October Inflation Index Below Expectations! No Rate Hike by the Fed, Mortgage Rates Decline! Buyers’ Enthusiasm Soars!

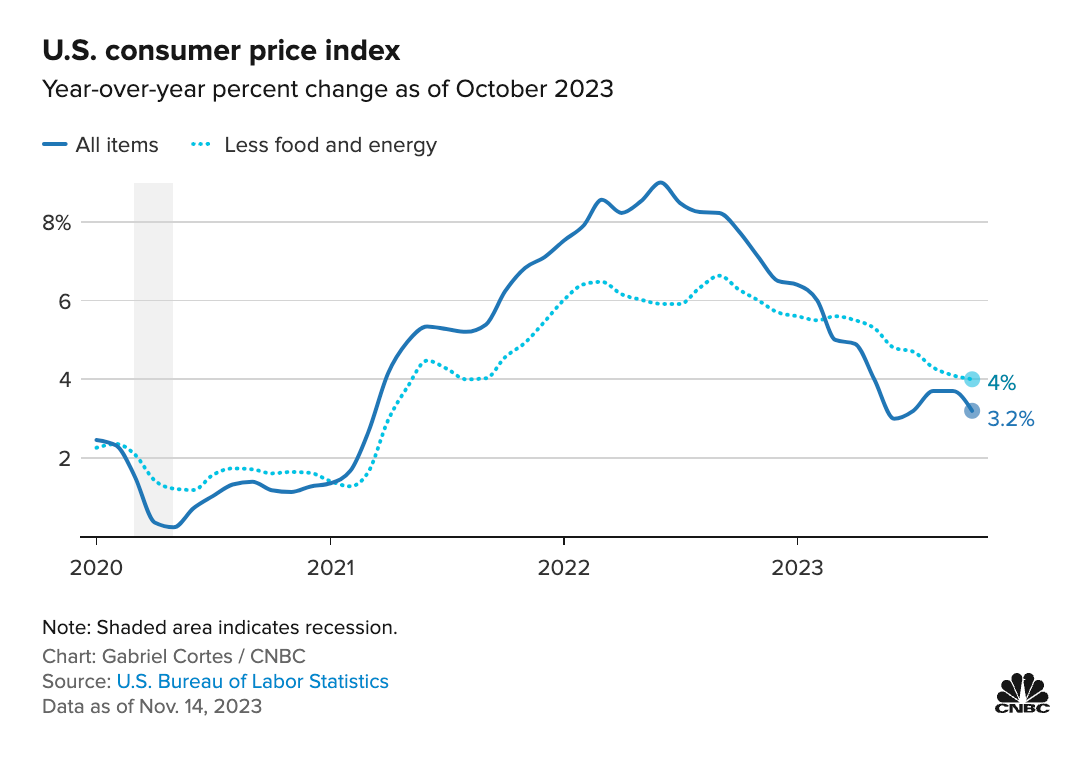

October CPI Data Report

Recent weeks have brought a series of positive developments, including Texas passing the largest property tax reduction bill in history! On Tuesday, November 14, the U.S. Department of Labor released its latest report, revealing that the October Consumer Price Index (CPI) and core index were both below Wall Street’s expectations. This marks the smallest increase since September 2021, virtually eliminating the possibility of a Fed rate hike this year! The stock market responded with gains, and mortgage rates dropped, boosting the confidence of prospective buyers. Many are now rushing to inquire about exclusive discounts through Real International’s group purchase, hoping to enter the market before any potential builder price adjustments.

________________________________________________________________________

As 2023 approaches its conclusion and the holidays draw near, popular areas are witnessing a dwindling supply of discounted new homes from major builders. If you missed out on our initial exclusive group purchase discounts, contact us immediately to seize the last batch of year-end promotions!

