It’s no secret that Austin home prices are skyrocketing. But that begs the question: are homes in Central Texas overvalued?

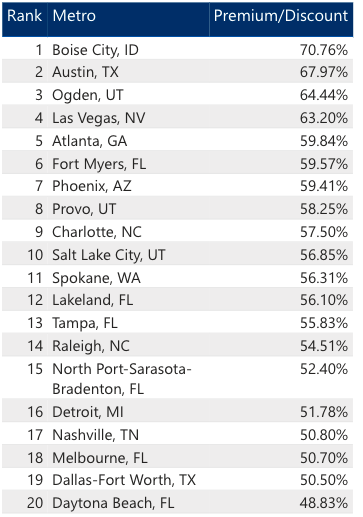

A recent study by researchers at Florida Atlantic University turned a lot of heads when it ranked Austin No. 2 in the country, in terms of how quickly prices have risen when compared with long-term patterns. The FAU study calculated that buyers were paying nearly 68% more than what historical averages would suggest.

But that level of analysis tells only a small part of the story, according to leaders at the Austin Board of Realtors.

The median home sale price reached $550,000 in May in the Austin metro, up from $329,893 in May 2020, according to ABOR data — an increase of more than 66%.

Brandy Wuensch, a Realtor and ABOR secretary-treasurer, said that jump reflects the remarkable economic and population growth of Central Texas in recent years. The population of the Austin metro grew faster than any other major metro in the country every year from 2010 to 2020 and the area has seen a surge in headquarters relocations and major corporate projects.

The FAU study called attention to rapid appreciation in places like Austin, Boise, Idaho; Ogden, Utah; and Las Vegas. Big jumps can be jarring in these “cities of the moment,” while buyers in costlier markets are used to high prices. For instance, New York and San Francisco ranked among the least overvalued in the FAU study, because their high average prices are closer to historical trends.

Obviously, there is plenty of disagreement over whether we’re in a housing bubble or whether the region has experienced a seismic reset of prices based on Austin’s new standing in the economic pecking order.

For the June 29 episode of the ATX Next podcast, Austin Business Journal spoke with Wuensch about the FAU study as well as the wider trends shaping the housing market. Listen to the entire conversation in the player at the top of this story, or wherever you get podcasts. Below are a few highlights from the interview, edited slightly for clarity.

ABJ: Is the market in Austin really that overvalued?

“It’s interesting whenever studies like these come out, because it’s easy for people from afar to take a look at our market and base it on cherry-picked data and come to their own conclusions not really based on the crucial factors. Austin is a different market than a lot of cities here in the U.S. A lot of our stuff is, I guess people say, blowing up due to job creation and the population growth that we’ve seen over the last few years with companies moving here, bringing their headquarters, their employees. So a lot of that is what’s contributing to our market getting a lot of attention.”

For this study what other factors could Florida Atlantic University look at when they’re determining overvalued markets?

“Honestly, in my professional opinion, I think they were just looking at the median sales price and how it’s increased compared to other markets. And again, historically, it has jumped over the last two years. I was born and raised in Austin, and as a native Austinite, I’ve seen this type of growth and it can be a little bit shocking. … But when you take a look at the whole economic situation, or just the developments in the growth within our city, it’s actually still very affordable compared to other markets in the country.”

You mentioned earlier that home prices were kind of blowing up in the past couple of years. Is that just due to people flooding into Austin, or are there other factors that are causing them to rise?

“With the last few years, we’ve had a really dangerously low supply of inventory. A typical balanced market, we consider six months of inventory and we’ve had 0.2 of a month. … We’re just now getting around close to a month’s worth of inventory. So the demand is still there, with the people wanting to buy a home where they’re local and they want to be first-time homebuyers, where they’re moving to the area and there just hasn’t been enough housing.

Then also, in the Austin area, development has been typically a long process. The permitting process with the city can take months. It can be anywhere from four months just to get your permit reviewed by someone. We hear builders saying it takes them up to 18-22 months to be able to get progress on a subdivision. So it’s been a very long permit process. Land development codes have restricted some building in certain areas. And so we’ve always kind of been behind when it comes to keeping up with inventory and housing and that coupled with a pandemic and then people not listing their home as much, it just kind of crippled us a little bit.”

Now we’re approaching a month of inventory. Are there any projections six months from now, maybe a year from now, as to what the inventory might look like?

“I wish I had a crystal ball to be able to predict that. That would make our job a lot easier. But we don’t know. I can say that in the last few weeks, we have seen our inventory increase, almost threefold, which is great. And so some people say, ‘Oh, that means sellers are going to have a hard time selling their home.’ But we are not seeing that. Homes are still moving quickly. And in terms of sales … last year, I think (homes) were sitting on the market about 15 days, and this year it’s about 16 days. So it’s really not that much of a difference — even though we’re seeing more homes listed, they’re still moving at a rapid pace.”

The Article is from Austin Business Journal, copyright belongs to owner