Austin Board of Realtors March Market Update – Investment Property Shares Reach Historic Highs! Will 30% of Houses Belong to Investors in the Future?

Investment Property Shares in Single-Family Homes Reach Historic Highs!

According to CoreLogic’s data report, despite market volatility, real estate investors are still forging ahead at full speed, with transactions in single-family homes as investments reaching record highs!

Investors’ shares in single-family homes purchased in Q4 of last year were 28%, 27.3%, and 28.7% respectively. The report speculates that by 2024, investors’ share of purchases may exceed 30%, contrasting with the volume of owner-occupied home purchases. Due to the impact of high interest rates, the number of homes purchased per month for owner-occupation is about 100,000 less than before 2022 (while also releasing demand for rental properties). This demonstrates investors’ financial resilience in the face of high interest rates and low inventory.

Investor reports from investment institutions RCN Capital and CJ Patrick Company also reflect that overall investor sentiment in the real estate market is “cautious yet optimistic.”

However, the business of renovating houses has significantly declined in the face of slowing home appreciation and high interest rates, with only 12% of house flippers selling in the short term, as renting becomes more attractive!

Important! The US government is investing $6.4 billion in the new Samsung factory in Austin to help Samsung accelerate its expansion! (Includes exclusive discounts on new homes in the surrounding area)

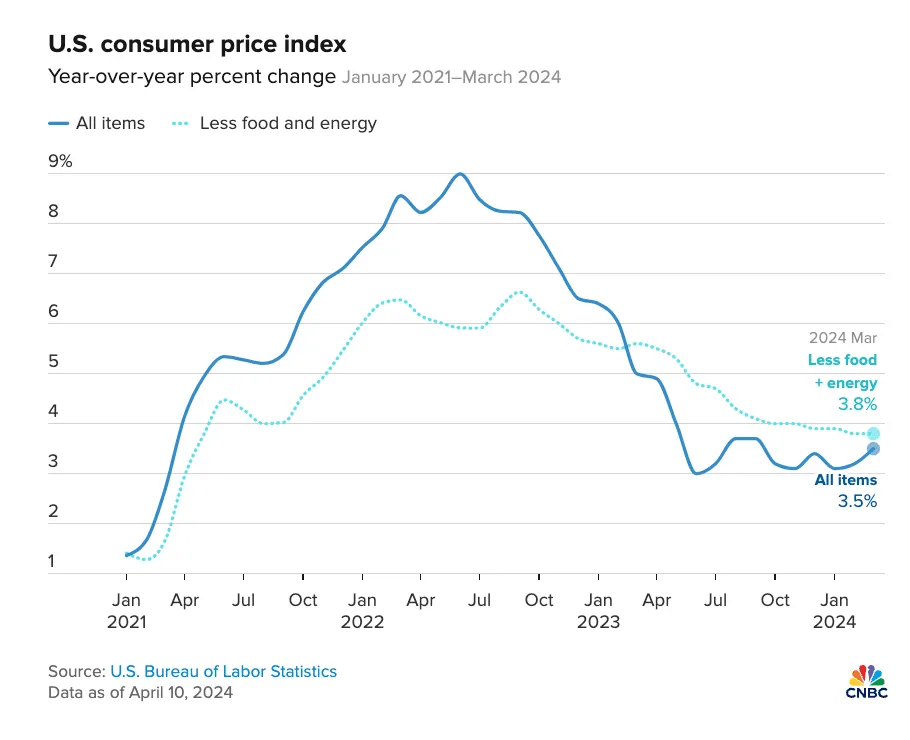

March CPI Data Report

Last week, the US Department of Labor released a report showing that the CPI in March was higher than expected, rising by 3.5% year-on-year, marking an acceleration in inflation, with housing and energy being the main factors, and housing costs rising by 5.7% year-on-year. Following the report’s release, the expected interest rate adjustment has been postponed from March to September.

