Defer Short and Long-Term Capital Gains Tax with Opportunity Zones

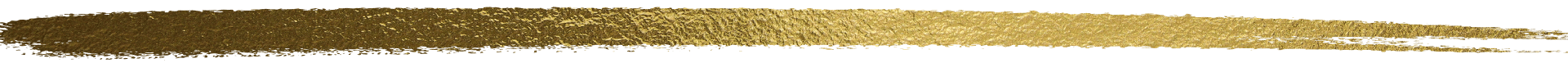

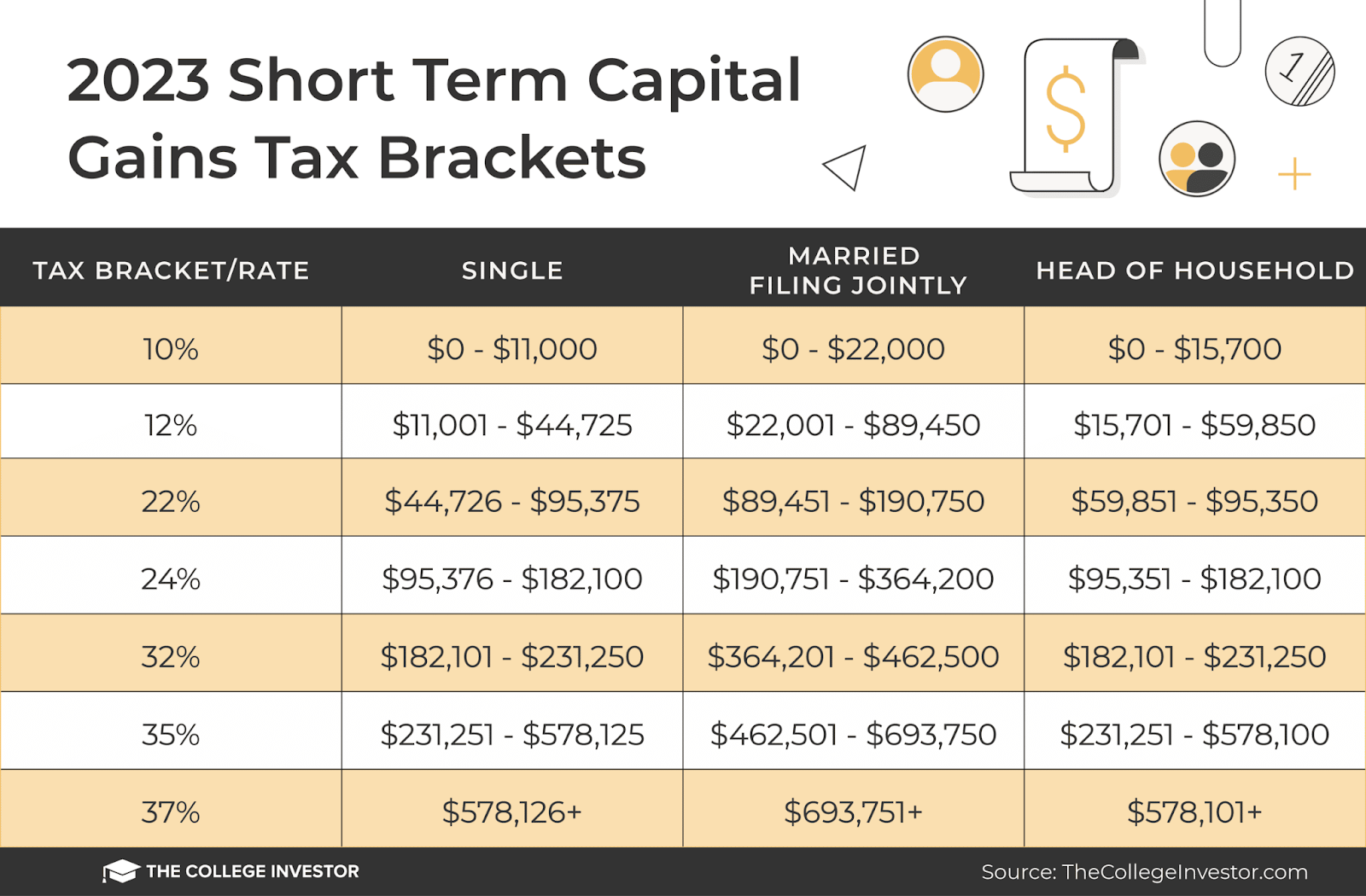

Below are the Short and Long term Capital Gains Tax Brackets for 2023:

Investors in the United States face a significant financial burden due to the capital gains tax liability incurred upon realizing investment gains.

For instance, in the case of a short-term capital gain of $1 million, investors in numerous states must bear not only the federal short-term capital gains tax but also the state-wide capital gains tax.

Fortunately, there is a viable solution available to defer these capital gains tax obligations for extended periods while also minimizing their impact, and that is through Opportunity Zones.

—————————————————————————————————————————————————-

Important: Opportunity Zone Investment Eligibility

Capital Gain Recognized by Individual

Capital Gain Event Prior to 2023: Your deadline to invest has already passed.

Capital Gain Recognized Through a Passthrough Entity Schedule K-1

Capital Gain Event in 2022: Your deadline is September 11, 2023. (Partnership returns due date of March 15, 2023 + 180 days.)

—————————————————————————————————————————————————-

What are Opportunity Zones?

Opportunity Zones are designated areas created by the US government to stimulate development and investments. They offer tax incentives to individuals and businesses who invest their capital gains in these zones. Typically, Opportunity Zones are located in low-income areas that require economic revitalization.

Texas: A Promising Hub for Opportunity Zone Investing

Texas, the second largest state in the US, boasts 628 designated Opportunity Zones, making it one of the most promising areas for Opportunity Fund investments nationwide. These O-Zones are strategically situated in or near major urban centers such as Austin, Houston, Dallas, and San Antonio. However, it is essential to note that the median household income in Texas’s Opportunity Zones is $36,268, significantly lower than the state’s median income of $57,547 for all census tracts. Additionally, 70.22% of Texas’s Opportunity Zones are located in metro areas, compared to 85.58% for all census tracts statewide.

Investing in Opportunity Zones

To take advantage of the tax benefits offered by Opportunity Zones, investors channel their capital gains into Opportunity Zone Funds. These funds pool and deploy capital into qualifying projects within the designated zones, including real estate development, infrastructure improvements, and operating businesses.

A qualified Opportunity Fund is an investment tool organized as a corporation or partnership with the specific purpose of investing in Opportunity Zone assets. These funds can be established by any entity and are self-certifying by completing IRS Form 8996, which is then submitted with annual federal income tax returns. Opportunity Funds are required to hold at least 90% of their assets in qualified opportunity zone businesses and/or business property.

Real International’s Agenda for Opportunity Zone Investments

Real International holds several tracts of land within Opportunity Zone boundaries, which makes potential developments and other opportunities eligible for tax deferrals if investors reinvest their capital gains (such as stock market proceeds and alternative investment profit) into the Opportunity Zones.

Qualifying Investments for Opportunity Zone Incentives in Texas

In Texas, investments in commercial and multifamily real estate qualify for Opportunity Zone incentives. To qualify, the property must either be new construction, or if it is a rehabilitation project, the Opportunity Fund must invest equal or greater funds into property improvements than it did to initially purchase the property. Additionally, all construction or rehabilitation projects must be completed within 30 months.

