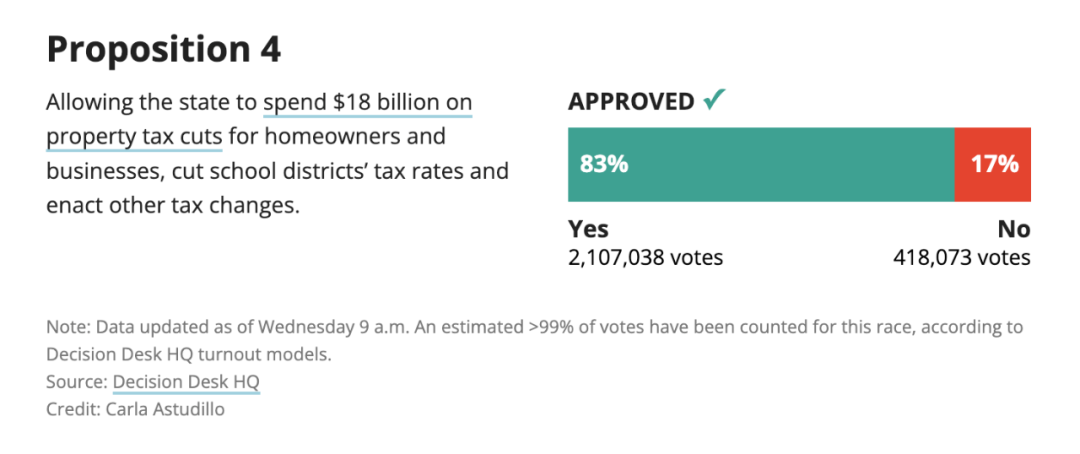

Texas Achieves Historic Property Tax Breakthrough! ($18 Billion Settlement)

In a resounding victory for property owners, Texas has successfully passed its most substantial property tax reduction proposal to date. The outcome of the mid-term election unveiled Proposition 4, a measure aimed at alleviating the burden of property taxes, securing an overwhelming 83.43% support over only 16.57% in opposition.

Key Developments:

- Homestead Exemption Boost:

- The approved measure marks a significant enhancement in the Homestead Exemption, soaring from $40,000 to an impressive $100,000.

- Controlled Assessment Increases:

- Empowering the state Legislature, the proposition grants authority to limit the annual increase in assessed value for non-owner-occupied homes.

- Wide-ranging Benefits:

- Both owner-occupants and investor homeowners across Texas stand to reap substantial benefits from this landmark decision.

This $18 billion settlement signifies a monumental step towards fostering a more favorable environment for property owners, enhancing affordability, and promoting the growth of real estate investments. The move is poised to have a lasting impact on the Texan real estate landscape, setting the stage for positive developments in the years to come.

In the aftermath of this historic decision, Real International is poised to navigate and leverage these changes, ensuring optimal outcomes for their clientele. As of November 9, 2023, Texas emerges as a beacon for property owners, demonstrating its commitment to fostering a thriving real estate market that benefits both residents and investors alike.