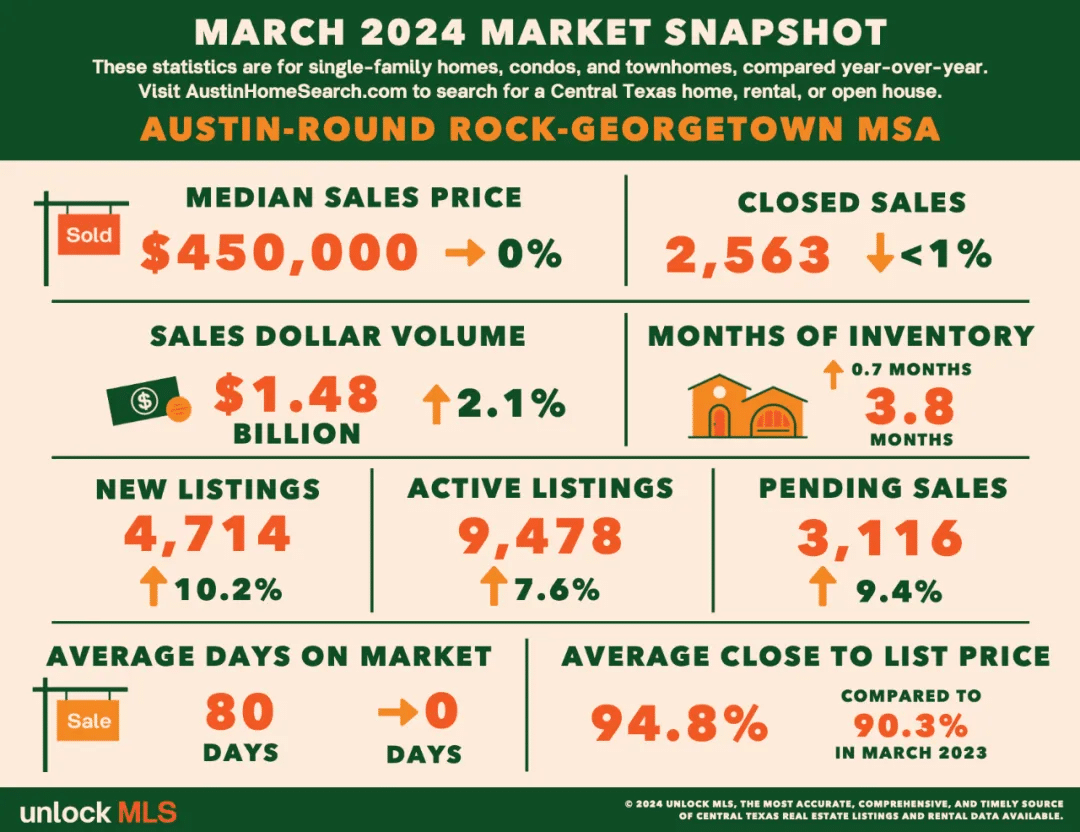

March Housing Price Data Report for Austin

According to the market report released by the Austin Board of REALTORS®, the metropolitan area since 2024 includes data not only from Austin and Round Rock but also from Georgetown. Also included is a comparison between average transfer prices and listing prices as a guide.

Austin is currently entering its seasonal peak, with the Huaao Real Estate transaction team busy every day, especially with an increase in clients seeking advice on selling properties. Friends in need of property selling services, please contact the assistant!

Austin’s peak transaction season is here! Choose Huaao Real Estate to sell your property quickly, decisively, and at the right price!

In March, the median price in the Austin metro area remained flat year-on-year, at $450,000. There were 2,563 transactions, a 10.2% increase in new listings to 4,714, 9,478 active listings, and 3,116 pending sales. The average time on the market was 80 days, with a 3.8-month supply. The average transfer price was 94.8% of the listing price.

