The largest industrial gas supplier in the world could save more than $11 million on property taxes if it’s granted incentives for a possible facility in Taylor.

That was among among the details found in Linde Inc.’s application for Chapter 313 incentives, which were made public Aug. 1.

It is the U.S. subsidiary of United Kingdom-based Linde PLC (Nasdaq: LIN), the largest industrial gas company in the world by market share and revenue. It is a supplier to Samsung Electronics Co. Ltd and has proposed building its own facility next to Samsung’s $17 billion plant in Taylor, northeast of Austin.

Linde proposes investing $271 million in the facility and creating at least 10 jobs, with an average salary of $68,560, according to the incentives application. Construction would start in 2026 and operations would commence by the end of 2027.

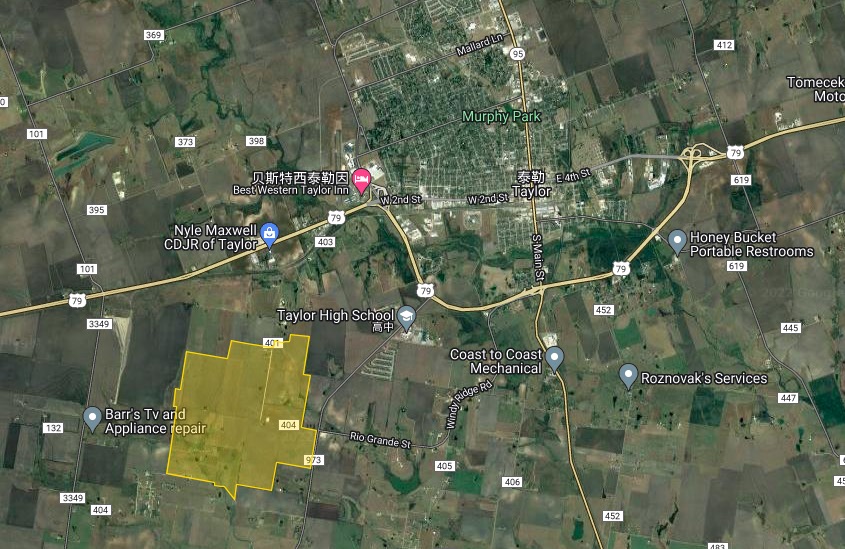

The Linde facility would rise on land owned by Samsung near the former intersection of County Roads 401 and 404 in eastern Williamson County.

It represents another supplier to the semiconductor sector eager to expand in Central Texas. Experts have predicted that the decision by South Korea-based Samsung to build its next-generation chipmaking plant in tiny Taylor could bring dozens of new companies and thousands of jobs to the region.

Linde did not respond to a request for comment, but the company noted in the documents that the property tax abatements were needed “in order to move forward with the development of the project.”

“Without this appraised value limitation, the impact of comparatively high Texas property taxes on the cost of the project does not allow the project to compete for global customers against similar projects operated by competitors of Linde Inc. in the U.S. and around the world,” representatives for the company wrote. “Without this appraised value limitation Praxair would have to strongly consider making this investment at another site outside of Texas.”

Linde, which was founded in Germany, is now domiciled in Ireland and headquartered in Surrey, outside London. It has locations in more than 100 countries, and reports its U.S. headquarters is in Danbury, Connecticut — the former headquarters of Praxair Inc., which merged in 2018 with Linde.

Should Linde ultimately build in Taylor, it would add to a seismic shift underway in the small town’s economy. Its population is about 17,000, according to the U.S. Census Bureau.

Linde is asking Taylor Independent School District for Chapter 313 incentives. The program allows Texas school districts to limit the taxable value of a property for a portion of school taxes. The Chapter 313 program allows a cap of $10 million to $100 million on property value for up to 10 years. The program is scheduled to sunset at the end of the year and manufacturers have been filing applications to lock incentives in before then.

Taylor ISD trustees voted in June to accept the Chapter 313 application.

The newly public application shows that Linde is seeking to place an $80 million cap on the value of the land for maintenance and operations school taxes. This is just the application stage; no deals have been finalized and the incentives details are still subject to negotiations.

But if Linde is ultimately approved for the incentives, and the project proceeds as described, the company could save about $11.1 million on property taxes over the course of the agreement, based on an Austin Business Journal analysis of the application. That’s based on projections of land values far into the future and assumes no changes to tax rates, so the final value could change significantly.

In the application, Linde wrote that the project would include two air separation units, two electroayzers, multiple storage tanks, multiple electronics-grade gas purifiers, infrastructure to enable export of industrial gases for merchant market, offices, warehouse and other necessary infrastructure to support operations.

“The proposed project is to build, install and operate the necessary industrial gases to support the proposed Samsung facility in Taylor ISD,” the documents state.

Samsung has begun construction on the Taylor factory and has revealed that it is considering even more investment in Central Texas. Incentives applications made public July 20 show Samsung is eyeing an additional 11 fabs, an investment of $192.1 billion that could create at 10,000 jobs in Taylor and at an existing manufacturing campus in Northeast Austin. Samsung has not yet decided whether to move ahead with those plans, which would come to fruition over decades.

Linde, which ranks No. 447 on the Fortune Global 500, has annual revenue of $29.8 billion, more than 74,000 employees and a market value of about $150 billion.

Interestingly, Linde also simultaneously submitted a Chapter 313 application for a similar project in Beaumont, in East Texas near the Louisiana border. It has proposed building a facility to support an OCI NV ammonia manufacturing plant, which may undergo a $5 billion expansion.

The Article is from Austin Business Journal, copyright belongs to owner