For more information, please contact our sales line:

Email: ziling@realinternational.com

Phone: (512) 808-0677

________________________________________________________________________

October Housing Price Data Report

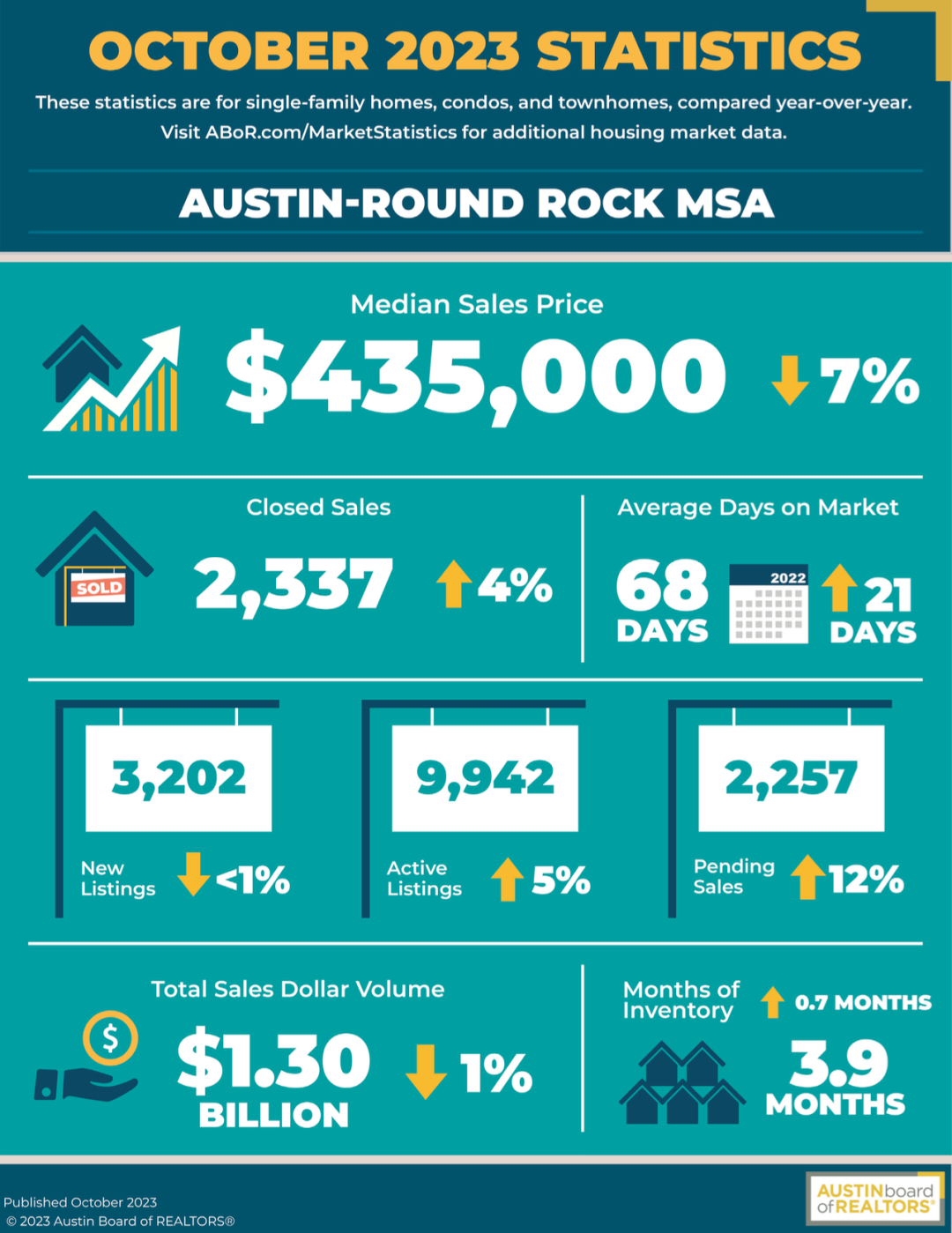

According to the market report released by the Austin Board of REALTORS® (ABoR), the Greater Austin metropolitan area (Austin-Round Rock) performed well during the off-season. The median home price in October was $435,000, a 7% YoY decrease. New listings dropped by 1%, active listings increased by 5%, and Pending Sales rose by 12%. The average time on the market was 68 days, with a 3.9-month inventory.