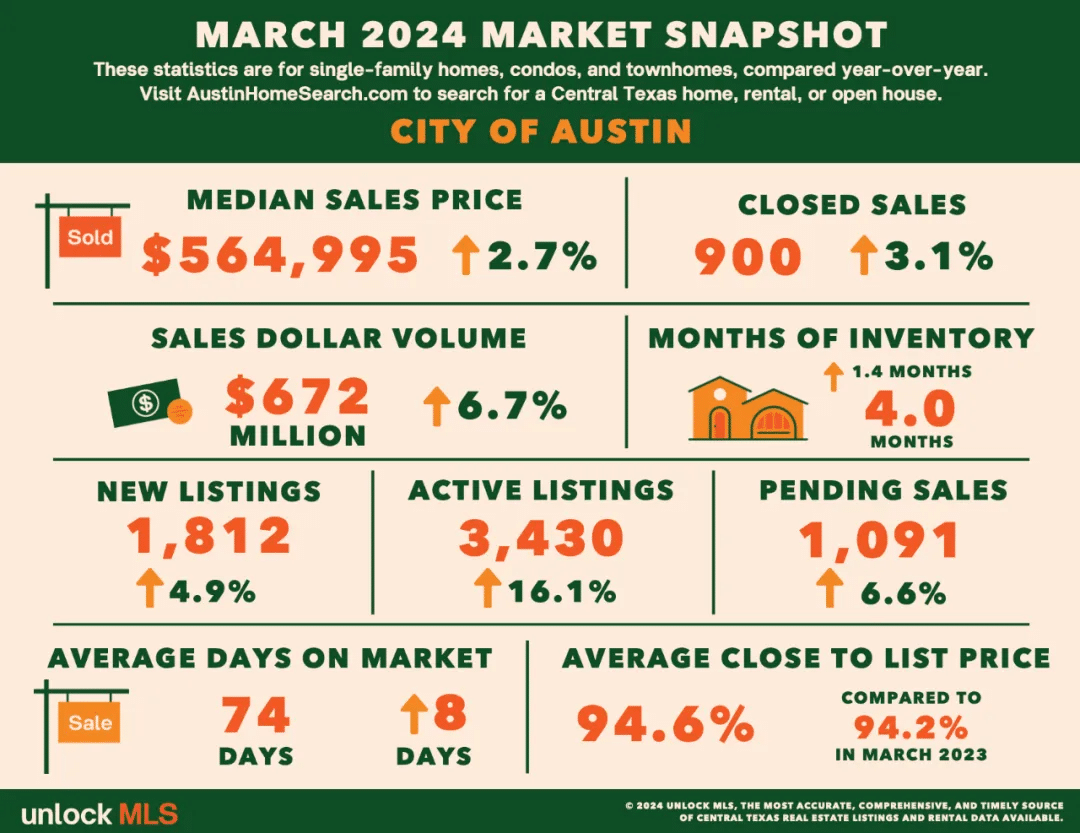

City of Austin

In March, the median price of homes in the Austin city area decreased by 2.7% year-on-year to $564,995. There was finally an increase in new listings to 1,812 units. There were 3,430 active listings. There were a total of 1,091 pending sales, a 6.6% year-on-year increase. The average time on the market was 74 days, with a 4-month supply.

