The apartment sector has been on a roller coaster since the onset of the Covid-19 pandemic.

Some markets in 2020 saw meaningful drops in rents, occupancy and other metrics, but even in markets that remained stable, landlords had to work with tenants who lost income and couldn’t pay rent, navigated a federal rental-relief fund program many say has been beset by delays, and saw renters flee from dense urban cores. Although recovery started to take place later in 2020, especially in high-growth markets, the multifamily industry started the year on somewhat rocky footing.

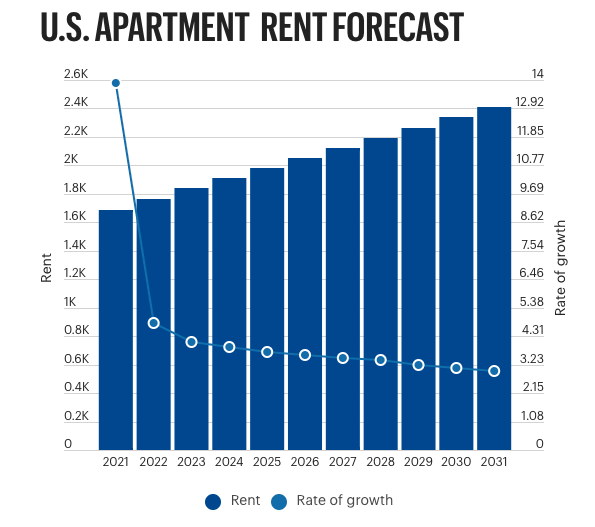

Now, at the end of 2021, the industry is closing the books on one of its strongest years ever. Richardson, Texas-based RealPage Inc., which tracks the rental-housing industry, expects a national surge of 13% in rental rates from the start of the year to the end. Most U.S. markets are seeing rents above pre-pandemic levels.

“2021 was a very unusual year,” said Jay Parsons, RealPage’s deputy chief economist and vice president of asset optimization and renter engagement. “I think most of us in this industry will say they’ve never seen a year quite like this one, and I don’t think we’ll ever see a year quite like this one again, (with) the enormous demand for rental housing and also the challenges we’ve seen, particularly on the affordable housing side and lack of access (there).”

Household formation and migration patterns have helped boost the apartment market, especially in the suburbs, which have emerged in many metro areas as top-performing submarkets.

Parsons said even with rental-rate increases, data that RealPage tracks indicates renters’ wages — especially among young professionals, a big share of the renter population — have overall risen to accommodate those hikes. Rent collections have come back and, Parsons said, tenants are largely paying rent from their own incomes and not relying as much rental assistance programs.

Still, low-income households continue to struggle. Access to affordable housing is becoming a more widespread issue, and new supply is delivering with top-of-the-market rents.

“You have super-high demand for Class B and C communities, and you can’t build those,” Parsons said. “Unfortunately, there’s a lack of government support at every level to fund additional affordable housing we really need. Longer term, today’s Class A projects will be tomorrow’s Class B, but it takes time for that happen.”

In 2022, RealPage is forecasting apartment rental rates to grow 8% year-over-year nationally. Santa Barbara, California-based real estate research firm Yardi Matrix is predicting 4.8% growth in 2022.

Doug Ressler, manager of business intelligence at Yardi Matrix, said he expects gateway markets to rebound even more in 2022.

New York and San Francisco were among the hardest hit by the pandemic, and have started to recover this year. But there remains runway for those markets, which’ll continue to be realized in 2022, Ressler said.

“The local policymakers are not sitting idly by,” Ressler said. “They’re doing a lot of things to (bring people back). Certainly, secondary and tertiary markets will still be robust, but we think urban gateway markets are still going to come back.”

Parsons said the expectation in the industry was that downtown apartment markets wouldn’t come back until more people returned to the office. But vaccinations and other efforts made to reopen downtowns have helped leasing efforts in center cities rebound. Even if people are still working from home, Parsons said many renters want to be in walking distance to restaurants, parks and other amenities.

Yardi Matrix found rent growth started to deescalate in November, rising nationally from the month prior by about $4, to a record high of $1,590. Some months in the spring and summer saw $20-plus month-over-month hikes.

Another subsector of the multifamily market growing quickly: single-family rentals. Rental rates for single-family rentals, which are booming in part because of the competitive for-sale housing market, grew 14.7% year-over-year, as of November, according to Yardi Matrix.

Apartments are seeing strong occupancy numbers, too, with the average U.S. occupancy rate of stabilized properties at 96.1% in October, a 1.4% annual increase, according to Yardi Matrix. Single-family rental occupancy rose 0.6% annually, as of October. That underscores continued demand for apartments this year and heading into 2022.

New York-based CP Capital US, a real estate firm that’s done $15 billion-plus in investments across multiple sectors, has in recent years — even prior to Covid-19 — invested primarily in new-construction suburban multifamily deals in Sun Belt metros.

It’s a strategy the firm will continue on with in 2022, said Jeremy Katz, co-head of CP Capital. The firm usually works in a joint venture with a developer, providing 80% to 95% of equity needed for a project.

Katz said 2021 saw a lot of appetite from investors for apartment properties, so CP Capital sold several properties within the past year. The stability of apartments — proven first through the global financial crisis and more recently through the Covid-19-induced recession — has attracted a lot of new capital, Katz said.

Even though Katz and others are predicting a strong 2022, the supply-chain headaches and inflation are sure to impact the industry.

Katz said there’s no question costs have increased, for the firm and its development partners. While construction costs always increase, he said the rate of growth in the past year has been faster than normal.

Parsons said in addition to delays and costs associated with materials, labor continues to be a big challenge for apartment developers.

“It’s not just the cost alone, it’s the time it’s now taking” to complete projects, he said. “Most developers will tell you they’re projecting longer timelines for each project. They’re still going to get built but it’s going to take longer. We need supply right now.”

The Article is from Austin Business Journal, copyright belongs to owner