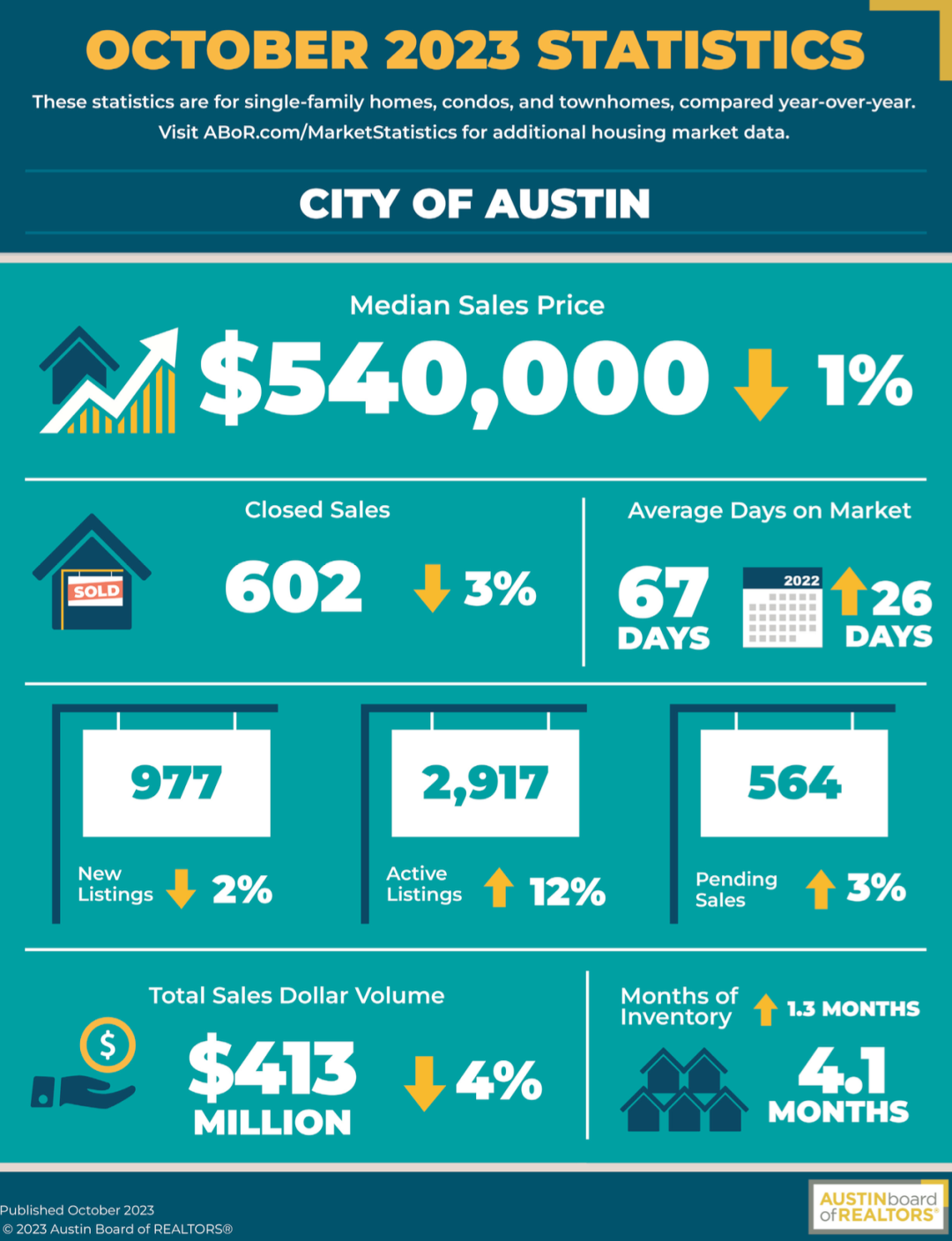

In the City of Austin, the median home price in October remained almost unchanged YoY at $540,000. This once again proves that high-interest-rate pressure cannot break the advantage of core real estate areas. New listings in October were tight, decreasing by 2% to only 977 units. Active listings increased by 12% to 2,917. There were a total of 564 Pending Sales, a 3% YoY increase. The average time on the market was 67 days, with an inventory of 4.1 months.

________________________________________________________________________

The performance of housing prices in the Austin city area reflects the promising prospects of the Real International Crystal Line Opportunity Zone investment project! Sophisticated real estate investors are advised to explore the “Opportunity Zone” tax-saving scheme:

The Real International Crystal Line project involves the construction of 23 single-family homes (BFR) in the core area of Austin along the new light rail line. It fully leverages the U.S. government’s policy support for “Opportunity Zones,” exempting investors from capital gains tax for 10 years, making every penny of your investment more valuable!

Subscription for this project is nearing completion and the investment channel may close at any time. Seize the opportunity to ride this “tax-free” bandwagon!