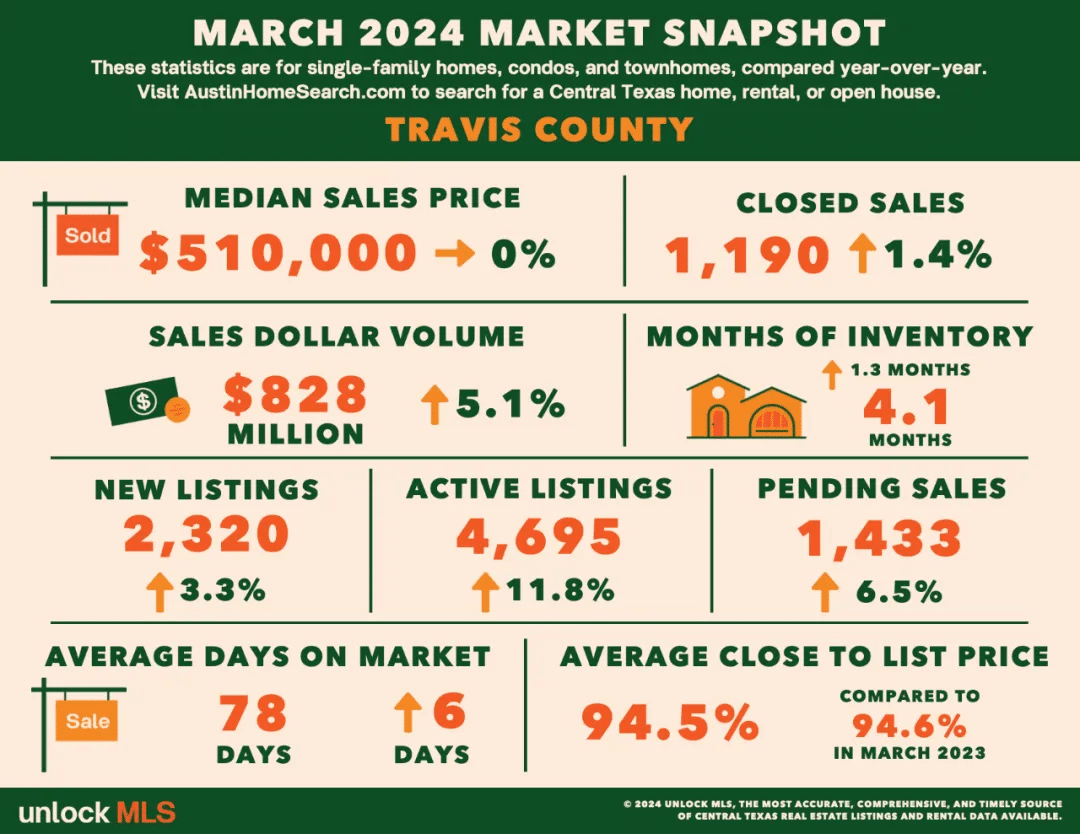

Travis County

In March, the median price of homes in Travis County remained flat year-on-year at $510,000. There were 1,190 transferred homes, and 2,320 new listings. There were 1,433 pending sales. There was a 4.1-month supply, with an average time on the market of 78 days.

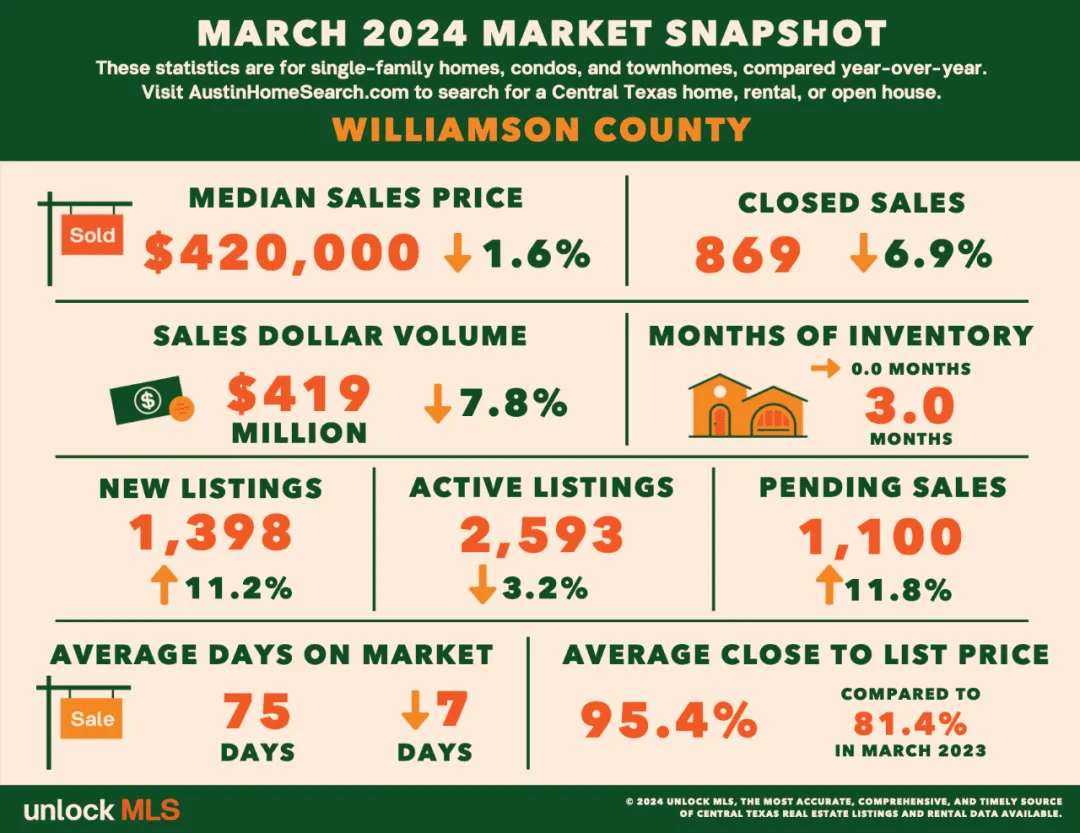

Williamson County

Williamson County covers the four major cities north of Austin. The median price of homes in March was $420,000, a decrease of 1.6% year-on-year. There were 869 transactions. There were 1,398 new listings, 2,593 active listings, and 1,100 pending sales. There was a 3-month supply, with an average time on the market of 75 days.

