal hearing before a three-person panel appointed by a local judge will be held. If the property owner is still not satisfied, an appeal can be made.

If you don’t want to go through the defense process yourself, Real International recommends using a property tax defense firm to help you with the defense process. Defending a lower valuation won’t affect the price of future home transactions and can potentially save you money on property taxes.