Contact us for more information on this investment opportunity:

Email: enge@realinternational.com

Phone: (512) 298-1899

________________________________________________________________________

In Travis County, the median home price in October remained robust, almost unchanged YoY at $524,500. New listings decreased by 7% to 1,519. Pending Sales remained almost unchanged at 909. The inventory level was 4.2 months, with an increased time on the market at 70 days.

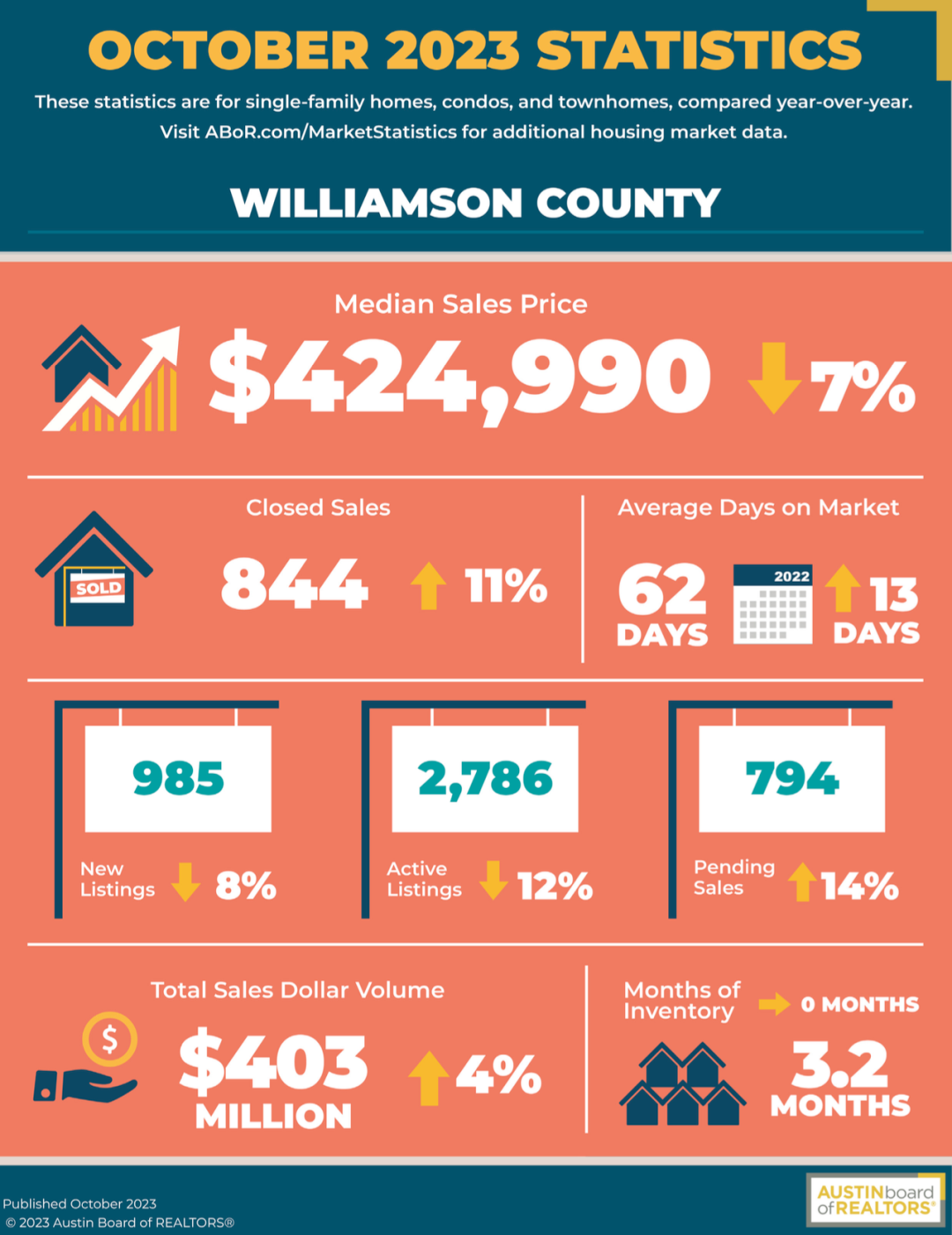

Williamson County, covering the four major cities north of Austin, saw a 7% YoY decrease in the median home price in October, reaching $424,990. Transfer transaction volume increased by 11% to 844 units, indicating continued buyer enthusiasm. New listings decreased by 8%, with a total of 794 Pending Sales, a 14% YoY increase. The inventory level remained at 3.2 months, with an average time on the market of 62 days.