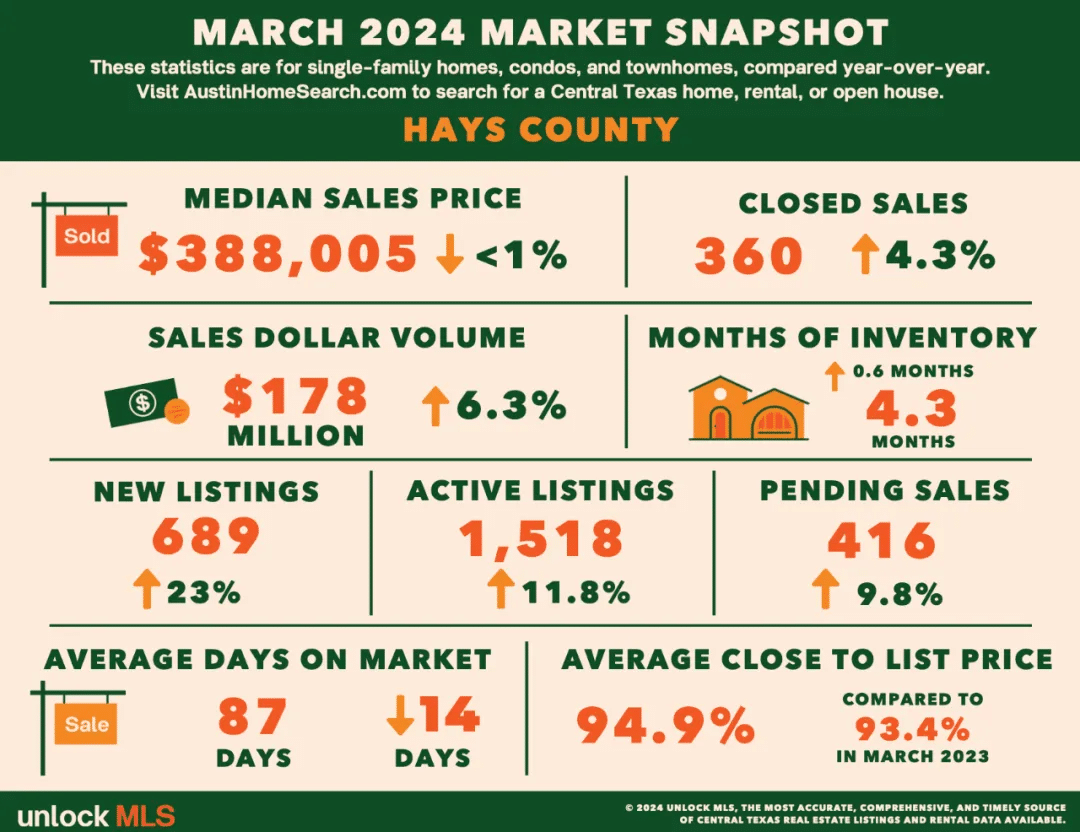

Hays County

In March, the median price of homes in Hays County was $388,005. There were 360 transfers, 178 new listings, 1,518 active listings, and 416 pending sales. The average time on the market was 87 days.