Benefits of OZ Fund Investments

- The Opportunity Zones tax incentive offers investors three tax incentives to encourage investments in federally designated Opportunity Zones through qualified Opportunity Funds:

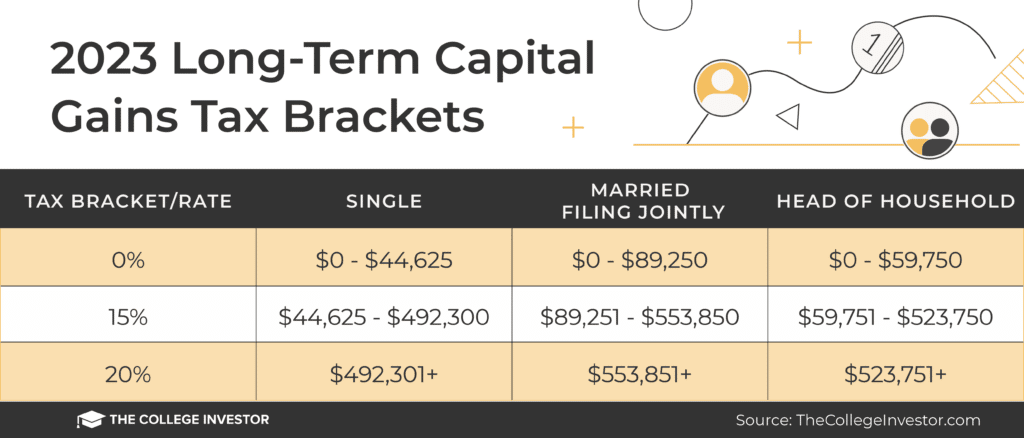

- Temporary Tax Deferral – Capital gains reinvested into an Opportunity Fund receive a temporary deferral of inclusion in taxable income. The deferred gain must be recognized on the earlier of the date on which the Opportunity Zone investment is disposed of or December 31, 2026.

- Permanent Exclusion – Capital gains from the sale or exchange of an investment in an Opportunity Fund are permanently excluded from taxable income if the investment is held for at least 10 years. This exclusion only applies to gains accrued on investments made through an Opportunity Fund, and there is no permanent exclusion possible for the initially deferred gain.

Examples of Investor Benefits Using OZ Fund Tax Benefits

Example 1: Temporary Tax Deferral

Nora purchased $100,000 worth of Going Up, Inc. stock 20 years ago. The stock has since increased in value to $1.1 million. Nora wants to liquidate her stock but doesn’t want to pay the capital gains tax at this time.

To achieve her goals, Nora could sell her $1.1 million worth of Going Up, Inc. stock and reinvest only the $1 million of gains into a QOF. By doing so, Nora can “pocket” her original $100,000 investment (into Going Up, Inc.) tax-free for living expenses or another investment and defer the capital gains tax on her $1,000,000* of gains until as late as 2026.

*(Note: If Nora holds the QOF investment for five years or longer, the $1,000,000 total of original capital gains would also be further reduced via basis step-ups, as described below.)

Example 2: Permanent Exclusion

Continuing with Nora’s previous example, after selling her stock with a basis of $100,000 for $1.1 million, she reinvested only the $1,000,000 gain in a QOF on September 31, 2018. If Nora holds the QOF for a total of 11 years and sells it for $1.9 million in October 2029, she could increase her basis to that amount (the QOF’s fair market value) and pocket the $900,000 in gain attributable to the QOF entirely tax-free!

Frequently Asked Questions

1. Q: Do my income/ordinary sales/rent qualify as capital gain to invest in QOF?

A: No. Gains that may be deferred are called “eligible gains.” They include both capital gains and qualified 1231 gains, but only gains that would be recognized for federal income tax purposes before January 1, 2027, and that are not from a transaction with a related person.

2. Q: Are OZ funds eligible for real estate investment?

A: Yes, to be eligible, a property must either be new construction, or if it is a rehabilitation project, the Opportunity Fund must invest equal or greater funds into property improvements than it did to initially purchase the property.

3. Q: Can nonresident alien individuals and foreign corporations defer eligible gain by making an investment in a QOF?

A: Yes.

4. Q: Is it possible to avoid paying any tax and have 0 tax liability during the holding period?

Yes. Real International has extensive tax solutions to further mitigate tax liability during this period