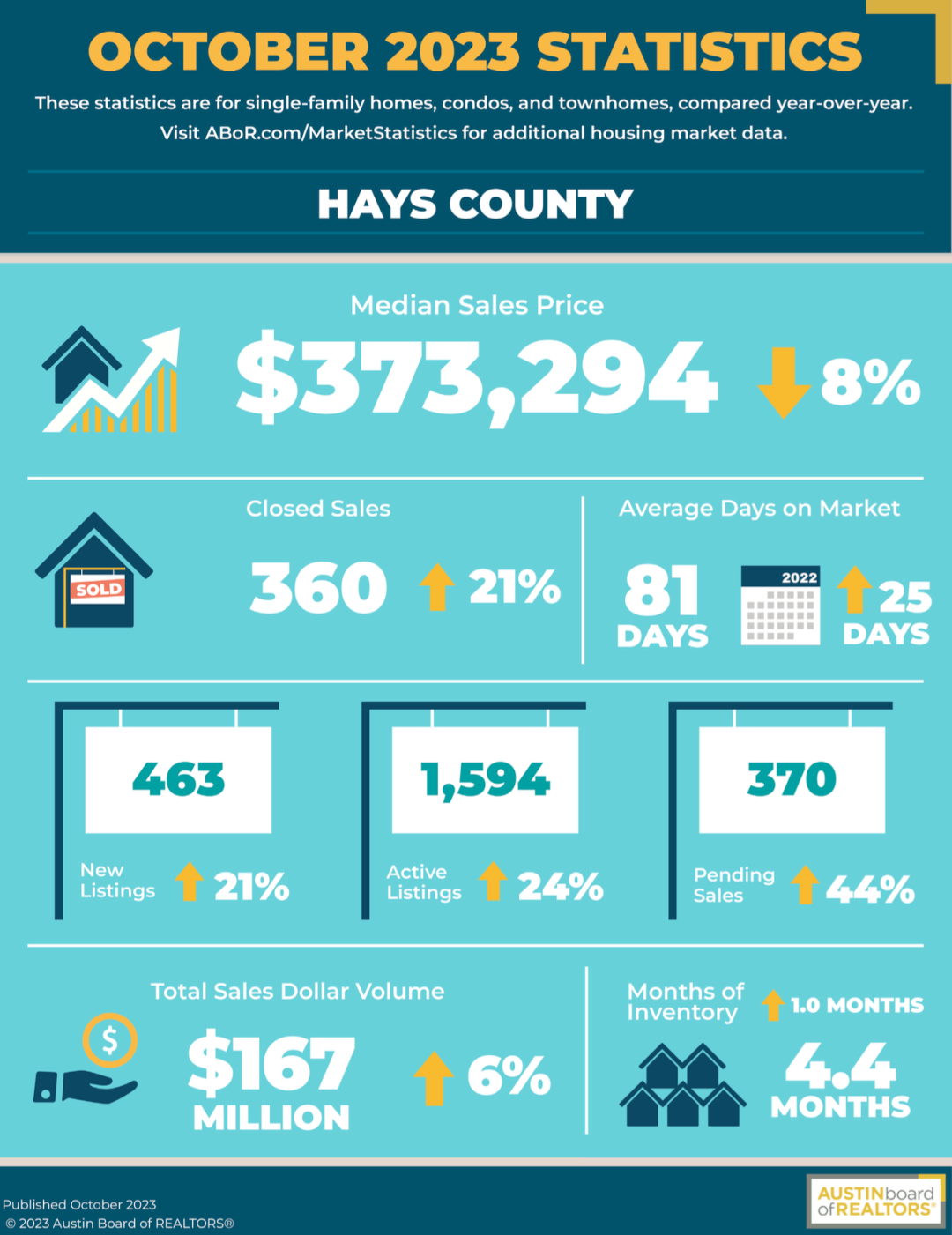

Hays County, part of the ASA Texas Innovation Corridor, remains one of the most popular and fastest-growing regions. The median home price in October was $373,294, an 8% YoY decrease. Transfer transactions increased by 21%, and Pending Sales rose by 44%, indicating ongoing activity in the area.