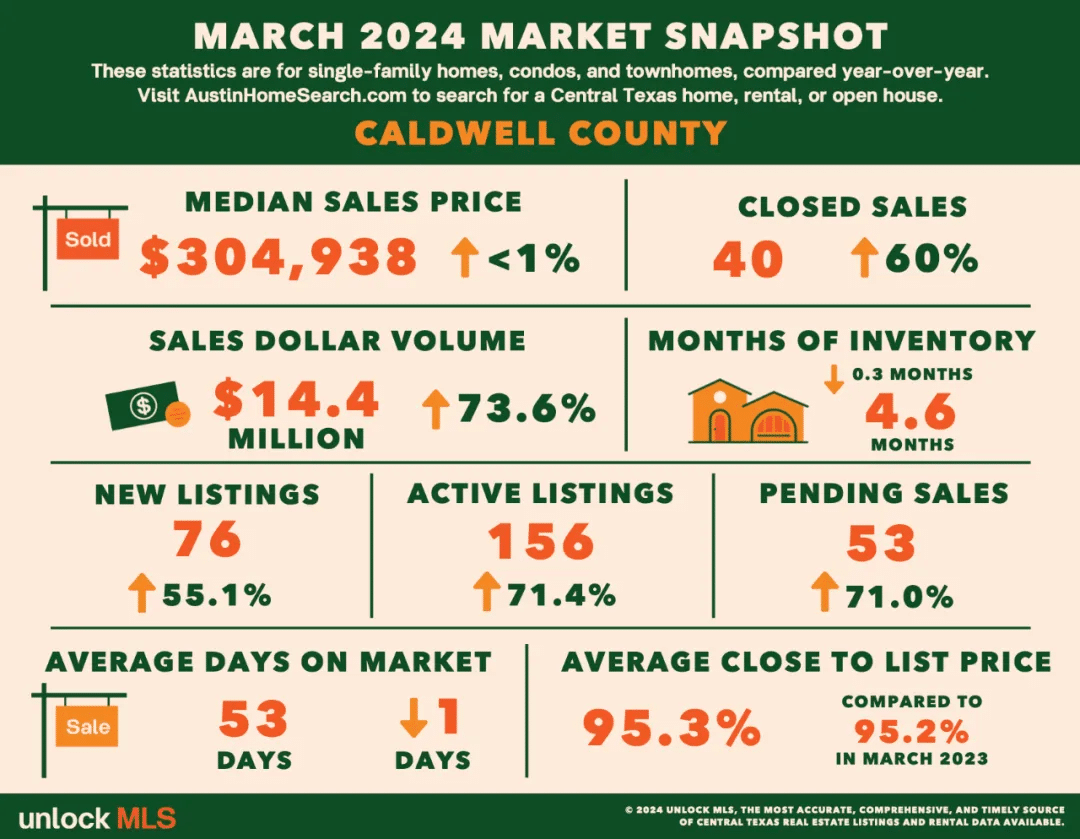

Caldwell County

In Caldwell County, the median price of homes in February was $304,938, almost unchanged year-on-year. There were 40 transferred homes, a 60% year-on-year increase. There were 76 new listings, 156 active listings, and 52 pending sales.

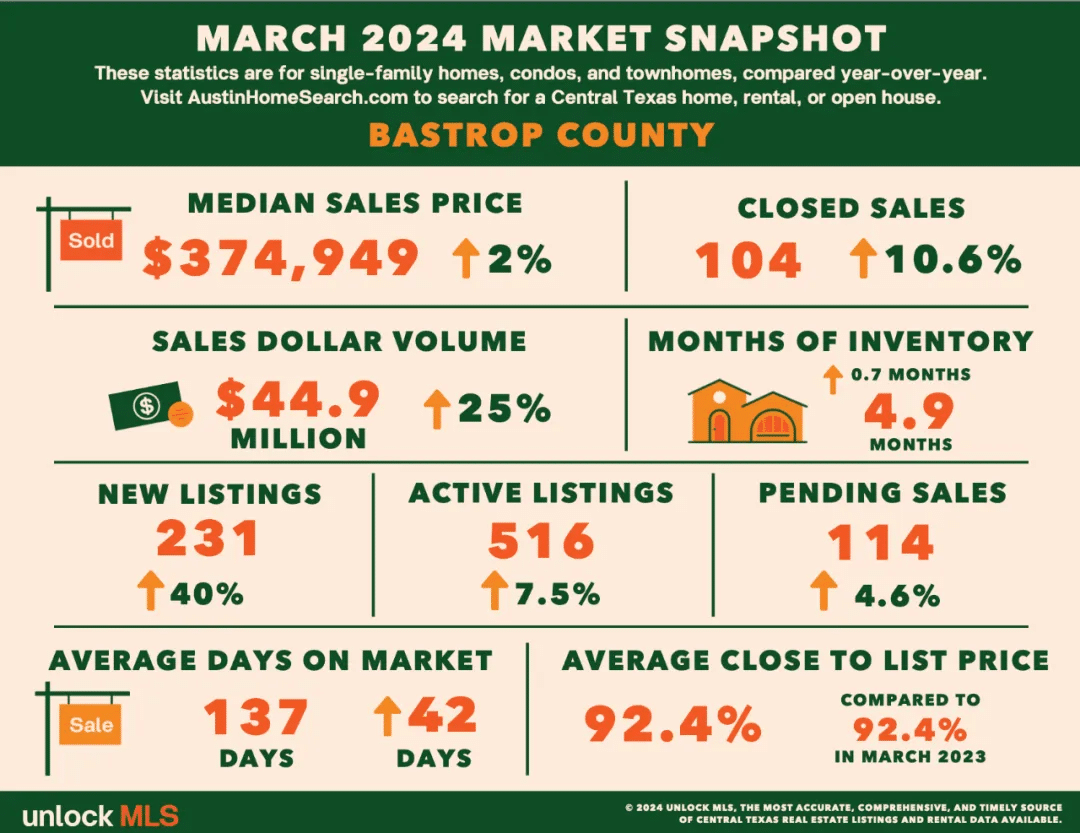

Bastrop County

In Bastrop County, the median price of homes in March was $374,949, a 2% year-on-year increase. There were 104 transactions, a 10.6% year-on-year increase. There were 231 new listings, 516 active listings, and 114 pending sales.