Caldwell County’s performance in winter seems better than in summer, with a 1% YoY increase in the median home price in October, reaching $318,480. Transfer and Pending Sales surged by 45% and 73%, respectively. With 67 new listings, a 31% increase, Caldwell County, as part of the Texas Innovation Corridor, is experiencing substantial population growth, providing strong support for the local real estate market with significant future development potential.

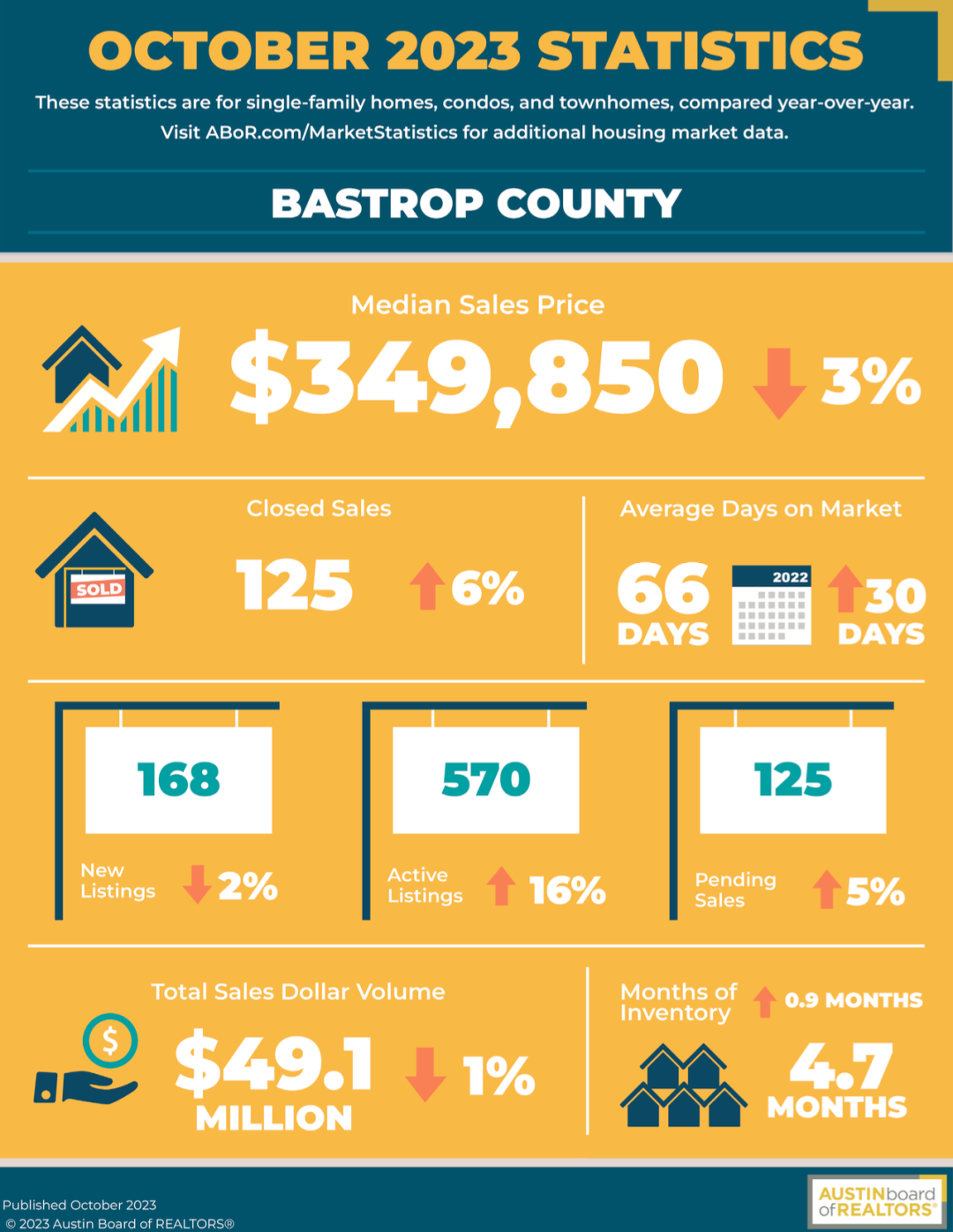

In Bastrop County, the median home price in October slightly rebounded to $349,850. Transfer transactions increased by 6%, active listings rose by 16%, and Pending Sales increased by 5%, reaching 125.